Definition & Importance of the Download Fill-In Form (171K)

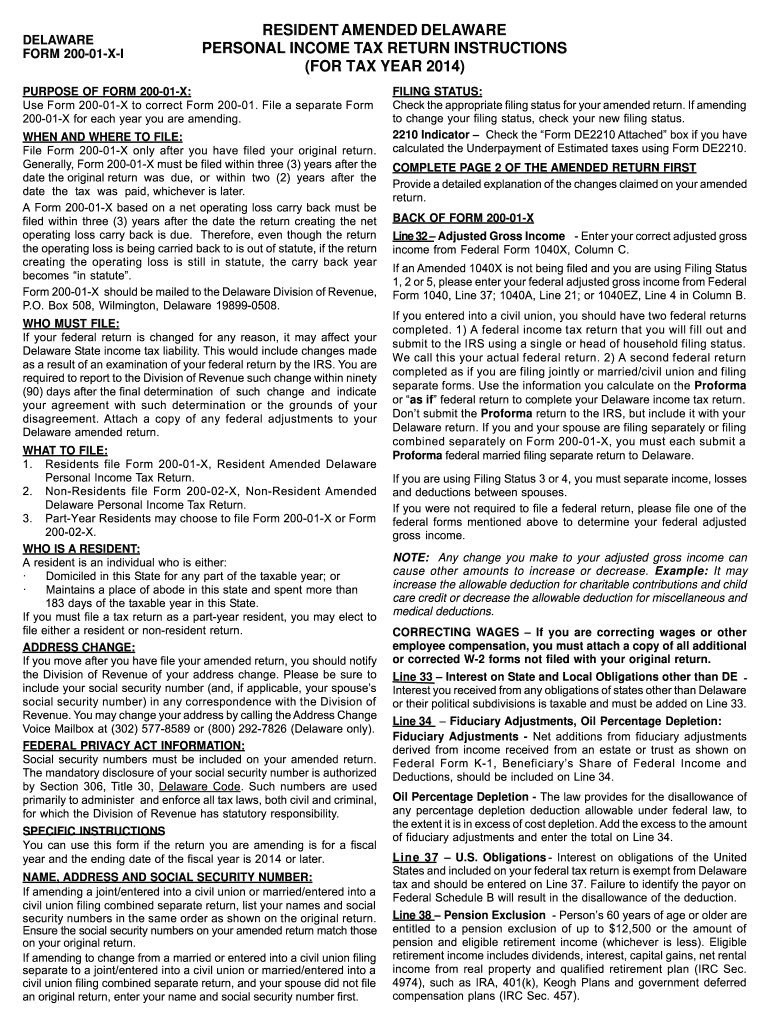

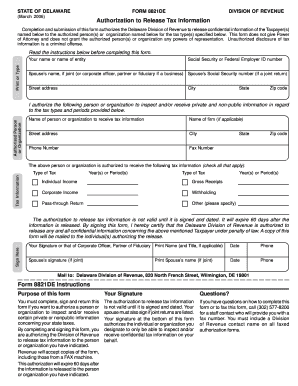

The "Download Fill-In Form (171K) - Division of Revenue - revenue delaware" is a crucial document used by entities or individuals to fulfill specific reporting or regulatory requirements related to taxes or financial disclosures in the state of Delaware. This form is essential for maintaining compliance with state tax laws and ensuring accurate revenue reporting. Typically, the form is tailored for various financial operations or tax obligations specific to Delaware residents and businesses. Its structured format allows users to provide detailed information accurately, minimizing errors and potential discrepancies in revenue data submitted to the Division of Revenue in Delaware.

Key Elements of the Form

- Sections for Personal Information: Includes fields for entering names, addresses, and contact details to verify the identity of the filer.

- Income Reporting Fields: Designed for detailing different sources of income, allowing for a comprehensive overview of earnings that need reporting.

- Deductions and Credits: Sections where filers can list applicable deductions or credits to which they might be entitled, impacting net taxable income.

- Signature and Date Acknowledgment: Providing legal validity to the document, ensuring all information is verifiable and accurate upon submission.

How to Obtain the Download Fill-In Form (171K)

Getting the "Download Fill-In Form (171K)" is straightforward. The form is accessible online through the official website of the Delaware Division of Revenue, where users can download it directly. It's available in both digital and print-ready formats for ease of completion. Alternatively, those preferring physical copies can visit local offices of the Division of Revenue in Delaware to request hard copies. It’s also accessible through various tax preparation software that supports Delaware tax filings, providing options for both digital convenience and traditional methods.

Access via DocHub

DocHub, a comprehensive platform for document editing and management, supports this form, allowing users to fill, sign, and share it online. With its features, users can edit the form directly without needing additional software, enhancing convenience.

Steps to Complete the Download Fill-In Form (171K)

Completing the "Download Fill-In Form (171K)" involves a structured process:

-

Gather Required Documents: Before starting, collect all necessary documents, such as income statements, previous tax returns, and receipts for potential deductions.

-

Fill Out Personal Information: Begin with your identifying details, ensuring accuracy as this section verifies your identity.

-

Report Income Sources: Carefully detail all income streams within specified sections, adhering to any instructions provided on the form.

-

List Deductions and Credits: Accurately document any deductions or credits you're eligible for, supported by relevant documentation.

-

Review and Validate Information: Double-check all entries for accuracy to avoid errors that could delay processing or require amendments.

-

Sign and Date: Legally bind the document by providing your signature and the date of completion.

-

Submit the Form: Depending on preferred submission methods, either mail it to the Delaware Division of Revenue or submit it electronically through compatible platforms.

Practical Tips for Completion

- Ensure all supporting documents are available for verification to streamline the process.

- Use electronic tools like DocHub for ease of editing and sharing if filing digitally.

State-Specific Rules for the Download Fill-In Form (171K)

Delaware has particular regulations and stipulations that apply to the submission of this form. Filers must ensure they adhere to state-specific income thresholds and deduction eligibility. Additionally, specific deadlines are enforced to ensure timely processing, aligning with Delaware's fiscal calendar. These rules are integral to preventing penalties or the need for resubmission. Understanding these guidelines, often outlined on the form itself or accompanying documentation, is critical for accurate completion.

Important Considerations

- Deadline Adherence: Missing a deadline might result in penalties or interest charges.

- State Guidelines: Ensure compliance with all Delaware-specific tax laws and regulations.

Legal Use of the Download Fill-In Form (171K)

The form is used legally to report income and claim deductions in line with Delaware state laws. It’s crucial for providing a transparent and verifiable record of a taxpayer's financial obligations to the state. Misuse or falsification of form details can lead to legal consequences, including audits or fines. Therefore, ensuring accuracy and honesty when completing this form is paramount.

Compliance Assurance

- Accuracy in Reporting: Ensure all data entries are accurate and reflect true income and deductions.

- Confidentiality: Maintain privacy and security of personal and financial information during and after form completion.

Who Typically Uses the Download Fill-In Form (171K)

The primary users include individual taxpayers, businesses, and other entities that are required to report to the Delaware Division of Revenue. It’s often used by individuals who have multiple sources of income or those who qualify for various state-specific tax credits and discrepancies. Additionally, business entities operating in Delaware might use this form to report revenue, ensuring they adhere to state tax laws.

Common Users

- Individual Taxpayers: Especially those with diverse income streams or significant eligible deductions.

- Business Entities: Corporations and small businesses with operations or revenue sources in Delaware.

- Accountants and Tax Professionals: Handling multiple client portfolios requiring accurate compliance reporting.

Understanding Required Documents for the Download Fill-In Form (171K)

To accurately fill out this form, several documents might be needed. These include W-2s, 1099s, receipts for deductible expenses, previous tax returns, and any documentation that supports claims of tax credits or deductions. Having these documents ensures that the data entered is thorough and minimizes items that could necessitate amendment or further inquiry.

Examples of Essential Documents

- W-2 Forms: Reporting employment income.

- 1099 Forms: Documenting non-employment income streams.

- Receipts and Invoices: For validating itemized deductions.

- Previous Tax Returns: Serving as benchmarks for current year reporting.

By precisely understanding the role and requirements of the "Download Fill-In Form (171K) - Division of Revenue - revenue delaware," filers can confidently comply with tax obligations while benefiting from applicable deductions and credits.