Definition and Purpose of the TC-572

The TC-572 form is a business application document issued by the Utah State Tax Commission. It is intended for making payments via credit card or electronic payment for services related to title and registration through the Division of Motor Vehicles. The form facilitates the process by which companies can provide essential information necessary for conducting these transactions securely and efficiently. By using TC-572, businesses ensure that their payments are correctly directed and properly documented.

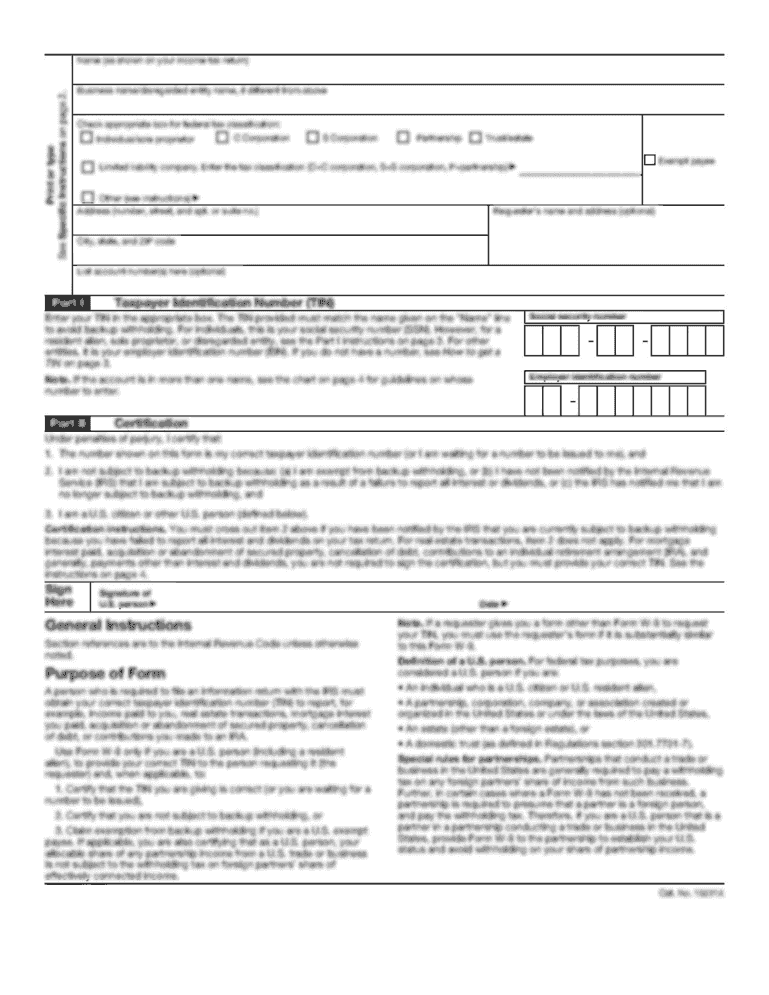

Steps to Complete the TC-572

-

Company Information: Begin by filling out the section that requires your company's details. This typically includes the legal name, address, and contact information.

-

Electronic Payment Details: Specify the type of electronic payment being made and the service for which this payment is intended. This is crucial to ensure that the payment is allocated to the correct account and service.

-

Credit Card Information: Enter the credit card details that will be used for the payment. Make sure that all information is accurate and up-to-date to avoid potential payment issues.

-

Authorization Statement: Before submitting the form, read the authorization statement carefully, which confirms the accuracy of the information provided. Signing this section validates the information and authorizes the transaction.

Who Typically Uses the TC-572

The TC-572 form is primarily used by businesses involved in transactions with the Division of Motor Vehicles in Utah. This includes automotive dealers, leasing companies, and other entities requiring title and registration services. The form is particularly useful for companies that prefer electronic payments for their convenience and speed. It also serves businesses that need a reliable method for recurring transactions related to vehicle titles and registrations.

Legal Use of the TC-572

The TC-572 complies with state regulations concerning financial transactions for title and registration services. Businesses using this form must provide accurate information to ensure compliance and avoid legal issues. The authorization statement included in the form serves as a legal acknowledgement that all data is true and accurate, providing a safeguard for both the business and the Utah State Tax Commission.

Key Elements of the TC-572

- Company Information: Legal name, address, and contact details.

- Payment Information: Type of payment and related services.

- Credit Card Information: Details necessary for processing the transaction.

- Authorization Statement: Acknowledgement and confirmation of accuracy.

These elements are essential for the proper processing and application of payments related to vehicle registration services.

State-Specific Rules for the TC-572

The TC-572 adheres to the specific regulatory requirements set by the Utah State Tax Commission for electronic and credit card payments. Businesses must ensure that their practices align with these standards to avoid disruptions in their transactions. Additionally, any changes or updates in state policies related to electronic payments should be monitored to maintain compliance.

How to Obtain the TC-572

The TC-572 form can be obtained directly from the Utah State Tax Commission. It is typically available on their official website for download. Businesses may also request it through direct contact with the state's motor vehicle division offices. Having easy access to this form ensures that businesses can promptly fulfill their payment obligations.

Filing Deadlines and Important Dates

The TC-572 is associated with recurring payments for vehicle registration services, so being aware of important payment dates is crucial. While there might not be fixed annual deadlines, timely submission after service transactions will prevent late fees and service interruptions. Regularly checking the Utah State Tax Commission's announcements will help in staying informed about any significant date changes or updates.

Form Submission Methods: Online, Mail, In-Person

-

Online: The most efficient way to submit the TC-572 is via online portals provided by the Utah State Tax Commission. This method ensures quick processing and confirmation receipts.

-

Mail: For those preferring traditional methods, the form can be sent via mail. Ensure that all necessary documents and checks, if applicable, are included.

-

In-Person: Direct submissions can be made at any Utah Division of Motor Vehicles office for those who prefer face-to-face transactions. This option can be useful for immediate clarifications or additional inquiries.

Digital vs. Paper Version of the TC-572

Digital forms offer ease of access, the convenience of electronic submission, and faster processing times. With enhanced security measures like encryption, digital submissions are safe options. However, the paper version remains available for those who prefer a tangible document or for areas with limited internet access. Each method has its own advantages, depending on business needs and preferences.

Software Compatibility

While the TC-572 form itself is a document, businesses may need to use accounting software such as QuickBooks or TurboTax to integrate their financial records. Compatibility with these software solutions ensures seamless data handling, especially for submitting electronic payments and maintaining up-to-date financial documentation concerning title and registration services.