Definition and Meaning of Form 1099-LTC

Form 1099-LTC, issued by the Internal Revenue Service (IRS), is used to report long-term care benefits and accelerated death benefits paid to policyholders or insured individuals. It plays a critical role in the tax reporting process by detailing the types of benefits received. The form also informs the recipients about the taxable aspects of these payments, which may influence their overall tax obligations. The form specifically lists benefits such as reimbursements for long-term care services, which could potentially affect the taxation status of the individual. The purpose is to ensure transparency and consistency in tax reporting for the concerned benefits.

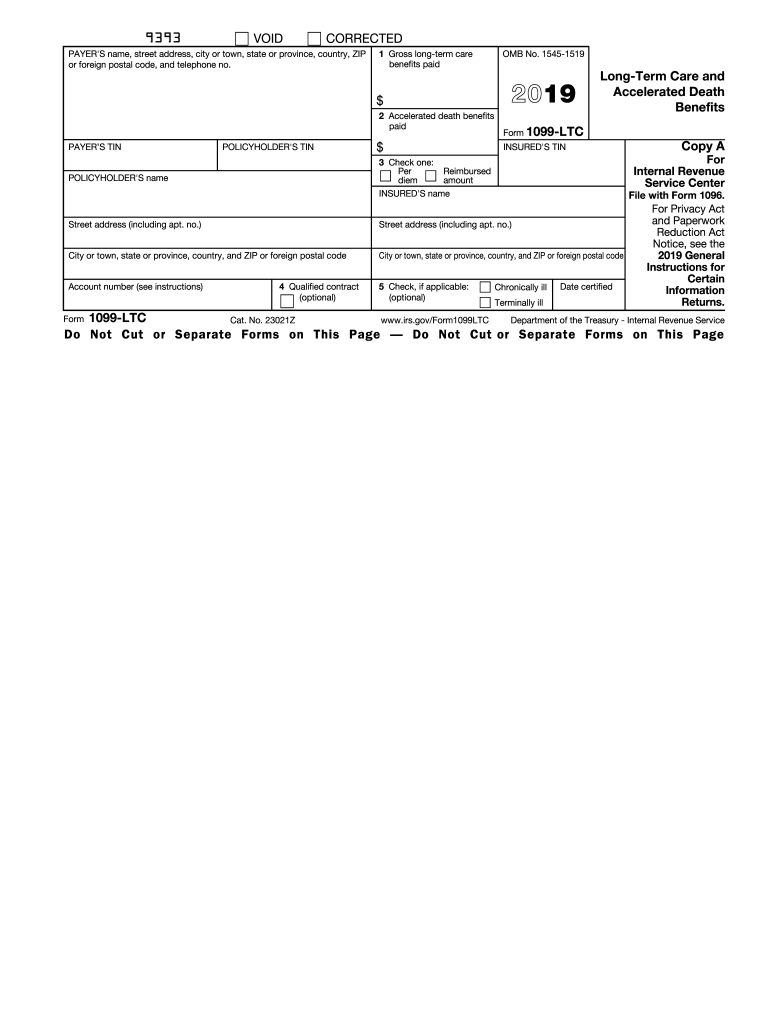

Key Elements of the Form

- Policyholder Details: Includes information regarding the individual who holds the insurance policy.

- Payer Information: Details the entity or individual responsible for paying the long-term care benefits.

- Type of Benefits: Differentiates between various benefits like reimbursements for long-term care services, per diem benefits, or similar amounts.

- Taxpayer Identification Numbers: Contains essential identification numbers, ensuring accurate tracking and filing of taxes.

How to Use Form 1099-LTC

To effectively utilize Form 1099-LTC, recipients should carefully review all the information listed, ensuring accuracy before integrating it into their overall tax filings. It acts as a guide for taxpayers, helping them determine which benefits are reportable income and how these financial details interplay with other tax data.

Steps to Proper Use

- Review Benefits Listed: Verify that the benefits listed match the records you have maintained throughout the year.

- Check for Accuracy: Ensure all personal and financial information is correctly entered.

- Incorporate into Tax Filing: Use the details to accurately report income on your IRS tax return.

Steps to Complete the Form

Completing Form 1099-LTC involves several critical steps that ensure the transfer of accurate information to the IRS and the taxpayer. It's essential to follow each step attentively to mitigate potential errors or discrepancies.

Steps for Payers to Follow

- Gather Necessary Information: Collect all relevant data about beneficiaries and payments made during the tax year.

- Fill in Details: Input details like the taxpayer identification number, policyholder information, and benefit amounts into the form.

- Review and Confirm: Double-check all entries to ensure precision before submitting.

- Send Copies: Forward copies of the form to the IRS and the respective recipient.

How to Obtain Form 1099-LTC

Form 1099-LTC can be acquired from multiple sources. Insurance companies typically issue the form to policyholders who have received long-term care benefits throughout the year. For taxpayers, it’s essential to know how to access this form through official channels.

Obtaining Methods

- Directly from the Payer: Contact the insurance provider or payer directly if you don’t receive the form by the expected date.

- Download from the IRS Website: The form is also available for download from the IRS’s official website for review or filing.

- Tax Software Platforms: Tax software, such as TurboTax or QuickBooks, may offer digital versions of the form.

Who Typically Uses Form 1099-LTC

Form 1099-LTC is predominantly used by individuals who have received long-term care benefits. The form is also vital for insurance companies and other entities paying out such benefits as it assists in systematic and transparent financial reporting.

Typical Users

- Policyholders: Individuals receiving long-term care benefits under an insurance policy.

- Insurance Providers: Entities responsible for issuing the benefits and relevant forms.

- Tax Preparers: Professionals aiding taxpayers in accurately compiling income tax returns.

IRS Guidelines for Form 1099-LTC

The IRS provides specific guidelines related to the issuance and handling of Form 1099-LTC, ensuring compliance and accuracy in financial reporting.

Key Guidelines

- Reporting Thresholds: Identifies minimum amounts that must be reported on the form.

- Submission Deadlines: Specifies timelines for issuing the form to the IRS and recipients.

- Amendments and Corrections: Outlines procedures to rectify any errors on filed forms.

Filing Deadlines and Important Dates

Compliance with deadlines is critical to avoid penalties and ensure proper filing. Form 1099-LTC adheres to specific timelines mandated by the IRS.

Important Dates to Remember

- January 31: Deadline for the payer to send Form 1099-LTC to the recipient.

- End of February: Due date for submitting paper versions to the IRS.

- End of March: Last day to file electronically with the IRS.

Penalties for Non-Compliance with Form 1099-LTC

Failure to comply with IRS regulations when handling Form 1099-LTC can result in significant penalties. It's essential for both payers and recipients to adhere to guidelines to avoid financial repercussions.

Potential Penalties

- Late Filing: Involves penalties for payers who submit forms past due dates.

- Incorrect Information: Financial repercussions for maintaining inconsistent or false information.

- Failure to File: Significant penalties, especially for entities neglecting to file the necessary forms altogether.

Understanding these aspects of Form 1099-LTC ensures that both individuals and entities manage their long-term care benefit reporting in compliance with IRS requirements, thereby minimizing risks of inaccuracies or legal complications in financial filings.