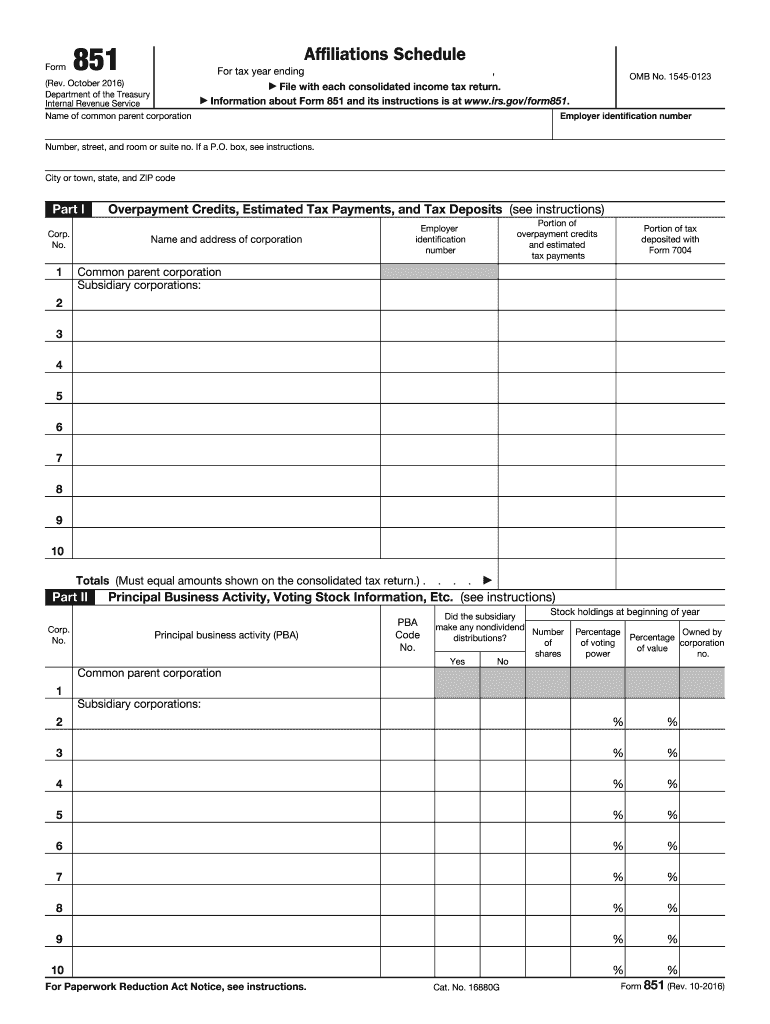

Definition and Purpose of Form 851

Form 851, formally known as the Affiliations Schedule, serves a critical role in the tax filing process for U.S. corporations. Specifically, it is used by the common parent corporation of an affiliated group to report consolidated activities. This form provides a structured avenue to disclose overpayment credits, estimated tax payments, and tax deposits for the parent corporation and its subsidiaries. Essential details captured in Form 851 include identifying the common parent corporation, stock ownership and changes within the tax year, and pertinent business activities. Filing Form 851 alongside the consolidated income tax return ensures compliance with IRS regulations and assists in maintaining transparency within corporate financial activities.

Steps to Complete Form 851

Completing Form 851 involves several critical steps to ensure accuracy and compliance:

-

Section I: Parent Corporation Identification

- Clearly state the name, address, and Employer Identification Number (EIN) of the common parent corporation.

- Include the date of incorporation and the state where the company is legally registered.

-

Section II: Affiliated Group Information

- List all subsidiary corporations within the group, providing names, addresses, and EINs.

- Detail ownership interests, describing any changes in stockholder information during the tax year.

-

Section III: Business Activities Description

- Offer a comprehensive overview of the main business operations conducted by both the parent and subsidiary corporations.

-

Signature and Declaration

- Conclude with the signature of an authorized corporate officer, certifying the accuracy of the information provided.

Important Terms Related to Form 851

Understanding key terminologies associated with Form 851 aids in accurate completion:

- Affiliated Group: A group of related corporations connected through stock ownership, forming a single economic entity for tax purposes.

- Common Parent Corporation: The controlling corporation that owns a majority interest in one or more subsidiary companies within the affiliated group.

- Consolidated Return: A single income tax return that combines the financial data of an affiliated group's parent and subsidiary companies.

- Overpayment Credits: Excess tax payments that can be credited against future tax liabilities for the taxpayer or affiliated group.

Practical Definitions and Examples

- Subsidiary Corporation: For example, if Corporation A owns 80% of Corporation B's stock, Corporation B is a subsidiary of Corporation A.

- Estimated Tax Payments: These are quarterly payments made based on projected tax liability, vital in avoiding penalties for underpayment by the end of the fiscal year.

Legal Use and Compliance of Form 851

Legal compliance with Form 851 is paramount for corporations operating as affiliated groups:

- IRS Regulations: Filing Form 851 is mandatory when submitting a consolidated income tax return. Non-compliance could result in penalties, increased scrutiny, or denial of tax benefits.

- Documentation Requirements: Maintain documentation supporting reported details, such as stock certificates, financial statements, and ownership records.

Penalty Considerations

- Failure to File: Corporations failing to file Form 851 when required may incur penalties, impacting their legal and financial standing.

Filing Deadline and Submission Methods

Timely submission of Form 851 is critical for uninterrupted business operations:

- Filing Deadline: The form must be filed alongside the consolidated income tax return, typically due by April 15th following the end of the tax year.

- Submission Options:

- Online Filing: Use IRS e-file systems for quick processing.

- Mail-in Option: Physical forms can be submitted to the designated IRS office based on corporate location.

- In-Person Delivery: Direct submission at designated IRS service centers, suitable for businesses preferring physical documentation.

Examples of Using Form 851 in Real-World Scenarios

Form 851 plays a vital role in various business scenarios:

- Example 1: Large Corporations: A multinational corporation with subsidiaries across different states uses Form 851 to report and consolidate tax data, ensuring a cohesive tax strategy under U.S. law.

- Example 2: Family-Owned Businesses: A family-operated corporation with several small business subsidiaries uses the form to streamline tax reporting and optimize fiscal efficiency.

IRS Guidelines for Form 851

The IRS provides comprehensive guidelines to assist corporations in accurate completion:

- Publication References: The IRS publishes detailed instructions accompanying Form 851, available on their official website.

- Help Resources: Corporations may contact IRS support or consult a tax professional for specific inquiries or clarifications regarding form completion and submission.

By adhering to these in-depth guidelines, corporations can efficiently manage their tax obligations using Form 851, reducing risks and optimizing compliance.