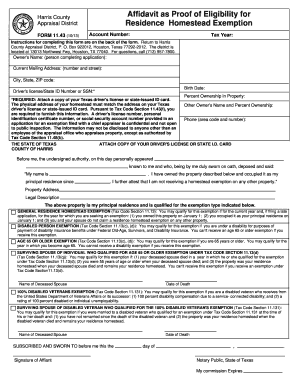

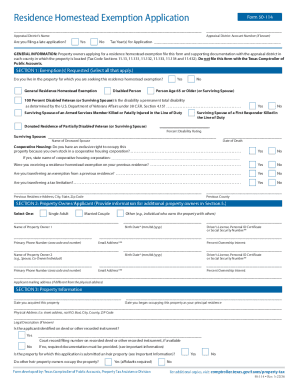

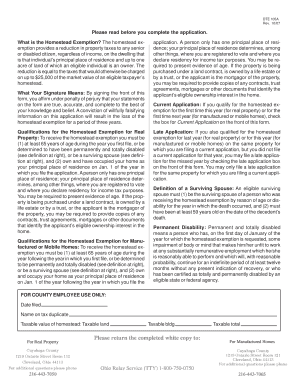

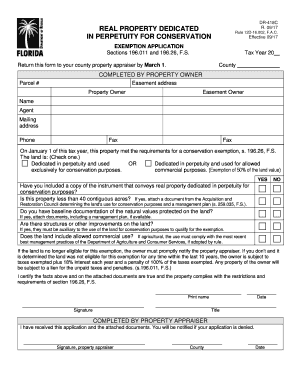

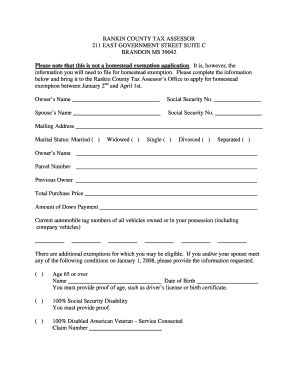

Pick from dozens of ready-made Homestead exemption Application Forms forms and simplify your processes with a few clicks. Obtain, upload, and fill out your form on the go with DocHub.

Document administration can stress you when you can’t find all the documents you require. Luckily, with DocHub's extensive form categories, you can get all you need and swiftly manage it without changing between apps. Get our Homestead exemption Application Forms and start utilizing them.

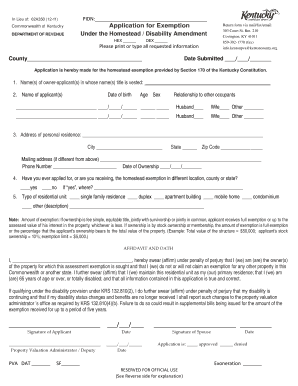

The best way to manage our Homestead exemption Application Forms using these easy steps:

Try out DocHub and browse our Homestead exemption Application Forms category without trouble. Get your free account right now!