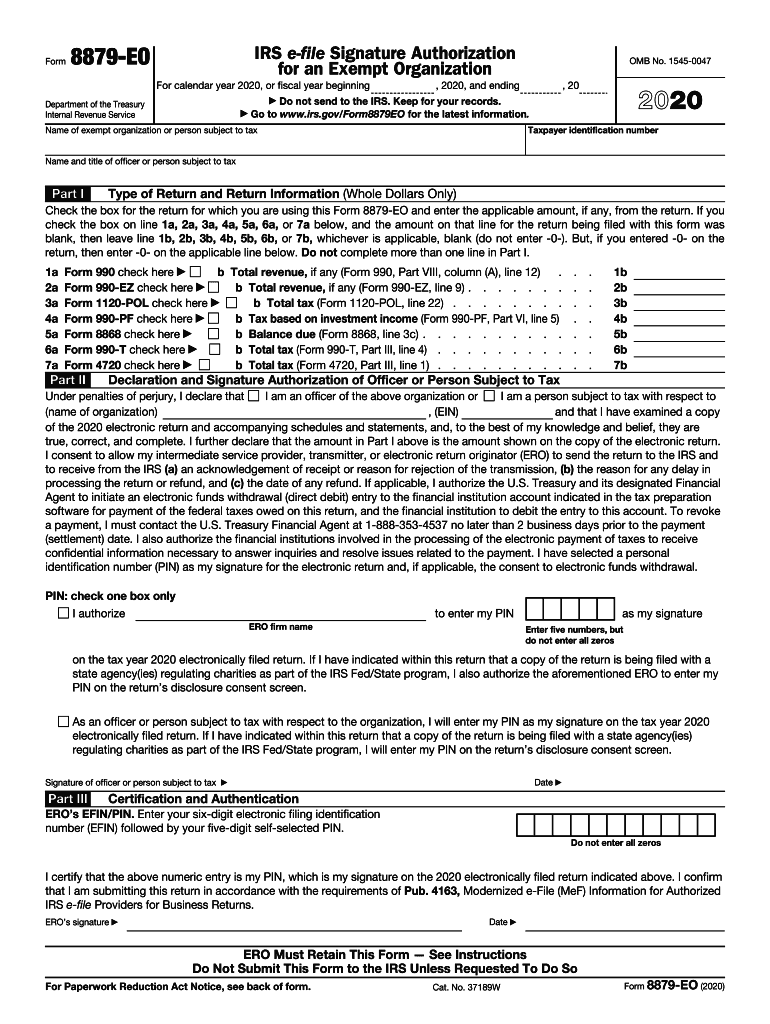

Definition and Purpose of Form 8879-EO

Form 8879-EO, known as the IRS e-file Signature Authorization for Exempt Organizations, allows an officer or responsible individual from an exempt organization to sign their electronic tax return. The digital signature simplifies the filing process and ensures that the organization can authorize electronic fund withdrawals if necessary. This form outlines the roles of the organization’s officer and the Electronic Return Originator (ERO), stressing that it should not be sent to the IRS but stored for the organization’s records.

How to Use Form 8879-EO

To effectively use Form 8879-EO, follow these steps:

- Review Eligibility: Confirm the organization's exempt status to qualify for electronic filing.

- Complete Relevant Sections: Input relevant details including the organization's EIN, the tax year, and the officer’s PIN.

- Sign the Form: The form must be signed by the responsible officer after completing the sections to authorize the e-filing.

- Transfer to ERO: Provide the completed form to the Electronic Return Originator for their acknowledgment and submission of the return to the IRS.

- Retain Records: Keep a copy of the signed form with organizational records as proof of authorization.

Steps to Complete Form 8879-EO

Completing Form 8879-EO involves several critical steps:

- Organization Information: Start by filling out the organization's name, address, and EIN.

- Tax Return Details: Include details about the tax return being filed, such as the tax year and form type.

- Designation of PIN: Decide on a Personal Identification Number that the officer will use to electronically sign the document.

- Signature and Date: The responsible officer must sign and date the form, which authorizes the ERO to submit the return on their behalf.

- ERO Responsibilities: Ensure that the ERO completes their section of the form, including their identification and signature.

Who Typically Uses Form 8879-EO

The form is predominantly used by exempt organizations such as:

- Non-Profits: Including charitable organizations that require electronic filing of their IRS returns.

- Educational Institutions: Schools and colleges under tax-exempt status needing to streamline their filing processes.

- Religious Organizations: Churches and similar entities often leverage the form to manage tax obligations efficiently.

Importance of Using Form 8879-EO

Utilizing Form 8879-EO is critical for several reasons:

- Streamlined Filing: Enables faster and more efficient electronic submission of tax returns.

- Security: Provides a secure method for authorizing electronic filings and funds withdrawals.

- Compliance: Ensures adherence to IRS requirements for exempt organizations.

- Record-Keeping: Acts as a formal record of the authorizing officer’s consent to file electronically.

Key Elements of Form 8879-EO

Form 8879-EO includes several sections requiring attention:

- Organization Details: Essential for IRS identification and processing.

- Personal Identification Number (PIN): Acts as the digital signature for electronic submissions.

- Officers and ERO’s Signatures: Compliance is ensured through documented consent.

- Record Retention: Instructions for retaining the physical or digital copy for organizational records.

IRS Guidelines for Form 8879-EO

The IRS provides various guidelines to ensure proper usage of Form 8879-EO:

- Authorization Rules: Only officers may sign using a PIN.

- Submission Requirements: Do not send the form to IRS; it should be retained within the organization.

- Timing: Form must be executed before the return is transmitted by the ERO.

Filing Deadlines and Important Dates

- Annual Filing: It must align with the organization’s annual tax return filing schedule.

- Review IRS Calendar: Stay abreast of filing deadlines to ensure timely submission.

- Amendment Filing: If amending returns, a revised form is required, consistent with the amendment filing date.

These steps and insights into Form 8879-EO ensure that exempt organizations can manage their e-filing processes efficiently and stay compliant with IRS regulations.