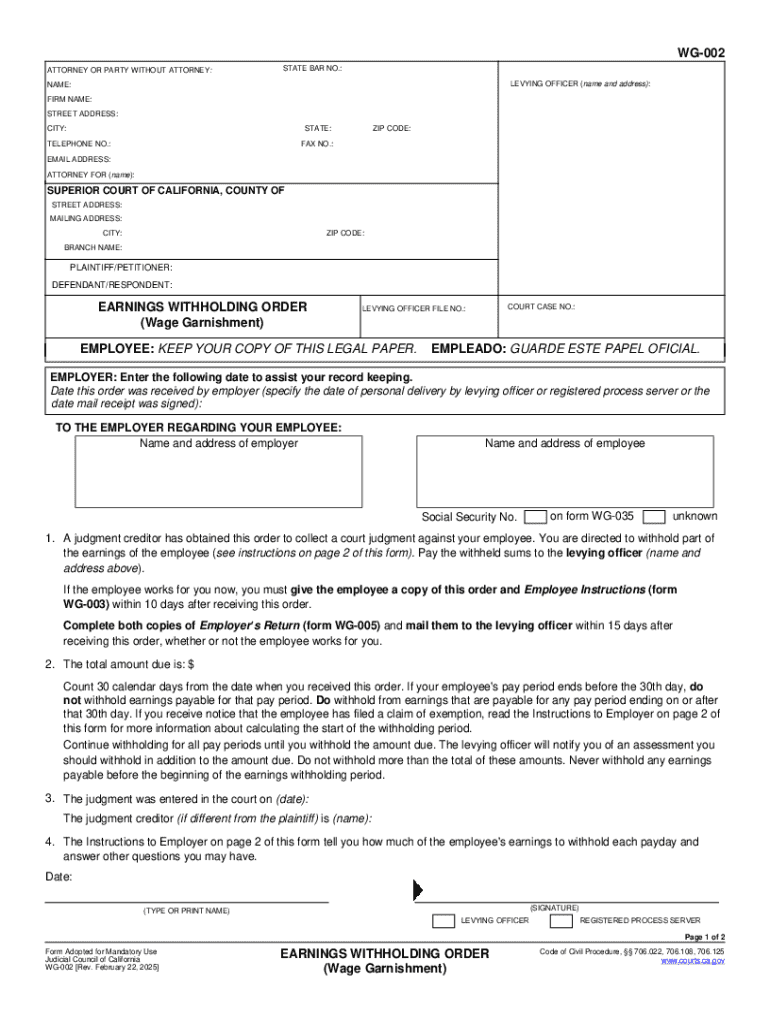

Definition and Meaning of WG-002 Earnings Withholding Order

The WG-002 Earnings Withholding Order, also known as Wage Garnishment, is a legal directive issued by the Superior Court of California. This document mandates employers to withhold a portion of an employee's earnings to satisfy a court-ordered debt or judgment. The form lays out specific guidelines for employers on how to calculate the amount to withhold based on the employee's disposable earnings and the applicable minimum wage laws.

Core Aspects of the Order

- Purpose: Enforces the collection of debts owed by an employee.

- Applicable Context: Typically used in cases of unpaid debts, such as child support or creditor dues.

- Legal Foundation: Acts under the jurisdiction of California state law, with compliance required by the employer.

Steps to Complete the WG-002 Earnings Withholding Order

Completing the WG-002 form involves several key steps to ensure all legal responsibilities are met. The form should be completed meticulously to avoid legal pitfalls.

- Review the Order: The employer must carefully review the court's instructions, ensuring all employees' rights are considered.

- Calculate Withholding: Use the employee’s disposable income to determine the correct withholding amount, respecting legal limits as outlined.

- Notify the Employee: Inform the affected employee of the garnishment, providing them a copy of the order and details on the deductions.

- Submit Payments: Forward the withheld amounts to the levying officer by the specified deadlines.

Detailed Considerations

- Deadlines and Timeliness: Each step has a time constraint, which if not adhered to, can lead to penalties or legal repercussions.

- Confidentiality: Handle the garnishment process with discretion, maintaining the confidentiality of the affected employee.

Legal Use and Implications

The WG-002 Order has specific legal applications primarily in the enforcement of debt repayments. Employers must adhere to these to remain compliant and avoid potential penalties.

Legal Obligations for Employers

- Compliance: Strict adherence to the stipulations of the WG-002 is mandatory.

- Record-Keeping: Accurate records of all transactions and communications related to the garnishment must be maintained.

- Prohibitions: Retaliatory or discriminatory actions against employees subject to garnishment are prohibited by law.

Who Typically Uses the WG-002 Earnings Withholding Order

The form is predominantly utilized by employers in California when directed by the Superior Court to garnish wages.

Primary Users and Scenarios

- Employers: To enforce court orders concerning debt collection.

- Levying Officers: To ensure the appropriate amount is withheld and distributed.

- Legal Departments: To oversee compliance with state and federal laws regarding wage garnishment.

Who Issues the WG-002 Earnings Withholding Order

The issuance of the WG-002 is the prerogative of the Superior Court of California, which exercises legal authority over wage garnishment proceedings within the state.

Issuance Process

- Court Initiation: The court instructs the employer through a formal order which entails guidelines and deadlines.

- Collateral Agencies: At times, other state agencies may be involved in the processing of these orders to enforce collection.

Important Terms Related to WG-002 Earnings Withholding Order

Understanding specific terminology is crucial for navigating the WG-002 effectively. These terms are integral to interpreting and enforcing the garnishment order.

Key Terms

- Disposable Earnings: Employee's remaining income after mandatory deductions, critical for calculating withholding amounts.

- Levying Officer: The official responsible for managing the distribution of garnished funds.

- Wage Garnishment: The process by which a court order requires a portion of an individual's earnings to be withheld for debt repayment.

State-Specific Rules for the WG-002 Earnings Withholding Order

While the WG-002 is a California-specific form, other states may have varying requirements for wage garnishment.

Specific Differences in California

- Calculation Methods: Distinct methods for calculating withholding limits based on California's minimum wage laws.

- Notification Procedures: Specific procedures for notifying employees about wage garnishment varies between states.

Penalties for Non-Compliance

Failure to adhere to the WG-002 can result in significant penalties, emphasizing the importance of compliance.

Possible Consequences

- Fines: Penalties in the form of heavy fines for the employer.

- Legal Actions: Potential lawsuits or actions by aggrieved employees or the court.

- Operational Repercussions: Non-compliance may affect the business’s operational licenses or standing.