Definition and Purpose

The Tax Exemption Certificate Form 721-C is a critical document utilized by businesses and institutions predominantly within the United States to claim exemptions from specific taxes. This includes sales tax, use tax, tourism tax, and motor vehicle rental tax. Designed by the Utah State Tax Commission, this form serves as proof that the entity holding it is authorized to make tax-exempt purchases based on the qualifications and categories outlined. Each entity must understand the nuances and implications of this form to ensure correct usage and compliance.

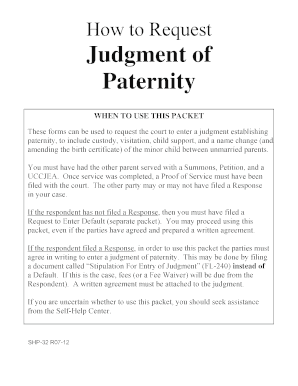

How to Obtain the Form 721-C

Securing a copy of the Tax Exemption Certificate Form 721-C requires direct interaction with the Utah State Tax Commission or through online resources provided by related tax authorities. The form can typically be accessed and downloaded from the official Utah State Tax Commission's website. Upon retrieval, businesses must prepare to complete and store the form, as it is essential not only for immediate tax exemption claims but also for record-keeping purposes in the event of an audit.

Completing the Tax Exemption Certificate Form 721-C

- Verify Eligibility: Ensure your business or entity qualifies for tax exemptions under Utah's regulations.

- Gather Information: Collect necessary details, including legal business name, address, and tax identification number.

- Specific Exemption Claims: Clearly identify and document the categories under which the exemption is being claimed, such as resale, agricultural production, or medical equipment.

- Entity Certification: The form requires a signature from an authorized representative to certify the claims and provide legal confirmation of the information.

- Retention: Retain a copy of the completed and signed form as part of the business records.

Who Typically Uses the Form

The Tax Exemption Certificate Form 721-C is primarily utilized by businesses and institutions operating in Utah that engage in transactions qualifying for tax exemptions. This includes corporations, retailers, manufacturers, and certain non-profit organizations. Entities that purchase goods for resale or those engaged in agricultural production or construction using specific materials often fall under this category. Understanding the sectors and types of businesses that are eligible is crucial for effective application and compliance.

Legal Use and Compliance

The legal framework surrounding the Tax Exemption Certificate Form 721-C necessitates meticulous attention to compliance to avoid legal pitfalls. The use of this form entails meeting certain legal and administrative requirements, where businesses must ensure that they strictly adhere to the qualifying conditions for exemption. Non-compliance or misuse can lead to penalties, including fines or revocations of exemption status, necessitating a thorough understanding of the legal obligations imposed by this form.

Key Elements of the Form

- Entity Details: The business name, address, and contact information must be precise.

- Identification Number: Tax Identification or Employer Identification Number (EIN) for verification.

- Exemption Clauses: Detailed explanation or code for claimed exemption.

- Authorized Signature: Legal confirmation by an official representative of the entity.

These elements form the core framework of the form, ensuring that the application is correctly directed and processed.

State-Specific Rules

While the form is specific to Utah, understanding state-specific nuances and regulations is paramount for businesses. Each state has its own guidelines and rules pertaining to tax exemptions, necessitating attention to compliance with Utah’s particular stipulations. Being well-informed about these distinctions can help businesses avoid errors in filing and ensure efficient processing of tax-exempt transactions.

Required Documentation

To supplement the filing of Form 721-C, businesses may need to provide additional documentation such as business licenses, proof of sales tax registration, and evidence of the exempt nature of the transaction. Ensuring all required documentation is complete and correctly associated with the form will facilitate smooth claim verification and approval processes.

Penalties for Non-Compliance

Misuse or improper filing of the Tax Exemption Certificate Form 721-C can result in substantial penalties. These include potential fines, revocation of exemption privileges, and liabilities for any taxes that were not paid as a result. Understanding these penalties underscores the importance of strict adherence to legal guidelines and accurate filing procedures, fostering a culture of compliance and diligence within business practices.