Definition & Meaning of Tax Alaska

The term "Tax Alaska" generally refers to the tax incentives and credits available within the state of Alaska. These may include various financial advantages provided by the state to encourage economic activity, such as tax credits for gas exploration, education, veterans' employment, and film production. These credits aim to support both individuals and businesses by reducing state income tax liabilities, fostering growth and development in targeted areas.

How to Obtain the Tax Alaska

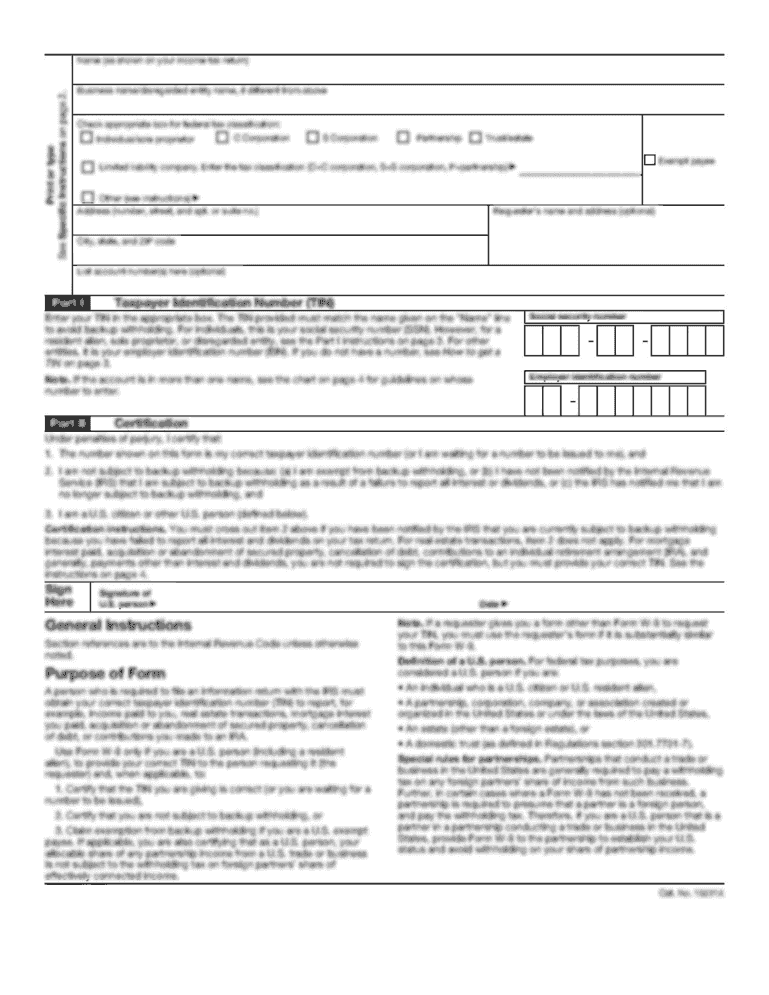

In order to access the tax incentives available in Alaska, individuals and businesses need to apply through the state's specific tax forms. This process typically involves identifying the applicable tax credits, understanding the eligibility requirements, and submitting the appropriate documentation to the Alaskan tax authorities. Applicants may need to prove their involvement in specific activities, such as qualifying for gas exploration or hiring veterans, to be awarded the credits.

Steps to Complete the Tax Alaska

- Identify Applicable Credits: Begin by reviewing the available tax credits and determining which ones you qualify for.

- Collect Required Documentation: Gather documentation that supports your eligibility, such as business registration paperwork, employment records, or financial statements.

- Complete the Relevant Forms: Fill out the necessary tax forms accurately, ensuring all required fields are filled and calculations are correct.

- Submit the Forms: Send the completed forms and supporting documents to the Alaskan tax authorities by the specified deadline, either electronically or by mail.

- Keep Records: Retain copies of all submitted forms and documentation for future reference and potential audits.

Important Terms Related to Tax Alaska

- Incentive Credits: Specific tax reductions aimed at encouraging certain activities, like gas exploration.

- State Income Tax Liabilities: The amount of tax owed to the state before any credits or deductions are applied.

- Eligibility Requirements: Conditions that must be met to qualify for specific tax incentives.

- Supporting Documentation: Evidence required to prove eligibility for tax credits, often including financial and operational documents.

Legal Use of Tax Alaska

The use of tax incentives in Alaska is governed by state legislation, which outlines the criteria and procedures for claiming such credits. Legal compliance involves adhering to the rules governing eligibility, filing accurate claims, and ensuring all submitted information is truthful and documented. Misuse or fraudulent claims of tax credits can result in severe penalties, including fines or legal action.

State-Specific Rules for the Tax Alaska

Alaska's tax credits program is uniquely tailored to its economic and geographic needs. For example, incentives for gas exploration are significant due to the state's rich natural resources. Further, hiring incentives target sectors where workforce development is needed. Understanding these specific rules requires examining state policies, which may differ from general federal guidelines.

Examples of Using the Tax Alaska

An Alaskan film production company may claim tax credits to offset production costs, thereby attracting more business to the state. Similarly, a small business owner hiring veterans may reduce their state tax liability through employment-related credits, thereby promoting workforce inclusion and reducing unemployment rates.

Filing Deadlines and Important Dates

It is crucial for applicants to be aware of key filing deadlines for Alaska tax credits to avoid penalties. These deadlines are often set annually and coincide with general tax submission dates. However, specific incentive programs may have unique deadlines that applicants need to adhere to, requiring close attention to the state’s official tax calendar.

IRS Guidelines

While IRS guidelines primarily concern federal tax issues, they can interact with state programs. For instance, Alaska tax credits may affect calculations pertinent to federal filings. Understanding these interactions is important, as they can have implications for overall tax strategy, ensuring that taxpayers remain compliant on both state and federal levels.