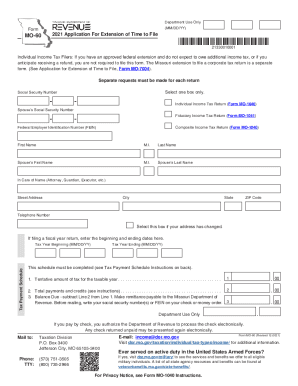

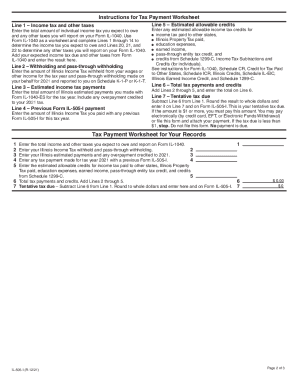

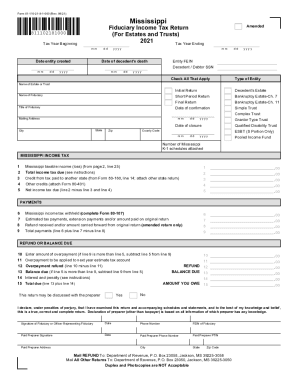

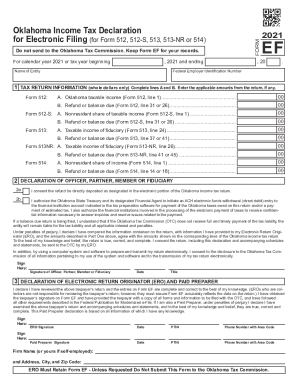

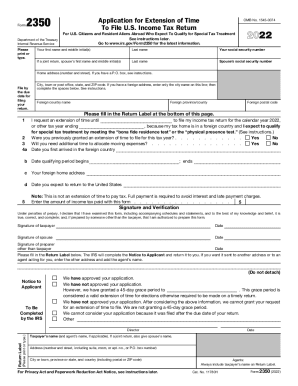

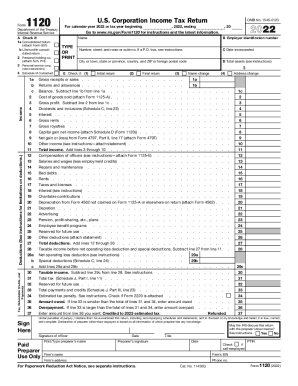

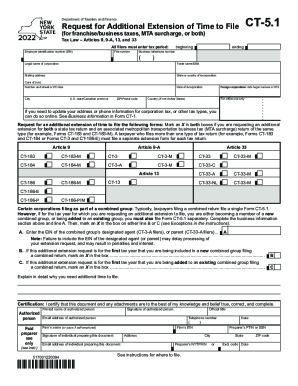

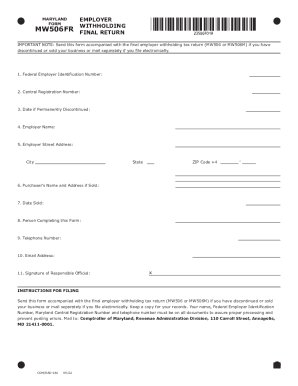

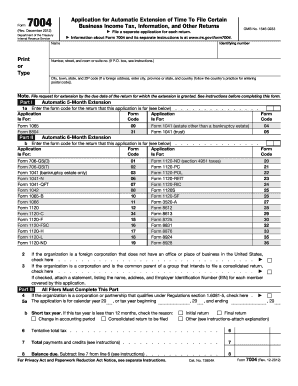

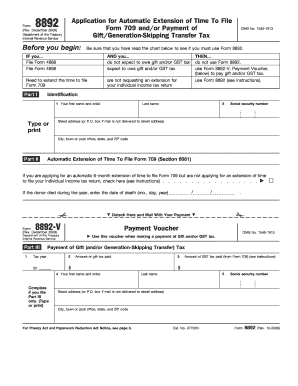

Improve your form management with Automatic extension 7004 Application Forms. Select from various of forms for individual and business use and start modifying them immediately.

Document administration can overwhelm you when you can’t discover all the documents you need. Luckily, with DocHub's extensive form collection, you can get all you need and easily handle it without the need of changing among applications. Get our Automatic extension 7004 Application Forms and start working with them.

Using our Automatic extension 7004 Application Forms using these easy steps:

Try out DocHub and browse our Automatic extension 7004 Application Forms category without trouble. Get your free account today!