Definition and Purpose

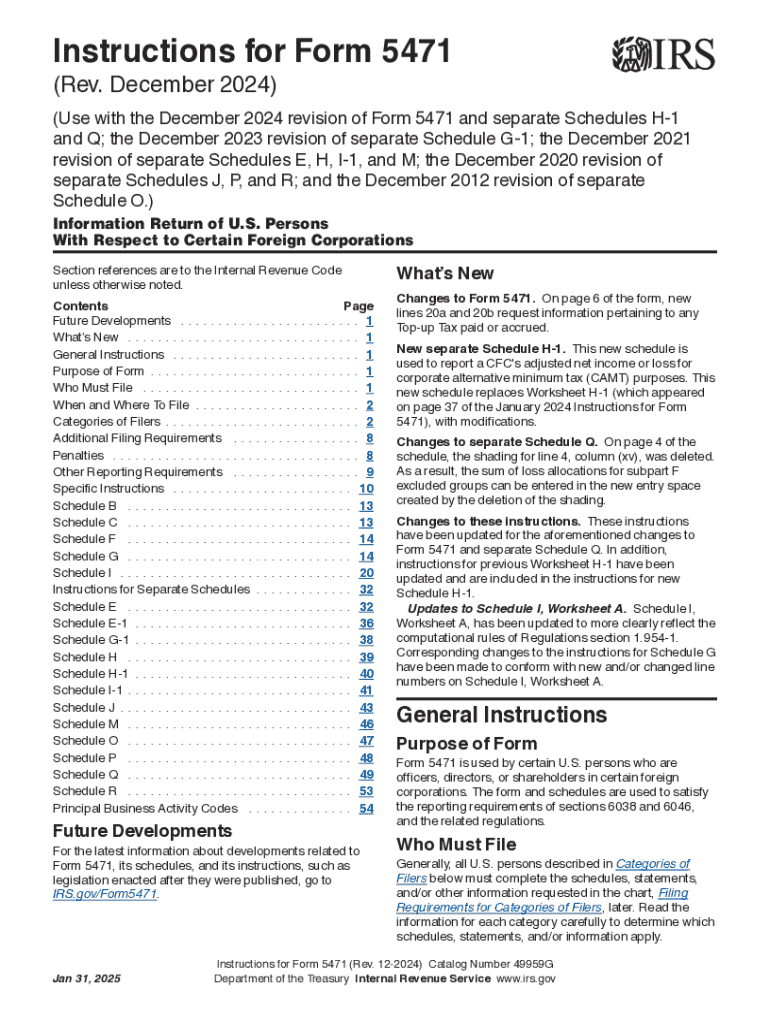

The Instructions for Form 5471 (Rev December 2024) are designed to guide U.S. citizens and residents regarding the filing requirements for form 5471, which is necessary for certain individuals who are shareholders in specified foreign corporations. The primary aim is to provide the required financial and ownership information of these foreign entities to the IRS, enabling the assessment of a shareholder's global tax responsibilities.

Key Features

- Detailed Guidance: The instructions offer step-by-step procedures, ensuring that each section of the form is completed accurately.

- Predefined Terms: The document includes definitions for important terms, helping users to understand specific terminologies related to foreign corporations.

- Applicable Schedules: The revision specifies schedules that accompany the form, such as Schedules H-1, Q, and G-1, relevant for different reporting requirements.

How to Use the Instructions for Form 5471 (Rev December 2024)

To effectively use the Instructions for Form 5471, individuals should carefully read through each section, ensuring comprehension of filing requirements and associated schedules.

Steps for Utilization

- Gather Required Information: Collect financial details and ownership structures for the foreign corporation in question.

- Review Defined Sections: Pay attention to specific instructions that correspond to the schedules you need to fill out.

- Use Real-Life Scenarios: The instructions often include examples that demonstrate typical filling scenarios, which can aid in understanding.

Common Errors to Avoid

- Incomplete Information: Ensure all fields are debated, especially those that involve complex calculations.

- Misinterpretation of Terms: Utilize the definitions provided in the instructions to ensure accurate reporting.

Steps to Complete the Instructions for Form 5471

A systematic approach is essential for completing Form 5471 using these instructions.

Step-by-Step Guidance

- Understand Eligibility: Verify if you're required to file based on your shareholding percentages and corporate engagements.

- Identify Necessary Schedules: Determine which accompanying schedules (like H-1 and Q) are applicable.

- Calculate Figures: Utilize the guidance for completing financial sections accurately, such as income distribution and shareholder details.

- Double-Check Entries: Precise data entry is crucial, as errors can lead to compliance issues with the IRS.

Key Elements of the Instructions for Form 5471 (Rev December 2024)

The instructions include several crucial components essential for a complete submission.

Highlights

- Schedules Overview: Detailed breakdowns of each relevant schedule ensure you know which one applies to your situation.

- Line-by-Line Instructions: Comprehensive line-by-line guidance helps capture and articulate financial data and corporate details.

Required Documents

Submitting Form 5471 demands certain documents be prepared beforehand to ensure accurate reporting.

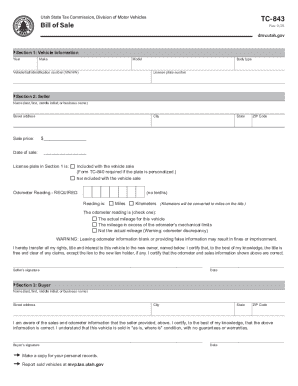

Vital Documents Include:

- Financial Statements: Current and previous financial records of the foreign corporation.

- Shareholder Agreements: Any agreements depicting ownership percentages and distributions.

Form Submission Methods

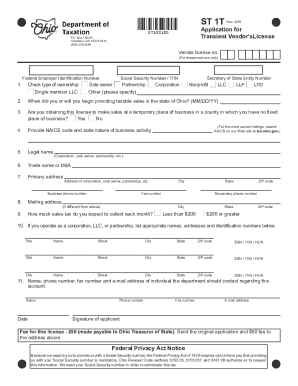

Form 5471 can be submitted through various channels, accommodating different preferences and infrastructure capabilities.

Options for Submission

- Online Filing: Utilizing IRS-approved software platforms for electronic filings.

- Mail Submission: Sending printed, completed forms to the designated IRS processing center.

- In-Person Submission: Directly delivering forms to IRS branches, if applicable.

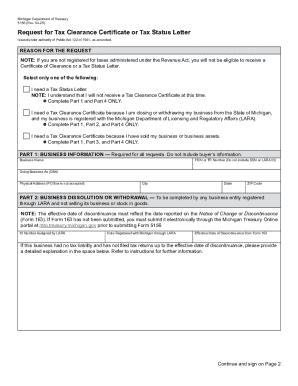

Penalties for Non-Compliance

Failing to file Form 5471 accurately and punctually can lead to serious penalties.

Consequences

- Monetary Penalties: Fines are common, often beginning at $10,000 per form annually for non-compliance.

- Additional Assessments: Further penalties may include additional charges for incomplete information or intentional omissions.

Taxpayer Scenarios: Who Should Use This Form?

Form 5471 instructions are relevant to various taxpayer scenarios, primarily involving those with foreign subsidiaries.

Example Applications

- Business Entities with International Holdings: U.S.-based businesses with overseas affiliates must use this form to report ownership and operational metrics.

- Individual Investors: Terms on reporting obligations for individuals having a significant interest in foreign corporate structures.

IRS Guidelines

The IRS's overarching guidelines for Form 5471 are crucial for compliance and to avoid legal repercussions.

Understanding Guidelines

- Timely Filing: Align filing dates with the taxpayer's U.S. federal tax return deadline, including extensions.

- Accuracy: All declared figures should match submitted documents, ensuring transparency.

Filing Deadlines

The instructions set specific filing deadlines that correlate with individual and corporate tax reporting timelines.

Important Dates

- Tax Year Alignment: Generally due alongside income tax returns, on or before April 15th or with extensions granted.

- Extension Options: Options include filing extensions commonly available to lengthen the deadline to October 15th.

Through familiarizing oneself with these detailed instructions, taxpayers can ensure compliance with IRS regulations regarding foreign entity holdings, mitigating the risk of significant financial penalties.