Definition & Meaning

Form 8821DE, issued by the Delaware Division of Revenue, is utilized to authorize the release of confidential tax information to designated individuals or organizations. This document plays a crucial role in ensuring that taxpayer data is shared legally and under controlled circumstances. Not only does it empower taxpayers to grant access to their tax-related information, but it also outlines the specific types of data that can be disclosed and the time periods covered. Understanding the purpose and function of Form 8821DE is essential for navigating legal aspects of tax information sharing.

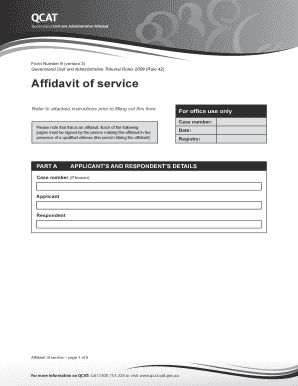

How to Use the de Form 8821DE

Utilizing Form 8821DE involves several straightforward steps aimed at legally granting access to sensitive tax information. First, identify the specific tax documents and periods that the form should cover to ensure clarity and prevent accidental over-disclosure. When completing the form, clearly list the individuals or organizations to whom the information will be released. This ensures that only authorized parties gain access. It’s important to adhere to the specified requirements and instructions outlined by the Delaware Division of Revenue to maintain compliance.

Steps to Complete the de Form 8821DE

- Gather Necessary Information: Collect all relevant tax details and personal information needed to fill out the form accurately. Ensure that the details correspond to the type of information being requested.

- Identify the Recipient: Clearly specify the individuals or organizations authorized to receive the information. Include their full name and contact details if applicable.

- Specify Tax Information: State the types of tax data and tax periods the authorization will cover. Be precise to avoid excessive data sharing.

- Sign and Date: To validate the form, the taxpayer must sign and date it in the designated areas. Without a signature, the form is void.

- Submit the Form: Send the completed form to the Delaware Division of Revenue through recommended channels, ensuring it reaches the appropriate department.

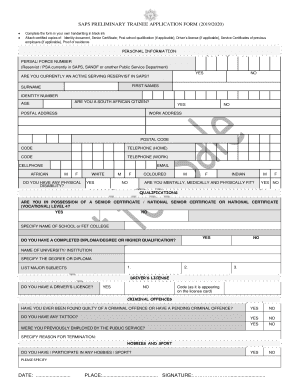

Who Typically Uses the de Form 8821DE

Form 8821DE is commonly employed by individuals and entities requiring third-party access to their tax information. Taxpayers often use this form when a tax professional, attorney, or financial advisor needs documentation to assist with tax preparation or financial planning. Businesses may also rely on this form to authorize accountants or legal representatives to manage and review confidential tax documents. Recognizing this common usage context helps determine who needs to complete Form 8821DE in various scenarios.

Key Elements of the de Form 8821DE

- Taxpayer Identification: Requires the full name and taxpayer identification number for accurate processing.

- Authorized Party Details: Includes the name and contact details of the individual or entity receiving the information.

- Tax Information Scope: Specifies the types of data being released and the periods covered.

- Signatures and Dates: Essential for the form's validity and indicating consent.

- Expiration of Authorization: Details on when the form's authorization ceases, typically 60 days after the information is released.

Legal Use of the de Form 8821DE

The legal framework surrounding Form 8821DE emphasizes documented permission for disclosing confidential tax information. This form adheres to privacy laws by ensuring disclosures are authorized and limited to the outlined scope. The significance of this legal protection cannot be overstated, as it prevents unauthorized access and misuse of personal tax data. Engaging with this form ensures compliance with regulations governing data protection and disclosure.

Filing Deadlines / Important Dates

Understanding deadlines associated with Form 8821DE is essential. While the form itself doesn't have a fixed submission deadline, the 60-day expiration period after information release is crucial. Users should plan submissions accordingly to ensure that authorizations fall within this time frame. Awareness of any changes in dates due to policy updates or legal reforms is also important, ensuring that submitted forms remain compliant.

Form Submission Methods (Online / Mail / In-Person)

Submit Form 8821DE through a variety of methods to accommodate different preferences and circumstances. While traditional mail remains a widely used option, many individuals opt for electronic submissions when available for faster processing. In-person submissions might be used when immediate confirmation is desirable. Examining these methods allows flexibility and ensures timely authorization, adapting to the user's specific logistical needs.