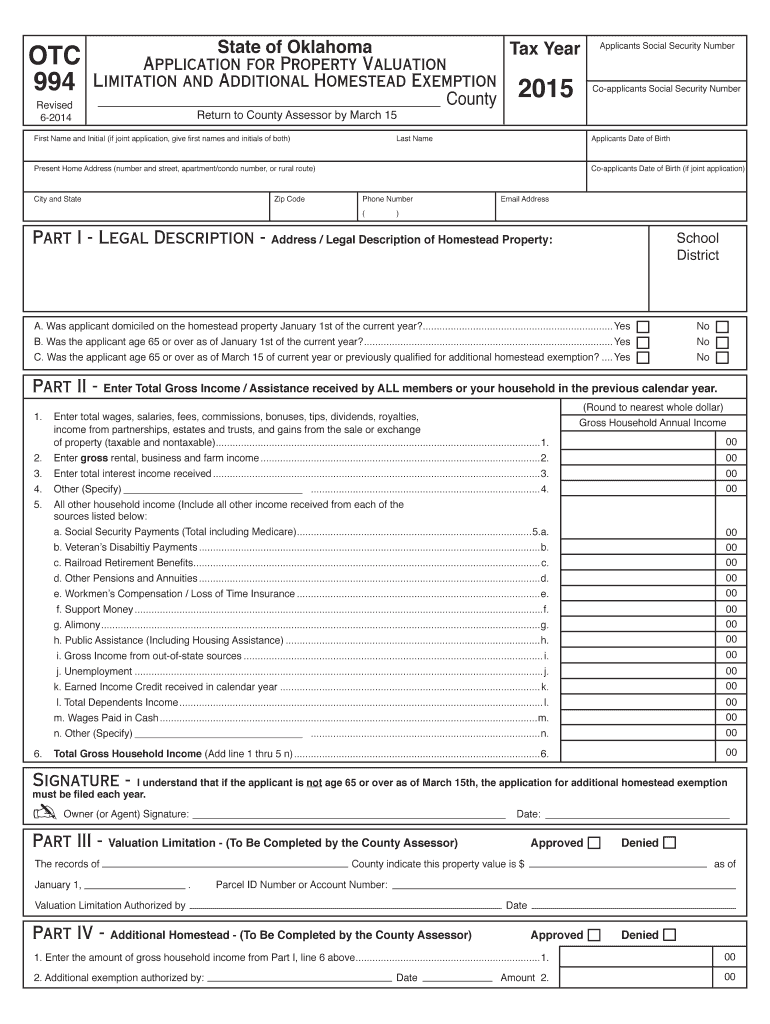

Overview of the Oklahoma Tax Homestead Exemption 2015 Form

The Oklahoma Tax Homestead Exemption 2015 Form serves as an application for property valuation limitation and additional homestead exemption within the state. This form is vital for homeowners seeking to lower their property tax responsibilities by recognizing specific eligibility requirements. The form includes sections for personal information, household income, and legal descriptions of the property. Understanding the nuances of this application can provide considerable financial benefits to eligible taxpayers.

Eligibility Criteria for the Oklahoma Homestead Exemption

To qualify for the homestead exemption in Oklahoma, certain criteria must be met:

- Ownership and Residency: The applicant must own and occupy the property as their primary residence on January 1 of the tax year.

- Income Limitations: Specific income thresholds may apply, particularly for additional exemptions aimed at seniors or veterans.

- Age Requirements: For additional exemptions, applicants typically need to meet a minimum age requirement, often set at 65 years.

- Filing Requirements: The form must be submitted to the county assessor by March 15 of the tax year.

Key Elements of the Form

The Oklahoma Tax Homestead Exemption 2015 Form comprises several critical sections:

- Personal Information: Includes name, address, and contact details of the applicant.

- Property Description: Legal description of the homestead property is necessary to ensure accurate processing.

- Income Declaration: Applicants must disclose total household income, which affects eligibility and exemption amount.

- Signature and Certification: The form must be signed to certify the accuracy of the information provided.

Steps to Complete the Oklahoma Tax Homestead Exemption 2015 Form

Filling out the form requires careful attention to detail. Here’s a step-by-step guide:

- Gather Personal and Property Information: Ensure you have the full legal description of your property and up-to-date contact information.

- Review Eligibility Requirements: Confirm you meet the residency, ownership, and any additional criteria for the year 2015.

- Calculate Household Income: Prepare detailed records of combined income sources for all household members.

- Complete the Form: Fill out each applicable section of the form accurately.

- Sign and Date: Ensure the form is signed to certify all information is true.

- Submission: Deliver the completed form to your county assessor by the March 15 deadline.

Obtaining the Oklahoma Tax Homestead Exemption 2015 Form

Acquiring the form is straightforward. Homeowners can:

- Download the Form: Often available on the county assessor’s website or related state portals for easy access.

- In-Person Collection: Visit your local county assessor’s office to obtain a printed version.

- Contact the Office: Request a form through mail or email by contacting the assessor's office directly.

Legal Use of the Oklahoma Tax Homestead Exemption Form

The homestead exemption form is governed by state law, ensuring that qualifying homeowners receive valid reductions in assessed property values. This form is specifically used to apply for tax savings within the legal framework outlined by Oklahoma's statutes, and completing it accurately is crucial for maintaining compliance and securing potential tax reductions.

State-Specific Rules for Oklahoma

Oklahoma has unique guidelines, such as:

- Cap on Property Assessment Increases: An exemption might limit increases in property valuation, effectively stabilizing tax payments.

- Additional Exemptions: Senior citizens or disabled veterans may qualify for supplementary exemptions with a higher level of tax relief.

Important Deadlines and Submission Methods

The submission deadline is critical, with forms due by March 15. Homeowners have multiple submission options:

- Online Submission: Some counties may offer online portals for electronic submissions.

- Mail: Properly addressed and postmarked by the deadline to ensure consideration.

- In-Person Delivery: Directly submit to the county assessor’s office for immediate processing.

Examples and Scenarios of Homestead Exemption in Practice

To illustrate the form's utility, consider these scenarios:

- Senior Homeowner: A retired individual living on a fixed income qualifies for reduced assessed valuation through the additional exemptions available.

- First-Time Homeowner: By claiming the standard exemption, a new homeowner reduces their annual property tax burden, facilitating home ownership affordability.

- Veteran Benefits: An eligible veteran, through verification and documentation, can apply for extended exemptions, significantly lowering property taxes.

Understanding these elements ensures potentially eligible parties benefit fully from the homestead exemption process in Oklahoma, effectively managing their property tax liabilities.