Definition and Meaning

The executor of estate form is a legal document that empowers a designated individual to manage and distribute a deceased person's estate according to the stipulations of their will or, in the absence of a will, under the jurisdiction's probate laws. This form establishes the executor’s authority, enabling them to handle various estate-related tasks, such as paying off debts, distributing assets to beneficiaries, and handling tax obligations. The document serves as official proof that the executor has the legal right to make decisions on behalf of the estate, ensuring their actions are recognized by financial institutions, courts, and other relevant entities.

The form is critical in the probate process, as it ensures that the executor operates within the legal framework, providing accountability and clarity. Executors use this form to gain access to the decedent’s bank and investment accounts, sell property, or transfer ownership of assets. Understanding its significance can help smooth the transition of responsibilities during a challenging time.

How to Use the Executor of Estate Form

-

Identify the Executor: Typically, the will names the executor, but if absent, the court appoints someone. The named individual should be willing and capable of executing the duties.

-

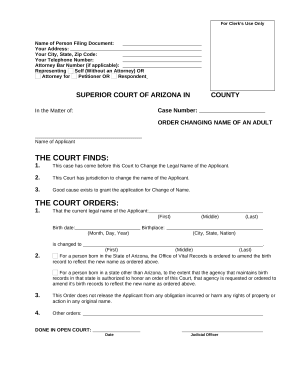

Complete the Form: Carefully fill out the form, ensuring that all sections are complete and accurate. This includes details about the decedent, the executor, and pertinent information about the estate.

-

Submission and Approval: Submit the completed form to the local probate court for approval. The court will review and, if everything is in order, officially appoint the executor, granting legal authority to act on behalf of the estate.

-

Execute Duties: Once appointed, use the form to carry out responsibilities such as settling debts, managing assets, filing taxes, and eventually distributing the remaining estate to the rightful heirs.

-

Documentation and Records: Keep detailed records of all transactions and decisions made as the executor. This can protect against potential disputes from beneficiaries or legal challenges.

How to Obtain the Executor of Estate Form

The executor of estate form is typically obtained from the probate court in the county where the deceased resided. The court’s website may offer downloadable PDF versions, or provide instructions for in-person collection or mail requests. Alternatively, legal counsel can assist in securing the form, ensuring it meets all jurisdictional requirements.

The form varies by state, so ensure you have the correct version for your state to avoid processing delays. If managing an estate with properties in multiple states, consult a legal expert to understand each state's requirements fully.

Steps to Complete the Executor of Estate Form

-

Gather Necessary Information: Collect relevant details about the decedent’s estate, including a list of assets, liabilities, and personal information.

-

Fill in Deceased’s Details: Include full name, date of death, and last known address. This establishes the form's context.

-

Provide Executor Information: Enter the executor’s full name, contact details, and relationship to the deceased. This confirms their eligibility and willingness to serve.

-

Asset and Liability Declaration: List all known assets and liabilities of the estate to give a comprehensive view of the estate’s financial situation.

-

Sign and Submit: The executor must sign the form in the presence of a notary or court officer, then submit it to the probate court for validation and appointment.

Key Elements of the Executor of Estate Form

- Personal Details: Information about the deceased and the executor.

- Estate Overview: Summary of assets and liabilities.

- Executor’s Authority: Documentation of the executor’s powers and responsibilities.

- Legal Compliance: Agreement to abide by probate laws and ethical standards.

- Signatures and Witnesses: Formal signatures to authenticate the form, witnessed where required.

Each section of the form plays a crucial role in ensuring the estate's resources are managed lawfully and in accordance with the decedent's wishes or under legal obligations.

Important Terms Related to the Executor of Estate Form

- Probate: The legal process of administering the deceased's estate.

- Decedent: The individual who has passed away.

- Beneficiary: A person or entity entitled to receive a portion of the estate.

- Fiduciary Duty: The legal obligation of the executor to act in the estate's best interests.

- Intestate: When a person dies without a will, necessitating the distribution of their estate according to statutory guidelines.

Understanding these terms is vital for any executor, ensuring they fulfill their role effectively and legally.

Legal Use of the Executor of Estate Form

The executor of estate form is used legally to validate the executor’s authority. This authorization allows the executor to interact with financial institutions, sell property, distribute assets to beneficiaries, and perform other estate-related tasks. In failing to use the form properly, unauthorized actions can lead to disputes, financial penalties, or legal challenges.

Court approval of the form provides a safeguard, ensuring the designated person is most suitable for handling the estate. Executors should always act within their legal rights and responsibilities, adhering to court directives and statutory probate laws.

State-Specific Rules for the Executor of Estate Form

Rules governing the executor of estate form can vary significantly by state, impacting the probate process. Some states require executors to post a bond, while others may have simplified procedures for smaller estates.

-

Bond Requirements: States may require a bond to protect beneficiaries against executor mismanagement.

-

Simplified Probate: Certain states allow for expedited processes for small estates, reducing the need for extensive court oversight.

-

Notification Requirements: Executors may need to notify potential heirs or creditors of the pending probate proceedings.

Consulting with a state-specific probate expert can ensure compliance with all rules, preventing legal complications.