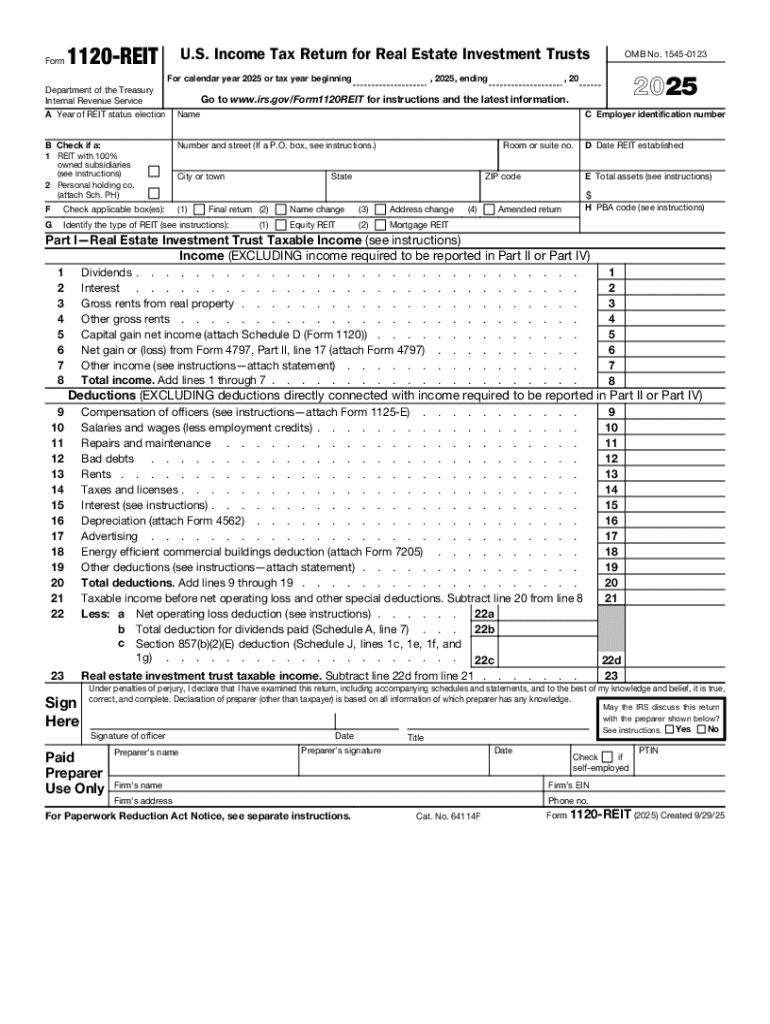

Understanding Form 1120-REIT for Real Estate Investment Trusts

Form 1120-REIT is a crucial tax document for Real Estate Investment Trusts (REITs) in the United States. This form is used to report income, gains, losses, deductions, and to calculate the tax liability of REITs that have elected to be treated as a corporation for tax purposes. The filing of this form ensures compliance with the Internal Revenue Service (IRS) regulations as outlined for entities classified under REIT status.

Key Elements of Form 1120-REIT

- Income and Deductions: This part of the form requires detailed reporting of the REIT's total income, including gross rents, dividends, and other receipts, alongside permissible deductions such as property taxes, management fees, and depreciation expenses.

- Credits and Tax Computation: It includes sections for calculating applicable tax credits and the overall tax payable after considering the impact of these credits.

Filing Deadlines and Important Dates

REITs must submit Form 1120-REIT by the 15th day of the fourth month after the end of their tax year. For those following a calendar year, this typically means filing by April 15. Extensions can be requested, but require Form 7004 to be submitted on time.

Steps to Complete Form 1120-REIT

- Gather Financial Documents: Before starting, ensure all relevant financial documents, including income statements and records of deductions, are prepared and organized.

- Complete the Income Section: List all forms of income that the REIT has earned throughout the year.

- Fill Out Deductions: Enter all allowable deductions to calculate adjusted gross income.

- Tax Computation and Credits: Compute the taxes owed and apply any applicable credits before determining final tax liability.

- Review and Sign: Ensure accuracy by reviewing the completed form and have an authorized officer of the REIT sign it.

Eligibility Criteria for Form 1120-REIT

To be eligible to file Form 1120-REIT, an entity must meet specific criteria established by the IRS, such as deriving the majority of income from real estate-related activities and adhering to shareholder distribution and income tests.

Common Scenarios and Use Cases

REITs, especially those handling diverse real estate portfolios, use this form to regularly report their annual financial activities to the IRS. It's also utilized in cases where REITs undergo mergers, acquisitions, or significant restructuring requiring specialized tax treatment.

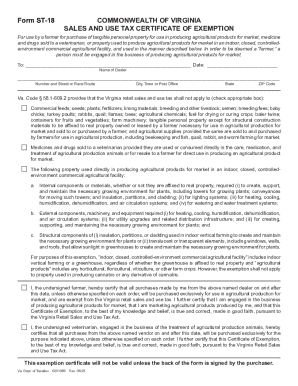

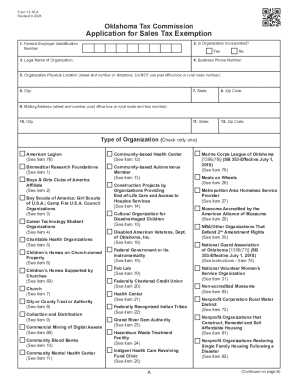

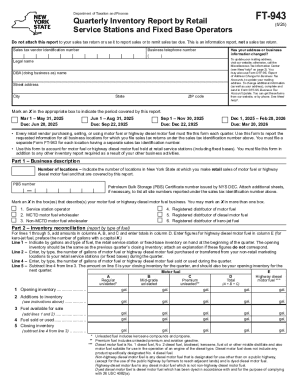

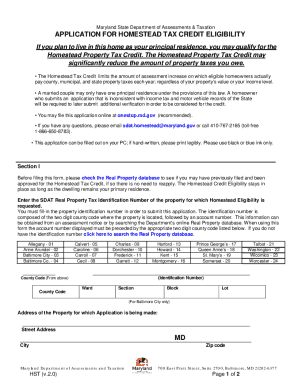

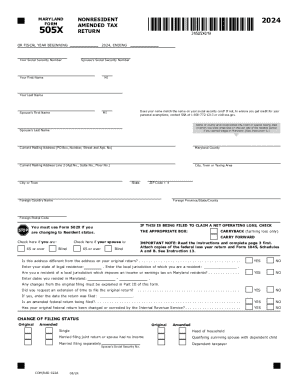

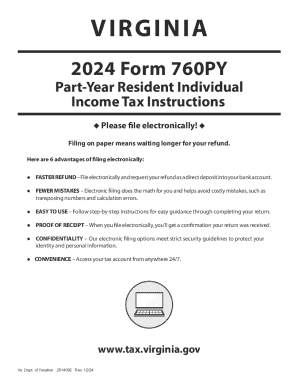

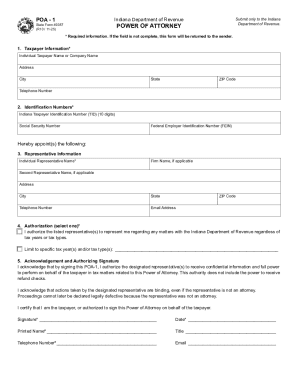

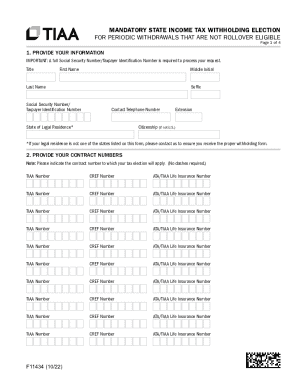

State-Specific Rules and Regulations

While Form 1120-REIT is a federal document, compliance might involve additional state-level filings, which can vary in terms of deadlines and specific reporting requirements based on the property locations and state-specific tax regulations.

Penalties for Non-Compliance

Failing to file Form 1120-REIT accurately or on time can lead to significant penalties. These can include fines, interest on overdue taxes, and potential audits or legal scrutiny from the IRS, emphasizing the importance of thorough and timely submission.

Digital vs. Paper Filing Options

REITs have the option to submit Form 1120-REIT either digitally or via traditional mail. Opting for electronic submission can lead to faster processing times and immediate confirmation of receipt. DocHub supports electronic documentation workflows, ensuring users can easily edit digital forms and incorporate secure signatures.

Software Compatibility

Form 1120-REIT is compatible with a variety of software solutions such as TurboTax and QuickBooks, which facilitate accurate calculations and ensure compliance with tax filing requirements through guided step-by-step procedures.

Conclusion: Importance of Compliance

Adhering strictly to IRS guidelines and filing Form 1120-REIT accurately is critical for REITs to maintain their tax-advantaged status. Utilizing platforms like DocHub can streamline document management, ensuring files are securely handled and efficiently processed, minimizing risks associated with non-compliance.