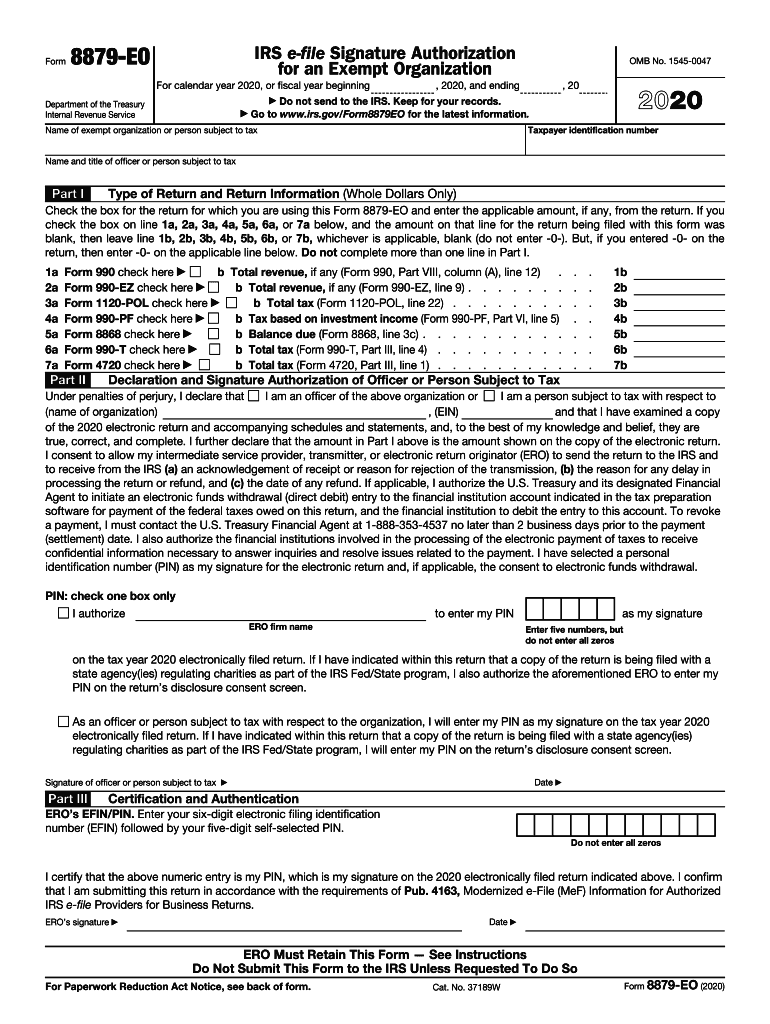

Definition and Purpose of Form 8879-EO

Form 8879-EO, officially known as the IRS e-file Signature Authorization for Exempt Organizations, is a crucial document for qualifying organizations that need to file specific tax returns electronically. This form authorizes an organization officer or an individual subject to tax to electronically sign and approve the submission of various forms, specifically tax documents relevant to exempt organizations. The primary purpose of the form is to provide a secure and verified method for electronically signing tax returns, ensuring compliance with IRS regulations while simplifying the filing process.

The form serves as a declaration that the information contained within the electronic return is accurate, complete, and true to the best of the signer’s knowledge. It includes several critical sections that detail the return information, the responsibilities of both the officer and the electronic return originator (ERO), and the declaration of consent to file electronically. By utilizing Form 8879-EO, organizations can expedite their tax filing process and maintain compliance with IRS requirements.

How to Use Form 8879-EO

Using Form 8879-EO involves several straightforward steps that ensure accurate and compliant filing. The process begins when an exempt organization prepares to submit its electronic tax return. The officer of the organization or authorized representative must then complete the necessary sections of the form, which include:

- Identifying Information: The organization must provide its legal name, Employer Identification Number (EIN), and other relevant details.

- PIN Selection: The signer selects a personal identification number (PIN), which is essential for signing the electronic return. This PIN must be kept secure and used consistently to authenticate future submissions.

- Declaration and Consent: The officer must carefully read and confirm the accuracy of the statements regarding the electronic return, acknowledging their responsibilities as outlined in the form.

Once completed, the signed form should be retained by the ERO and is not submitted to the IRS unless specifically requested. This process allows for a quick and secure way to authorize electronic filings while ensuring that all necessary precautions are taken in protecting sensitive data.

Steps to Complete Form 8879-EO

Completing Form 8879-EO requires careful attention to detail and adherence to the prescribed steps outlined by the IRS. The following guide breaks down the process clearly:

- Gather Required Information: Before starting the form, collect all necessary information, including organization details and the selected PIN.

- Enter Organization Information: Fill in the legal name and EIN of the exempt organization. Ensure this information matches what is already on file with the IRS.

- Review Return Information: Carefully validate the details from the electronic return that will be associated with Form 8879-EO. This ensures that there are no discrepancies.

- Sign and Date the Form: The designated officer must sign the form, indicating their authorization, and include the date of signing.

- Maintain Records: Keep the completed form secure with the ERO. It may be needed for reference in case of inquiries from the IRS.

Each step is crucial to maintaining compliance and preventing issues that may arise during the electronic filing process.

Important Terms Related to Form 8879-EO

Understanding the terminology associated with Form 8879-EO is fundamental for proper usage and compliance. Key terms include:

- Exempt Organization: Organizations that are eligible for tax-exempt status under the Internal Revenue Code, such as charities, educational institutions, and religious groups.

- Electronic Return Originator (ERO): A tax professional or organization authorized by the IRS to transmit electronic tax returns.

- Signature Authorization: The legal process by which the organization grants permission for its electronic return to be signed and submitted on its behalf.

- Personal Identification Number (PIN): A unique code selected by the signer which is used to validate their identity for electronic signatures.

Understanding these terms helps in recognizing the function and significance of the form within the electronic filing landscape.

Key Elements of Form 8879-EO

Form 8879-EO contains several key elements that are essential for its correct completion and submission. These elements include:

- Organization Information: Name, EIN, and other identifying details of the exempt organization.

- Return Information: Specific return forms being submitted electronically to the IRS, which may include forms such as the 990 series.

- Signature Section: A designated area for the officer's signature and date to confirm authorization.

- Responsibilities: A clear statement of the responsibilities of the signer and the e-filing procedure.

Each of these components must be accurately completed to ensure the form serves its purpose effectively and complies with IRS regulations.

Legal Use of Form 8879-EO

Form 8879-EO is legally binding under IRS regulations, signifying that electronic signatures made using the form comply with federal law. The use of the form ensures that:

- The electronic submission of tax returns adheres to the provisions set forth by the IRS, promoting integrity in tax filings.

- The authorized signature linked with the PIN used to file represents a commitment to the accuracy and completeness of information.

- Retention of the form by the ERO serves as evidence of authorization in case of audits or inquiries.

These legal implications underscore the importance of understanding and properly managing the use of Form 8879-EO.