Definition & Meaning

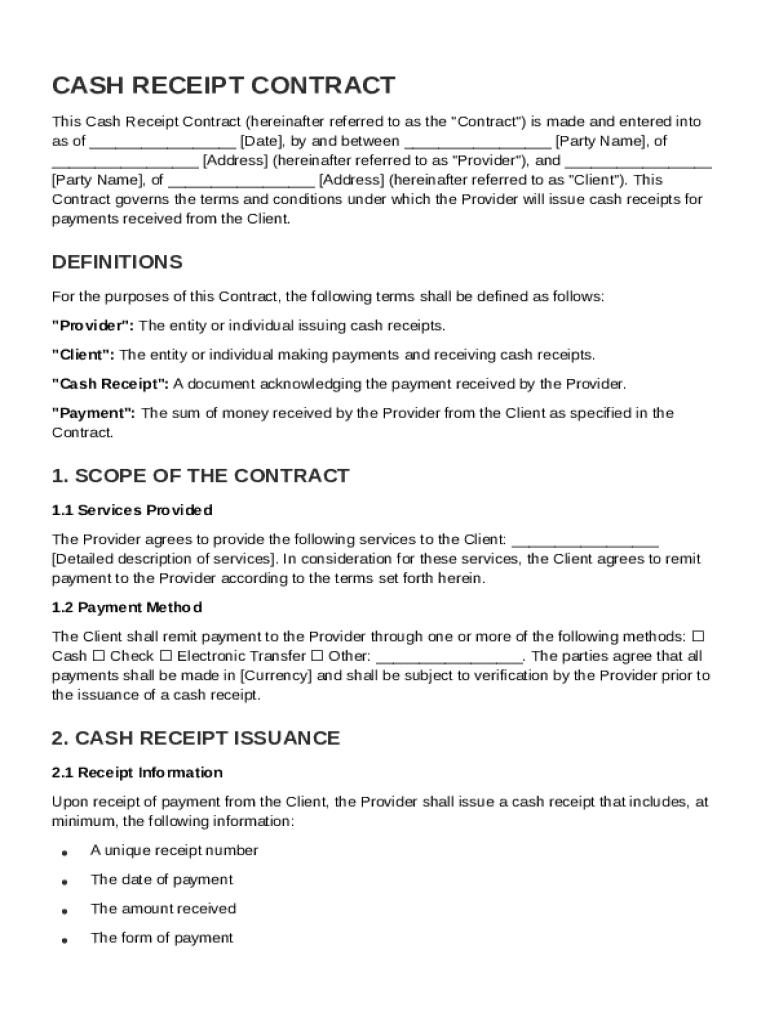

A Cash Receipt Contract Template is a formal document that outlines the agreement between a service provider and a client regarding the issuance and management of cash receipts for payments received. This template serves as a detailed record of the terms under which cash transactions are handled, including payment methods, responsibilities, and procedures for issuing receipts. It also encompasses provisions for recordkeeping, compliance with relevant laws, and conditions for modifying or terminating the agreement. The primary purpose of this template is to ensure clear communication and accountability between the parties involved in the transaction.

How to Use the Cash Receipt Contract Template

Utilizing the Cash Receipt Contract Template involves several steps to ensure it meets the specific needs of the transaction. Begin by downloading or importing the template from reliable sources, such as a document management platform like DocHub. Once obtained, the document should be customized to fit the particularities of the agreement. Adjust details like the parties' names, specific services, payment terms, and other relevant information. After customization, both parties should review and agree upon the terms, making any necessary amendments—ultimately leading to both parties signing the contract to legitimize the agreement. To further streamline the use of this template, users can leverage document collaboration tools, ensuring that all stakeholders have access to the most current version.

Steps to Customize the Template

- Download the template from a credible source or create a new document using a platform like DocHub.

- Fill in crucial details such as names, addresses, and contact information of the involved parties.

- Specify the scope of services and payment terms, including methods and schedules.

- Ensure compliance clauses are tailored to meet applicable laws and regulations.

- Review and amend any disputes, termination, or penalty clauses as needed.

Key Elements of the Cash Receipt Contract Template

Certain components of a Cash Receipt Contract are essential for maintaining clarity and comprehensiveness. These include:

- Parties to the Agreement: Clearly identifies who the service provider and client are.

- Scope of Services: Outlines the specific services or products related to the cash transactions.

- Payment Terms: Details when and how payments are to be made and what constitutes acceptable payment methods.

- Receipt Issuance Protocol: Describes the manner in which receipts will be issued and recorded.

- Responsibilities and Obligations: Defines the duties of each party throughout the contract's duration.

- Modification and Termination Conditions: Outlines how the contract can be modified or terminated, including necessary notice periods.

- Compliance and Recordkeeping: Ensures adherence to legal standards and details how records will be maintained.

Legal Use of the Cash Receipt Contract Template

The legal utilization of a Cash Receipt Contract Template involves adhering to the laws and regulations governing financial transactions and contractual agreements. In the United States, these can include state-specific regulations alongside federal laws. The template should reflect accurate legal language to ensure its enforceability. Parties should consider seeking legal counsel to ensure that the contract is comprehensive and adheres strictly to applicable legal standards to avoid potential disputes or invalidation.

Important Terms Related to the Cash Receipt Contract Template

Understanding the terminology used in a cash receipt contract is crucial for drafting a clear and enforceable agreement. Some important terms include:

- Consideration: The value exchanged between parties.

- Indemnity: A clause that specifies responsibility for loss or damage.

- Force Majeure: Conditions under which parties are excused from fulfilling contractual obligations.

- Governing Law: Jurisdiction whose laws govern the agreement.

Steps to Complete the Cash Receipt Contract Template

Completing a Cash Receipt Contract Template is a structured process designed to ensure accuracy and validity. Follow these detailed steps:

- Gather Information: Collect all necessary information about the transaction, including parties’ details and service specifications.

- Draft the Contract: Use the template to draft the initial version, adhering to accepted formats and language.

- Custom Tailoring: Modify sections to fit specific transaction requirements, inserting relevant payment and receipt terms.

- Review and Edit: Conduct a thorough review of the draft for accuracy, completeness, and legal compliance.

- Legal Consultation: Seek legal advice to validate contract provisions and avoid legal pitfalls.

- Finalize and Sign: Once both parties agree on terms, proceed to formalize the contract with signatures.

Examples of Using the Cash Receipt Contract Template

Real-world scenarios illustrate the practical application of a Cash Receipt Contract Template:

- Small Business Transactions: A local bakery uses this template to document cash purchases from customers, ensuring clear recordkeeping.

- Freelancer Agreements: Freelancers providing graphic design services utilize the template to outline payment terms for services rendered.

- Event Management: An event organizer employs the contract to document deposit payments for venue rentals.

These examples demonstrate the versatility and necessity of using a well-drafted cash receipt template in various business contexts.

State-Specific Rules for the Cash Receipt Contract Template

State-specific legislation may impact the way cash receipt contracts are drafted and enforced. Different states might have unique requirements regarding elements such as disclosures, notarization, and consumer protection standards. It is vital for companies to align their templates with these regulations to ensure legal enforceability. Businesses engaging in transactions across multiple states should consider customizing templates accordingly or seek legal advisement for statewide adjustments.