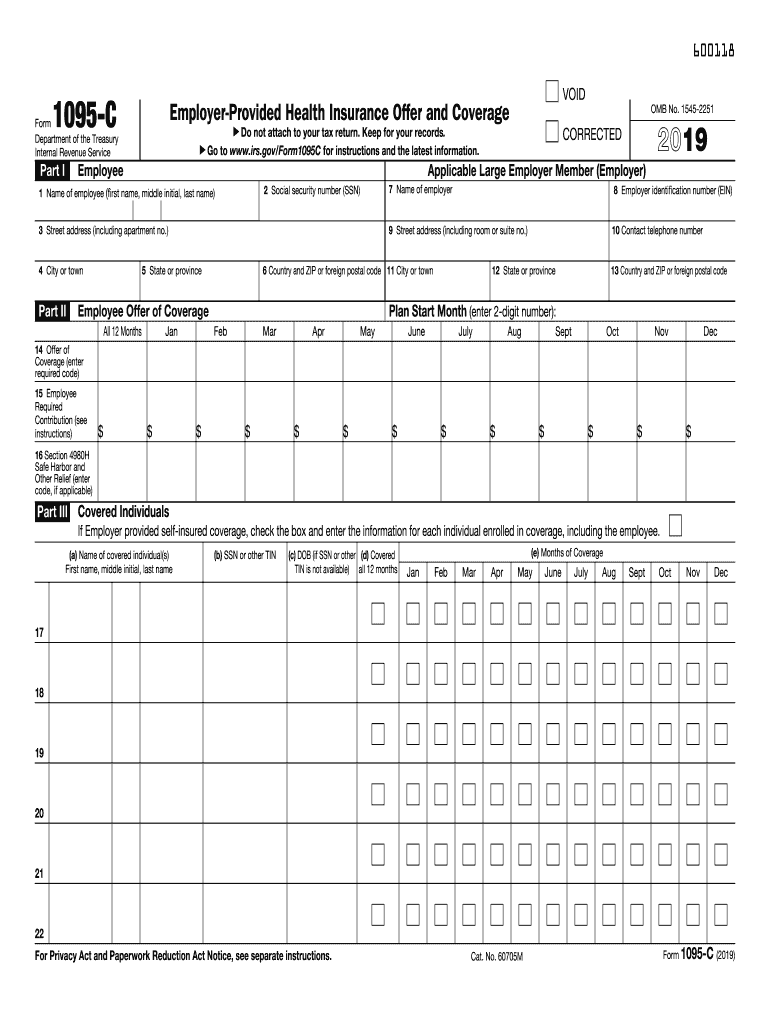

Definition and Purpose of Form 1095-C

Form 1095-C is an essential tax document utilized by Applicable Large Employers (ALEs) in the United States to report information regarding employee health insurance coverage under the Affordable Care Act (ACA). This form is a significant component of ensuring compliance with ACA regulations, as it provides both employees and the Internal Revenue Service (IRS) with details about the type of health coverage offered, the period it was available, and the costs involved. The data captured on the 1095-C form assists in determining eligibility for premium tax credits and helps the IRS verify individual health care coverage mandates.

How to Obtain Form 1095-C

Employers classified as ALEs are responsible for issuing Form 1095-C to each full-time employee. Typically, these forms are mailed directly to the employee's home address. But, employees can also access their Form 1095-C electronically if the employer provides such an option through a secure online platform. It is crucial for employees to have their current mailing information updated with their employer to ensure timely delivery. If the form is not received, employees should contact their employer’s HR department to request a copy.

Steps to Complete Form 1095-C

- Gather Employee Information: Employers should collect accurate data concerning the employee's full name, address, and Social Security Number (SSN).

- Employer Details: Fill out the employer’s name, address, and Employer Identification Number (EIN).

- Health Coverage Period: Indicate the months that health insurance was offered to the employee. This includes detailing any offers of coverage and the lowest-cost premium for self-only coverage.

- Plan Start Month: Employers need to specify the original start month of the health plan.

- Safe Harbor and Relief Codes: Employers should apply any relevant IRS-afforded safe harbor or relief codes for each employee per month.

Key Elements of Form 1095-C

- Part I: Includes basic identifying information for both the employer and the employee, ensuring clarity in reporting.

- Part II: Provides offer and coverage details, lighted by specific indicator codes that describe the affordability and availability of health coverage.

- Part III: Primarily used for reporting if the employer is self-insured, detailing individuals covered under this plan for each month.

Filing Deadlines and Important Dates

The IRS requires that Form 1095-C be provided to employees by January 31st following the reporting year. Employers must also file copies of these forms with the IRS by February 28th if filing by paper or March 31st if filing electronically. It is imperative to adhere to these deadlines to avoid potential penalties.

Required Documents for Completing Form 1095-C

To properly complete Form 1095-C, employers will need access to:

- Employee census data for the tax year

- Health plan documents reflecting the details of coverage

- Records of monthly premium amounts for minimum essential coverage

- Any applicable IRS codes pertaining to coverage offers and affordability

Legal Use and Compliance with Form 1095-C

The ACA mandates ALEs to file Form 1095-C to enforce transparency in employer-provided health insurance offerings. Employers must comply to avoid penalties under the employer shared responsibility provisions. Failing to issue a 1095-C form or inaccurate filings may result in fines imposed by the IRS.

Penalties for Non-Compliance

Non-compliance with Form 1095-C filing requirements can lead to significant penalties. Failure to furnish the form to employees or file with the IRS can result in a fine of up to $280 per form, per failure. Penalties may increase if errors are corrected after IRS audit initiation. Employers should implement strict review processes to ensure accuracy and timely submission of Form 1095-C.

Examples of Form 1095-C Usage

Consider a corporation with 150 employees. The company, classified as an ALE, must issue Form 1095-C to all full-time employees offered health coverage, indicating each individual's coverage terms, duration, and contributions. Employees, in turn, use this form to verify their health coverage while filing their individual income tax returns. Additionally, a smaller business transitioning to ALE status must adapt their internal processes to scale up compliance and reporting for their growing workforce.