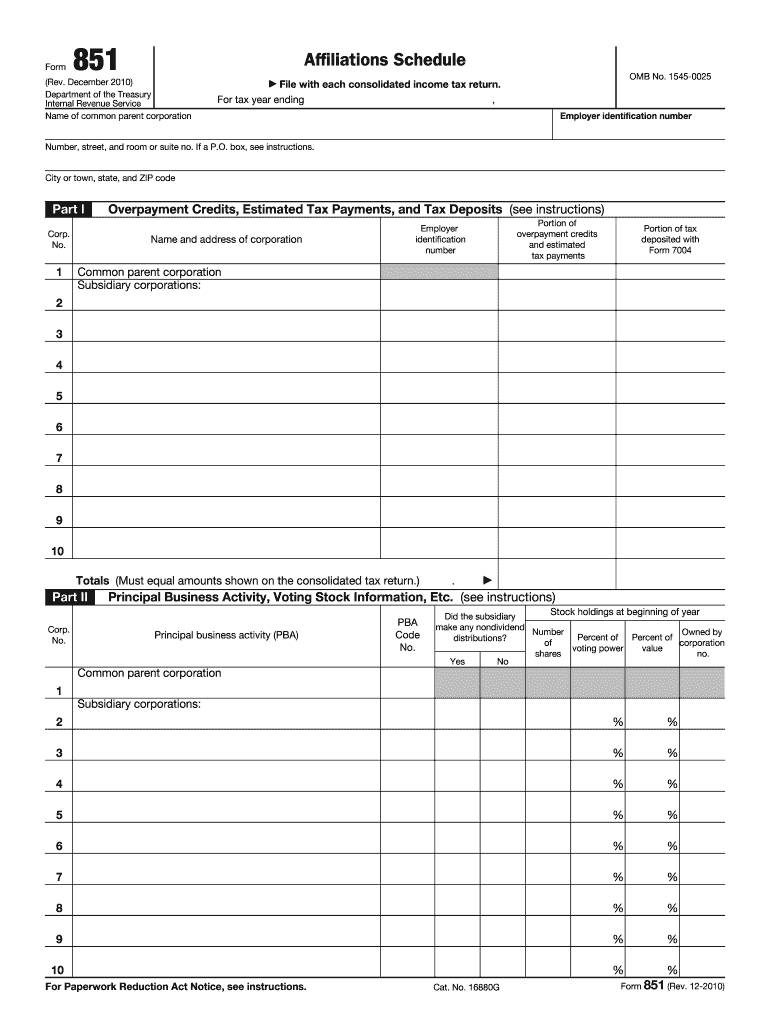

Definition & Purpose of IRS Form 851

IRS Form 851, also known as the "Affiliations Schedule," is utilized by the common parent corporation of an affiliated group for reporting overpayment credits, estimated tax payments, and tax deposits for each group member. This form includes various sections to detail stock holdings, changes in stock during the tax year, and other pertinent parent-subsidiary relationships. Understanding the purpose of this form is essential for businesses involved in consolidated income tax returns, as it ensures they comply with IRS regulations governing these submissions.

Steps to Complete IRS Form 851

-

Gather Necessary Information: Collect all relevant data about each member of the affiliated group, including specific tax-related details and information about stock holdings.

-

Identify Corporations: Fill out sections that require identification of each corporation within the group. This includes names, employer identification numbers (EINs), and addresses.

-

Detail Stock Holdings: Accurately complete sections detailing stock holdings and any changes during the tax year. This requires precise records to avoid discrepancies.

-

Fill in Tax Payments and Credits: Report all overpayment credits, estimated tax payments, and tax deposits made by each member.

-

Review and Verify: Double-check all entered information for accuracy. Given the complexity and potential legal implications of errors, taking the time to verify each entry is crucial.

Important Terms Related to IRS Form 851

- Affiliated Group: A cluster of corporations connected through stock ownership, which collectively file a consolidated tax return.

- Overpayment Credits: Credits claimed by a corporation for the overpayment of taxes in a previous period.

- Estimated Tax Payments: Payments made in anticipation of the total tax amount due for the year, paid quarterly.

- Employer Identification Number (EIN): A unique number assigned by the IRS used to identify business entities.

Filing Deadlines and Important Dates

Businesses must be aware of the filing deadlines for IRS Form 851. Generally, the form is due with the parent corporation's consolidated tax return, typically no later than the 15th day of the fourth month following the close of the group's tax year. Failing to meet this deadline can result in penalties and interest on unpaid taxes. It is advisable to consult the IRS guidelines annually, as specific dates may differ slightly each year.

Who Typically Uses IRS Form 851

The primary users of IRS Form 851 are the common parent corporations of affiliated groups. These groups can range from small holding companies to massive conglomerates. Essentially, any business entity with multiple subsidiaries interconnected through stock ownership likely needs to complete this form.

Key Elements of IRS Form 851

- Identification Section: Comprehensive details of each corporation’s identification within the group, such as name and EIN.

- Stockholder Information: Disclosure of information about stockholders, their respective holdings, and changes within the tax year.

- Payment Details: Specifics regarding tax payments and credits for each member.

Legal Use and Compliance

Filing IRS Form 851 correctly is legally mandated for eligible corporations. It ensures that the IRS has a complete and accurate account of the group’s tax obligations. Mistakes in filing can trigger audits or legal scrutiny, leading to potential penalties. Thus, maintaining compliance through proper filing and reliable record-keeping is essential for legal and financial security.

How to Obtain IRS Form 851

IRS Form 851 is readily accessible through the official IRS website, where businesses can download the form in PDF format. Additionally, many tax preparation software programs include IRS forms, providing direct digital access. For those without internet access, it is possible to request a physical form by contacting the IRS directly.

Digital vs. Paper Version

The IRS offers the flexibility of choosing between digital and paper submissions. Digital submissions can streamline the process, reduce errors, and facilitate quicker responses from the IRS. These benefits must be weighed against the familiarity and comfort that some businesses may experience with paper filings, ensuring they choose the method aligning best with their capabilities and workflow preferences.