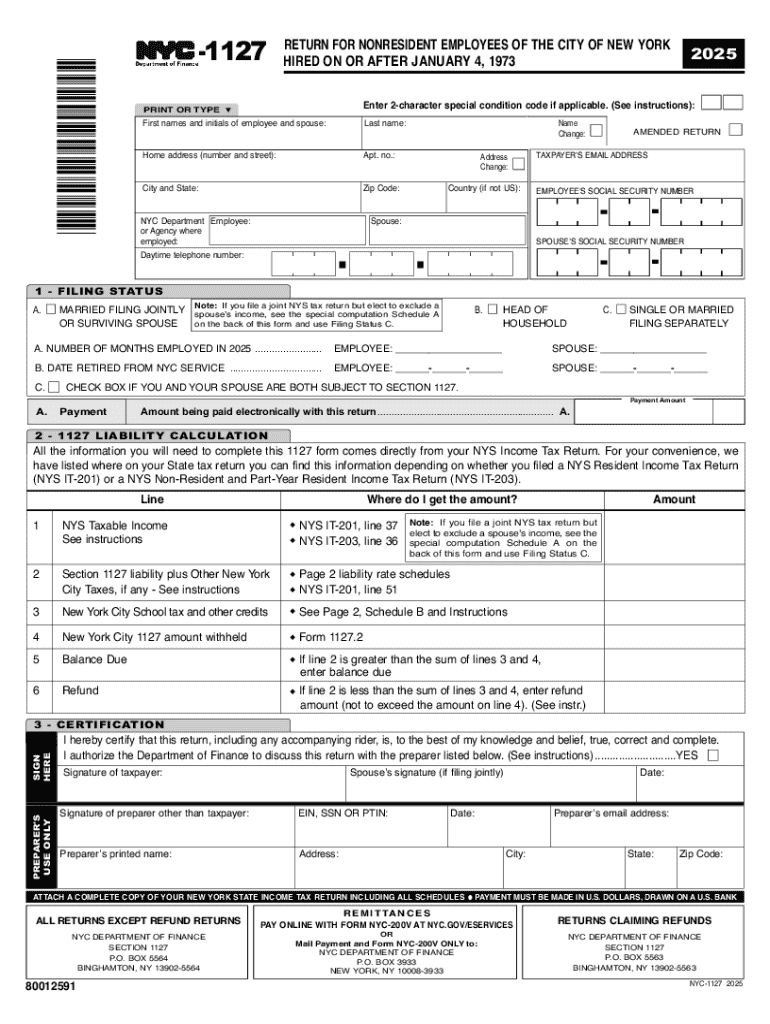

Definition & Meaning of -1127 HIRED

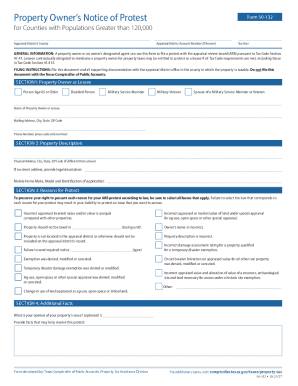

The form "-1127 HIRED" is primarily used for recording specific employment conditions related to nonresident employees of New York City who were hired on or after January 4, 1973. It applies to individuals who work in New York City but reside outside city limits. The form requires details such as employment commencement dates and specialized codes to define unique employment situations that impact tax obligations and residency considerations.

How to Use the -1127 HIRED

To effectively utilize the -1127 HIRED form, understanding its components is essential. Users must ensure accurate input of all required data, including employment dates, residency status, and any applicable special condition codes. These codes pertain to particular employment or compensation arrangements and should align with instructions provided for the form. The document should be reviewed for completeness before submission to avoid discrepancies or potential penalties due to incorrect information.

Steps to Complete the -1127 HIRED

- Gather Required Information: Prepare necessary documents that include employment details, residency proof, and identification numbers.

- Begin with Personal and Employment Information: Fill out personal details such as name, address, and Social Security number.

- Enter Employment Details: Specify the date of hire and clarify whether employment commenced on or after January 4, 1973.

- Include Special Condition Codes: Use a two-character special condition code if applicable. Cross-check with the instructions to ensure proper coding.

- Review for Accuracy: Verify all fields are correctly filled out to prevent data entry errors.

- Submit Form: Depending on the method required, submit the form through the specified channel – online, mail, or in person.

Important Terms Related to -1127 HIRED

- Nonresident Employee: An individual working within New York City limits but living outside the city.

- Special Condition Code: A two-character code used to denote specific employment conditions affecting the form's application.

- Hire Date: The official start date of employment, crucial for form eligibility.

Key Elements of the -1127 HIRED

The form consists of critical sections that include employment information, personal identification data, and special condition codes. Each segment must be filled out precisely to ensure full compliance and accurate representation of employment status. Documentation supporting residency and employment dates should accompany the form whenever possible.

Legal Use of the -1127 HIRED

The usage of -1127 HIRED aligns with regulatory requirements for nonresidents employed in New York City. The form helps both employees and employers ensure proper tax compliance. Failure to complete the form accurately may lead to legal and financial repercussions under city and federal employment regulations.

State-Specific Rules for the -1127 HIRED

Though the form primarily applies to New York City, awareness of how it interacts with state tax laws is crucial. Residency can affect state tax liabilities, and understanding any variances in state policy can prevent compliance issues. Regular updates from tax authorities should be monitored to stay informed about any changes affecting the form's use.

Examples of Using the -1127 HIRED

Consider an employee who commutes from New Jersey to work in New York City. This individual must complete the -1127 HIRED form to acknowledge their nonresident status and adhere to tax and employment obligations. Other cases might involve conditional employment classifications that necessitate specific code inclusions on the form, ensuring that all pertinent details are accurately conveyed.

Form Submission Methods: Online, Mail, In-Person

Submitting the form can be accomplished through various channels:

- Online: Electronic submission is secure and typically faster.

- Mail: Ensure documents are sent promptly to avoid delays in processing.

- In-Person: Provides immediate receipt confirmation and resolution of any submission issues.

Each method has its own advantages, and the choice may depend on user preference and specific instructions provided by the relevant authorities.