Definition and Meaning of - Tax Alaska

The "- tax alaska" form is an essential document designed for individuals and businesses who are seeking to understand and utilize the various tax incentives offered by the state of Alaska. These incentives are aimed at encouraging economic development across several sectors such as oil, gas, mining, education, and film production. The form provides structured guidelines for calculating and applying tax credits against state income tax obligations set forth by Alaskan statutes. This ensures that taxpayers can accurately assess their tax liabilities and optimize their eligibility for incentives.

How to Use the - Tax Alaska Form

Using the "- tax alaska" form involves several steps to ensure compliance and accuracy. To begin, gather all pertinent information regarding your business activities or personal circumstances that might qualify for state tax credits. Next, familiarize yourself with the specific incentives applicable to your industry. The form itself will guide you through various sections related to tax calculation, making it necessary to follow all instructions carefully to avoid errors in your submission. For those new to this process, consulting with a tax professional familiar with Alaskan tax incentives is recommended.

Steps to Complete the - Tax Alaska Form

-

Download the Form: Obtain the latest version of the "- tax alaska" form from an authorized source, such as the Alaska Department of Revenue's official website.

-

Review Eligibility: Verify your eligibility for the available tax credits by reviewing state-specific statutes that pertain to sectors like mining, education, or oil and gas exploration.

-

Gather Required Information: Collect all necessary documents and records, such as proof of qualifying expenditures, employment records for veterans, or documentation of educational contributions.

-

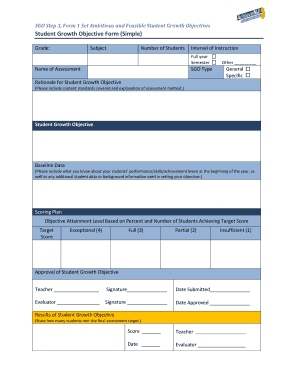

Complete Each Section: Carefully fill out each required section of the form, ensuring that all figures are accurate, and calculations adhere to provided guidelines.

-

Submit the Form: Depending on the submission methods available, submit the completed form through the preferred channel—online, via mail, or in-person at a designated office.

-

Maintain Records: Keep copies of the submitted form and all supporting documents for future reference and potential audits.

Eligibility Criteria for - Tax Alaska

Eligibility for the "- tax alaska" form incentives varies based on industry and specific business activities. Key eligibility requirements include:

- Industry-Specific Activities: Your business must operate in sectors targeted for state incentives, such as oil and gas, mining, or educational services.

- Expenditure Thresholds: You may need to meet certain thresholds for qualifying expenditures, such as costs incurred during oil exploration or investments in educational infrastructure.

- Employment Initiatives: Companies employing veterans or investing in workforce development programs may qualify for additional credits.

- Period of Activity: Typically, eligible activities must occur within a specified tax year to qualify for incentives.

Important Terms Related to - Tax Alaska

Understanding the terminology associated with the "- tax alaska" form is crucial for proper completion:

- Incentive Credits: Tax reductions available for specific business activities that meet state-defined criteria.

- Qualifying Expenditure: Expenses that are eligible for tax deductions or credits under state statutes.

- Compliance: Adherence to regulations governing the application and approval of tax credits.

- Statutes: Legal provisions established by the state to regulate the use of tax incentive forms.

Key Elements of the - Tax Alaska

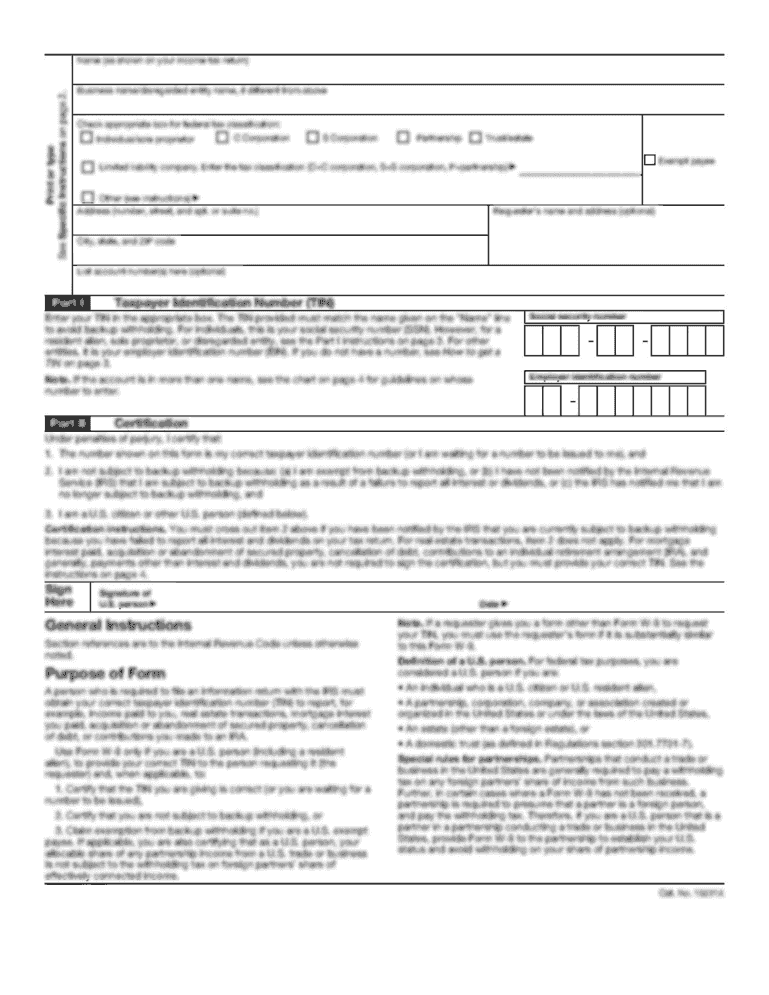

The "- tax alaska" form consists of several core sections that are integral to its completion:

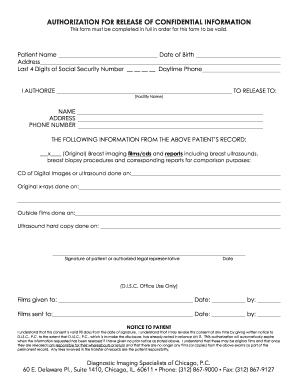

- Applicant Information: General details about the entity or individual applying for the incentives.

- Credit Calculation: A detailed section for computing eligible tax credits based on qualified activities and expenses.

- Declaration and Signature: A mandatory declaration certifying the accuracy and completeness of the information provided.

- Supporting Documents: Instructions on attaching required documents that verify eligibility for claimed incentives.

State-Specific Rules for the - Tax Alaska

The state of Alaska has specific rules governing the "- tax alaska" form, which can impact how taxpayers approach the application:

- Sector-Specific Conditions: Different rules may apply to various industries, with conditions that must be met for sectors like gas exploration or film production.

- Timeframes: There are specified periods during which qualifying activities must be conducted to be eligible for tax credits.

- Documentation Requirements: The state requires comprehensive documentation to substantiate claims made on the form, reflecting the importance of organization in record-keeping.

Examples of Using the - Tax Alaska

Consider the following practical scenarios where the "- tax alaska" form may be applicable:

- Oil and Gas Exploration: A company investing in new exploration sites may qualify for significant tax credits, reducing operational costs.

- Educational Donations: Businesses contributing large amounts to Alaskan educational initiatives may apply for credits, enhancing the attractiveness of such investments.

- Mining Operations: Mining companies may benefit from incentives by demonstrating sustainable practices or technology investments that align with state goals.

In conclusion, the "- tax alaska" form is a valuable tool for optimizing tax liabilities through targeted incentives. Understanding its nuances and completing it accurately can provide significant economic advantages for both individuals and businesses in Alaska.