Definition & Meaning

Form 2553 is a critical document used by eligible corporations in the United States to elect S corporation status under the Internal Revenue Code. This election allows corporations to be taxed as pass-through entities, meaning income, losses, deductions, and credits are passed through to shareholders for federal tax purposes. This shift can afford significant tax benefits by preventing double taxation at the corporate level. Understanding this form is essential for businesses aiming to optimize their tax strategy.

How to Use the Form 2553 InstructionsDocHubcom 2013

To utilize the Form 2553 instructions available on DocHub for 2013, begin by accessing the relevant document from their online platform. DocHub allows you to edit, annotate, and manage this form directly within their system. You can:

- Upload the form from your computer or cloud storage.

- Follow the annotated instructions to understand each section of the form.

- Make use of fillable fields for easy input of necessary information.

This process simplifies the completion and submission of the form while ensuring compliance with IRS requirements.

Steps to Complete the Form 2553 InstructionsDocHubcom 2013

Completing the Form 2553 involves several steps, which must be followed carefully to ensure accurate filing:

- Business Information: Fill in the corporation's name, address, Employer Identification Number (EIN), and incorporation date.

- Election Information: Specify the tax year and the date the election is to be effective.

- Shareholder Consent: Secure the consent of all shareholders, as their agreement is essential for S corporation status election.

- Officer Signature: An authorized corporate officer must sign and date the form.

- Submit the Form: Send the completed form to the IRS address provided in the instructions.

Each section is vital to ensure the form is processed without delays or errors.

Eligibility Criteria

To elect S corporation status through Form 2553, the corporation must meet several strict eligibility criteria:

- Must be a domestic corporation.

- Limited to 100 shareholders who are individuals, estates, or certain trusts.

- Only one class of stock is permitted.

- All shareholders must consent to the S corporation election.

Failing to meet these criteria can result in the rejection of the S corporation election, affecting the corporation’s tax treatment.

Filing Deadlines / Important Dates

Timely filing of Form 2553 is crucial to its acceptance:

- The form should be filed no later than two months and 15 days after the beginning of the tax year for which the election is to take effect.

- Late elections may still be accepted if they meet certain IRS criteria, such as showing reasonable cause for the delay.

It's important for corporations to track these dates closely to avoid penalties or lost opportunities for tax benefits.

IRS Guidelines

Adhering to IRS guidelines is essential when completing Form 2553. The instructions on DocHub for the 2013 form should be followed meticulously for detailed guidance on:

- Filling out each individual section.

- Meeting all requirements for a valid election.

- Correctly specifying S corporation status changes.

Compliance with these guidelines ensures smooth processing and acceptance by the IRS.

Key Elements of the Form 2553 InstructionsDocHubcom 2013

The 2013 DocHub instructions for Form 2553 highlight several key features:

- Structured Formatting: Facilitates ease of use by providing step-by-step guidance.

- Fillable Fields: Streamline data entry to avoid manual errors.

- Secure Distribution: Safeguards sensitive information when sharing with stakeholders or the IRS.

These features enhance understanding and efficiency in handling the form.

Business Entity Types (LLC, Corp, Partnership)

Form 2553 is primarily relevant to corporations seeking S corporation status but can also extend to Limited Liability Companies (LLCs) wanting to be taxed as S corporations. Understanding the distinction between these entities is crucial:

- Corporation: Primarily utilizes Form 2553 for tax status election.

- LLC: May elect S corporation status by filing Form 2553 to optimize tax benefits while maintaining liability protection.

Each business type has specific implications for tax filing and eligibility that must be comprehensively understood.

Submission Methods (Online / Mail / In-Person)

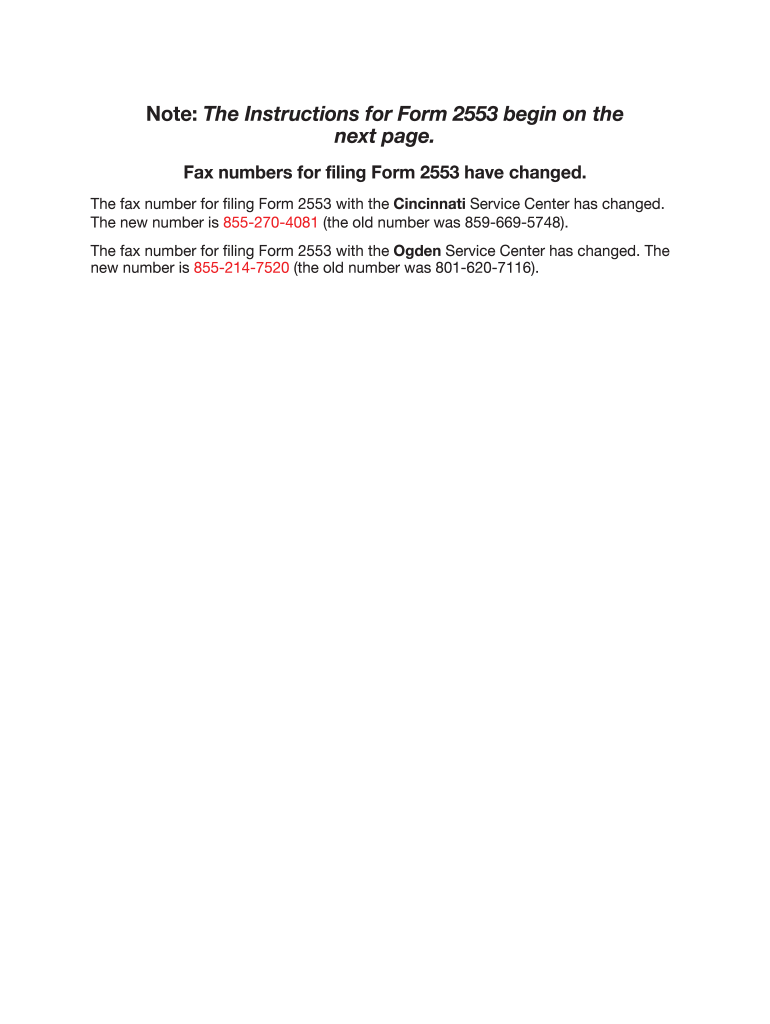

DocHub's online platform offers an efficient way to prepare Form 2553, but submission to the IRS can occur through multiple channels:

- Mail: Traditional method, often preferred if attachments are included.

- Online Fax Services: Provide a digital submission option, ensuring quicker delivery.

- In-Person: Less common but viable for receiving acknowledgment of receipt.

Selecting the appropriate method ensures compliance and expedites processing.