Definition & Meaning

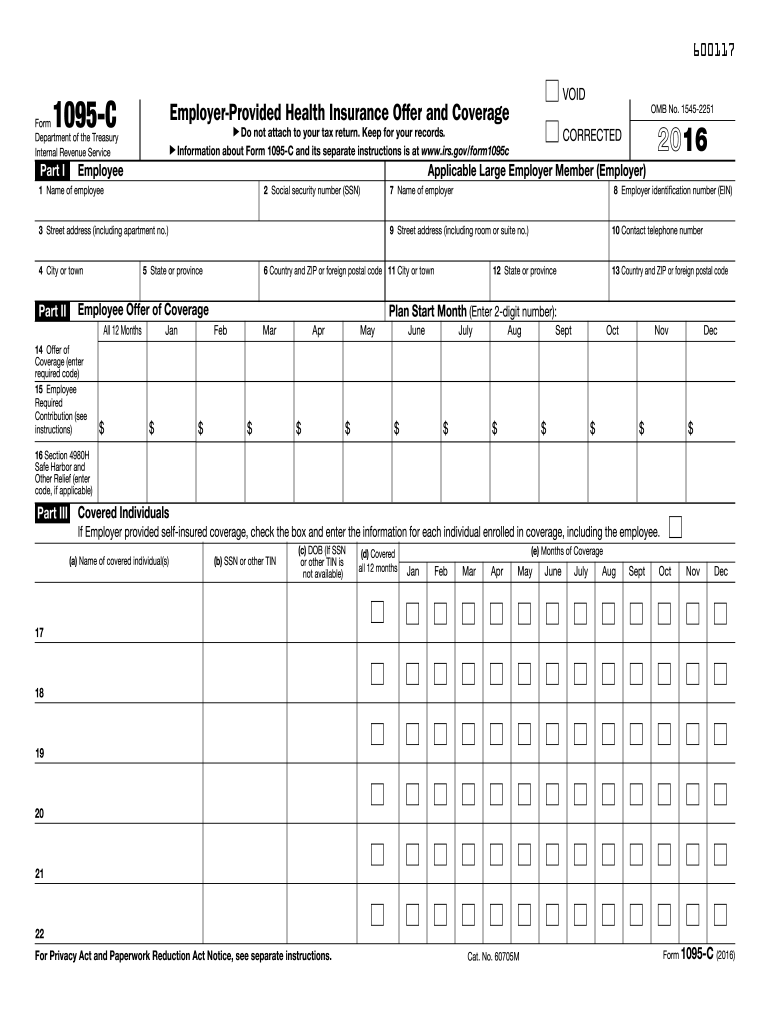

Form 1095-C is an essential document under the Affordable Care Act (ACA), provided by Applicable Large Employers (ALEs) to report health insurance coverage offered to employees. This form contains crucial information such as employer and employee details, the health coverage offered, and whether the coverage satisfies the minimum essential coverage requirements. Employees use this form to determine eligibility for premium tax credits, which might affect their tax returns. Keeping Form 1095-C for personal records is recommended, as it is a significant document for year-end tax filings and understanding healthcare benefits received.

How to Use the 1095-C 2016 Form

Employees primarily use the 1095-C form to verify that they had qualifying health coverage for each month of the year. It helps in confirming eligibility or determining the need to pay the individual shared responsibility payment. While employees don’t need to submit the form itself with their tax return, the information on the form is crucial for accurate tax filings. Beyond tax purposes, it also serves as a record of the health insurance offered by an employer, which can be useful in case of disputes or discrepancies regarding healthcare benefits.

Steps to Complete the 1095-C 2016 Form

- Review Personal Information: Ensure that the information such as name, address, and Social Security Number is accurate.

- Employer Details: Verify that your employer's information is correctly listed, including their employer identification number (EIN).

- Coverage Offered: Look at the details of the health coverage offered each month, which shows whether it meets the minimum essential coverage standards.

- Months Covered: Check the months for which you were covered by employer-sponsored health insurance.

- Tax Implications: Use the form to complete portions of your tax return related to health coverage and any potential penalties for not maintaining coverage.

Who Typically Uses the 1095-C 2016 Form

Form 1095-C is utilized by employees of ALEs, defined as companies with 50 or more full-time employees. Both employees who accepted and those who declined the offered coverage will receive this form to validate the offer made by their employer. Moreover, tax professionals and advisors frequently use this form to assist clients in reconciling healthcare coverage with tax obligations. It's also crucial for employees transitioning between roles or employment statuses to keep accurate health coverage documentation.

Key Elements of the 1095-C 2016 Form

- Part I: Employee and Employer Information: Includes full personal information for both entities.

- Part II: Offer of Coverage: Details the specific plan offered and whom it was offered to, indicating whether the plan meets affordability and minimum value thresholds.

- Part III: Covered Individuals: Lists those covered under the employee's plan, including dependents, with corresponding coverage months.

IRS Guidelines

The Internal Revenue Service (IRS) mandates ALEs to furnish Form 1095-C to eligible employees. According to IRS regulations, employers must ensure the form is accurate and distributed by the specified deadlines. The guidelines also outline employer penalties for non-compliance, such as failing to provide the form or providing incorrect information. Understanding the IRS requirements is essential for both employers and employees to avoid repercussions and ensure compliance with tax laws.

Filing Deadlines / Important Dates

Employers must generally provide Form 1095-C to employees by January 31 of the year following the coverage year. The IRS filing deadline for submitting copies of Form 1095-C to the IRS is March 31 if filing electronically, or February 28 if filing on paper. Staying aware of these deadlines is crucial for both compliance and individual tax purposes, as delays could result in penalties or incomplete tax records.

Penalties for Non-Compliance

Significant penalties are enforced by the IRS on employers who fail to comply with the requirements surrounding Form 1095-C. Penalties can include fines for providing the form with incorrect information, late distribution to employees, or failing to submit necessary forms to the IRS. Employees, meanwhile, may face adjustments or penalties on their tax returns if the form is not properly used to reconcile health insurance coverage status.

Digital vs. Paper Version

Employers can distribute Form 1095-C in either paper or digital format, following the IRS's guidelines for electronic consent and delivery procedures. The choice between digital and paper versions often depends on employer capability and employee preference. The digital option can offer a more streamlined and environment-friendly process, while the paper version remains essential for those requiring tangible documents for records and easier access without technological intervention.