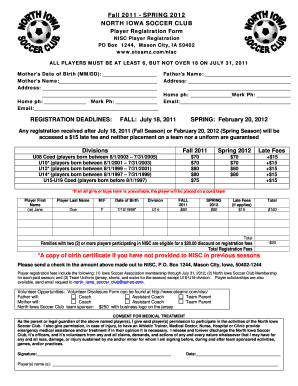

Definition & Meaning

Form 8843 is used by certain nonresident aliens who are claiming an exemption from the substantial presence test for tax purposes in the United States. It includes sections tailored to different categories of individuals, such as students, teachers, trainees, athletes, and those with medical conditions. The form is essentially a statement of personal circumstances that explain an individual's claim to exclude certain days of presence in the U.S., critical for areas such as tax obligations and compliance.

Key Elements of the 8843 Example

Form 8843 comprises several sections that cater to various categories of exempt individuals. Key elements include:

- General Information: This section requires basic personal details such as name, address, and taxpayer identification number.

- Teacher and Trainee Information: Designed for educators and trainees temporarily residing in the U.S., this part requires details about their academic activities.

- Student Information: Intended for students, it asks for data about their educational institution and course details.

- Professional Athletes: This section is meant for athletes visiting the U.S. temporarily for specific sporting events.

- Medical Condition Information: Individuals compromising their tax residency due to medical conditions must complete this section.

Steps to Complete the 8843 Example

Here is a step-by-step guide to completing Form 8843:

- Gather Personal Documents: Before starting, ensure you have your passport, Visa, or any documents that verify your identity and U.S. entry dates.

- Download the Form: The form is available from the IRS website and can be printed or filled out digitally.

- Fill General Information: Complete part one with your personal data, including name, address, and U.S. taxpayer identification.

- Complete Applicable Sections: Depending on your status (student, teacher, etc.), complete the relevant parts in detail.

- Review for Accuracy: Double-check all entries for punctuation, spelling, or informational mistakes.

- Submit the Form: Ensure submission is in line with IRS guidelines—either via mail or electronically if applicable.

Who Typically Uses the 8843 Example

Form 8843 is predominantly utilized by:

- Students on F, J, M, or Q Visas: Individuals studying in the U.S. who are classified as nonresident aliens.

- Foreign Teachers and Trainees: Individuals participating in education or training programs under similar Visa categories.

- Professional Athletes: Athletes temporarily in the U.S. for specific events, maintaining nonresident alien status.

- Individuals with Medical Conditions: Nonresidents who couldn't exit the country due to medical issues.

IRS Guidelines

The IRS provides specific guidelines for filing Form 8843, including:

- Annual Filing Requirement: The form must be filed annually by the due date of the individual's income tax return.

- No Tax Owed: Submission is needed even if you owe no taxes or have no other U.S. tax filing obligation.

- Supporting Documentation: It's advisable to keep additional supporting documents like travel itineraries for records.

Required Documents

As part of preparing to complete Form 8843, ensure you have:

- Identification Proofs: Passport and Visa copies indicating arrival and departure details.

- Academic or Program Papers: Proof of enrollment or participation in U.S.-based programs.

- Medical Documentation: Certified proof for those claiming medical exemptions.

Penalties for Non-Compliance

Non-compliance with Form 8843 can result in multiple consequences:

- Filing Default: Failure to file could jeopardize future immigration statuses and tax obligations under the IRS.

- Legal Implications: Past non-disclosure can lead to legal actions or inaccuracies in tax data leading to further audits.

- Future Visa Entries: Incorrect filing may hinder approvals for future U.S. Visa requests.

Form Submission Methods

Form 8843 may be submitted in multiple ways:

- Mailing to the IRS: Physical forms can be mailed directly to IRS processing centers, following the instruction booklet.

- Online Platforms: Platforms like DocHub might offer a way to fill and sign documents before mailing.

- In-Person Consultation: Certain tax professionals offer services for completing such forms in-office.