Definition & Meaning

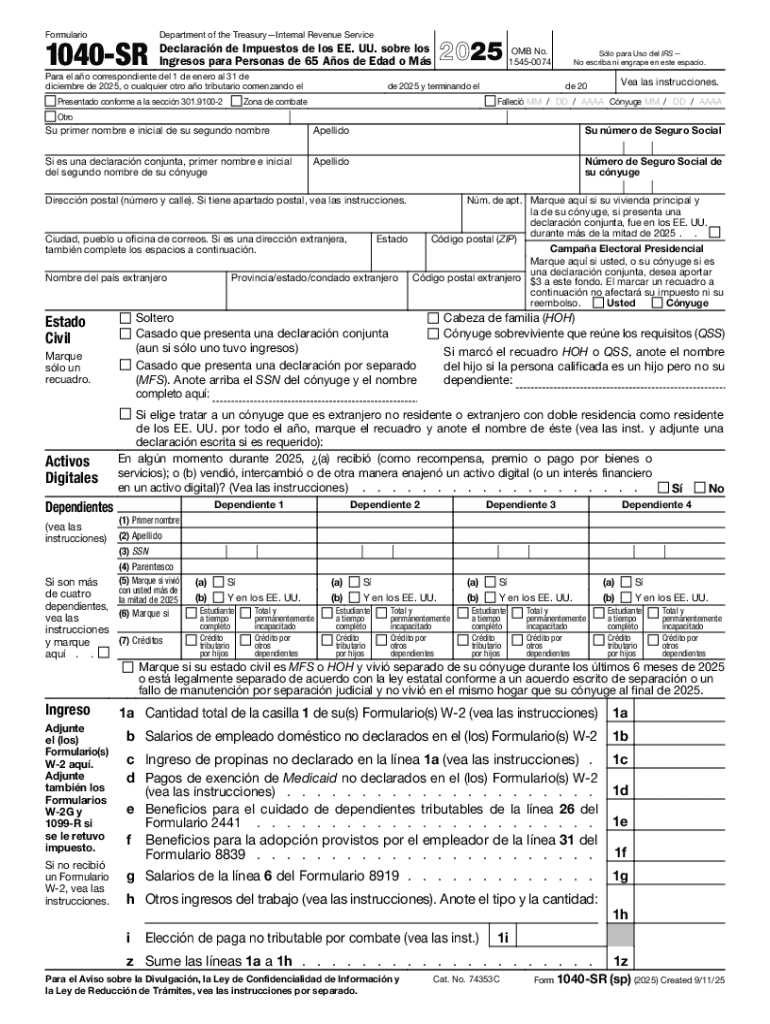

The 2025 Form 1040-SR (sp) is a specific version of the U.S. Individual Income Tax Return designed for senior citizens aged sixty-five and older who prefer to file their taxes using a simplified form. This version is tailored to meet the needs of Spanish-speaking taxpayers, providing instructions and sections in Spanish to facilitate a clearer understanding. The form maintains the core function of reporting income, deductions, and credits, ensuring compliance with annual tax obligations to the IRS. This tailored approach acknowledges language barriers and aims to make tax preparation more accessible for older individuals.

Who Typically Uses the 2025 Form 1040-SR (sp)

The primary users of the 2025 Form 1040-SR (sp) include:

- Senior Citizens: Individuals aged sixty-five and older who primarily rely on retirement income, such as Social Security benefits, pensions, and retirement account distributions.

- Spanish-Speaking Taxpayers: Those who prefer to complete their tax documents in Spanish, ensuring they fully comprehend the process and requirements.

- Simplified Filing Needs: Taxpayers with straightforward financial situations, such as those without dependents or complex deductions, who find the simplified format more suitable.

By catering to these groups, the form helps simplify the filing process, reducing the likelihood of errors due to language barriers or form complexity.

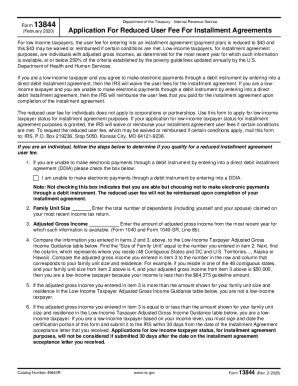

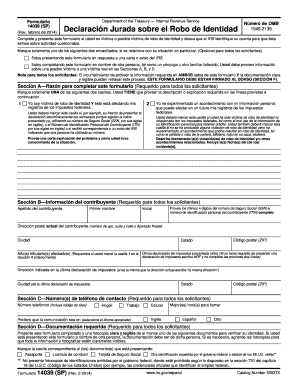

Key Elements of the 2025 Form 1040-SR (sp)

Understanding the essential components of this form is crucial for accurate completion:

- Personal Information: Spaces for inputting names, Social Security numbers, and filing status.

- Income Section: Fields for reporting various income types, including wages, retirement distributions, and Social Security benefits.

- Deductions and Credits: Options for claiming standard or itemized deductions, as well as available tax credits.

- Tax Calculation: Instructions for computing total tax liability.

- Payments and Refunds: Details for applying payments and determining refund amounts.

These elements are structured to provide a comprehensive overview of the taxpayer's financial situation and ensure that all relevant information is captured accurately.

Steps to Complete the 2025 Form 1040-SR (sp)

Filing correctly involves several key steps:

- Gather Required Documents: Collect all necessary forms, including income statements like W-2s and 1099s.

- Enter Personal Information: Fill in personal details, ensuring accuracy.

- Report Income: Record all sources of income, following form instructions.

- Claim Deductions/Credits: Determine eligibility for deductions or credits and complete the applicable sections.

- Calculate Tax Liability: Use the provided tax tables and worksheets to determine the total tax owed.

- Submit Form: Ensure the form is thoroughly checked for errors, and submit it using the preferred method.

These steps guide taxpayers through the process, aiding in a more efficient and accurate filing experience.

IRS Guidelines

The IRS provides specific guidelines for completing the 2025 Form 1040-SR (sp):

- Instructions and Publications: Taxpayers should refer to IRS publications for detailed guidance on each aspect of the form.

- Draft and Final Versions: Using the most current form version and updates can prevent issues during submission.

- Tax Resources: Accessing IRS helplines or online portals for additional clarification can be beneficial.

Compliance with IRS guidelines ensures that all filings are up to standard and reduces the risk of audit or correction requests.

Filing Deadlines / Important Dates

Staying aware of key dates is crucial:

- Standard Deadline: April 15, 2025, is the deadline for submitting the completed form and paying any owed taxes to avoid penalties.

- Extensions: Taxpayers can request an extension if additional time is needed, typically granting until October 15, 2025.

- Estimated Tax Payments: Quarterly deadlines exist for those required to make estimated tax payments.

Missing these deadlines can lead to fines and additional interest, so timely filing is essential.

Penalties for Non-Compliance

Failing to adhere to filing requirements can result in:

- Late Filing Penalties: Charges for submitting after the due date without an approved extension.

- Underpayment Penalties: Fees for underreporting income or underpaying owed taxes.

- Interest on Unpaid Taxes: Accrual of interest on any tax amount not paid by the due date.

Understanding these consequences underscores the importance of timely and accurate filing.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have multiple options for submitting the 2025 Form 1040-SR (sp):

- Online Submission: Utilizing IRS e-file services ensures faster processing and confirmation receipt.

- Mail: Traditional submission via mail includes sending the completed form to the IRS address listed in the instructions.

- In-Person: Filing through authorized tax preparers or IRS assistance centers is available for those needing additional guidance.

These options provide flexibility, catering to different preferences and access levels, ensuring the form is filed successfully.