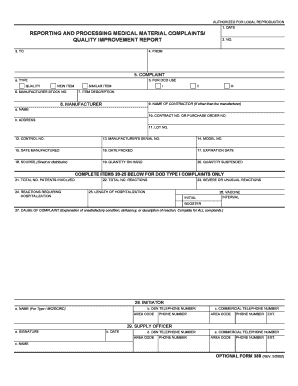

Definition and Meaning of the 740-NP-WH Form

The 740-NP-WH form, also known as the Kentucky Pass-Through Entity Nonresident Distributive Share Withholding Report, is a tax document used by pass-through entities to report the withholding of Kentucky income tax for nonresident individuals, estates, or trusts. This form is essential for entities such as partnerships, S corporations, and LLCs that must withhold taxes on income distributed to nonresident members.

Key Elements of the Form

Understanding the components of the 740-NP-WH form is crucial for proper completion. Key sections include:

- Entity Information: Includes the name, address, and federal Employer Identification Number (EIN) of the entity.

- Withholding Calculation: Details the income attributed to nonresidents and calculates the appropriate withholding tax.

- Nonresident Details: Lists each nonresident beneficiary, partner, member, or shareholder along with the distributive share and withholding amount.

Importance of the 740-NP-WH Form

The form ensures compliance with Kentucky state tax laws by allowing the Department of Revenue to collect taxes owed by nonresidents earning income in the state. Proper usage of the form helps avoid penalties and interest charges that may arise from underpayment or non-reporting of distributive share income.

How to Use the 740-NP-WH Form

Obtaining the Form

The 740-NP-WH form can be downloaded from the Kentucky Department of Revenue website. Ensure that you have the latest version to comply with any regulatory updates.

Completing the Form

To accurately fill out the form:

- Gather Information: Collect required details such as the federal EIN, nonresident information, and income distribution data.

- Calculate Withholding: Apply the Kentucky statutory withholding rate to the distributive share to determine the withholding amount.

- Complete All Sections: Fill in the entity and nonresident details, and ensure all calculations are correct.

Submission Methods

There are various methods for submitting the 740-NP-WH form:

- Online: Use the Kentucky Department of Revenue’s online filing system for efficiency and faster processing.

- Mail: Paper submissions can be sent to the Department’s address as specified on the form instructions.

Legal Use and Compliance

State-Specific Rules

As a Kentucky-specific document, the 740-NP-WH form requires adherence to state tax codes and regulations. Entities must be aware of the specific obligations concerning income reporting and tax withholding for nonresidents.

Penalties for Non-Compliance

Failing to file the 740-NP-WH form timely, or inaccurately reporting withholding information, can result in fines and interest charges. Entities must maintain accurate records to support reported amounts.

Business Types and Uses

Who Typically Uses This Form

The form is primarily used by Kentucky pass-through entities such as:

- Partnerships

- S Corporations

- Limited Liability Companies (LLCs)

Entities distributing income to nonresident members are required to withhold and report taxes using the 740-NP-WH.

Benefits for Business Types

Utilizing the 740-NP-WH form helps businesses:

- Ensure compliance with state tax laws.

- Avoid potential legal issues related to nonresident tax withholding.

- Maintain transparency in financial operations for stakeholders.

Filing Deadlines and Required Documents

Important Dates

The deadline for filing the 740-NP-WH form aligns with the fiscal year of the entity. It is critical to check for specific dates provided by the Kentucky Department of Revenue.

Documentation Needed

Entities must have:

- Federal tax identification details.

- Comprehensive records of income distributions to nonresidents.

- Documentation supporting the withholding calculations.

Examples and Scenarios

Real-World Application

For example, a multi-member LLC operating in Kentucky with several nonresident partners must use the 740-NP-WH form to report income distributions and withhold the required state taxes. By doing so, the entity demonstrates compliance and mitigates potential tax liabilities for its nonresident members.

Taxpayer Scenarios

Consider a scenario where a Kentucky-based S corporation distributes profits to nonresident shareholders. The corporation uses the 740-NP-WH form to report and withhold taxes, ensuring each nonresident shareholder meets state tax obligations.

In essence, the 740-NP-WH form is a critical element in the tax compliance process for pass-through entities operating in Kentucky, ensuring they fulfill the state’s requirements for nonresident income reporting and withholding.