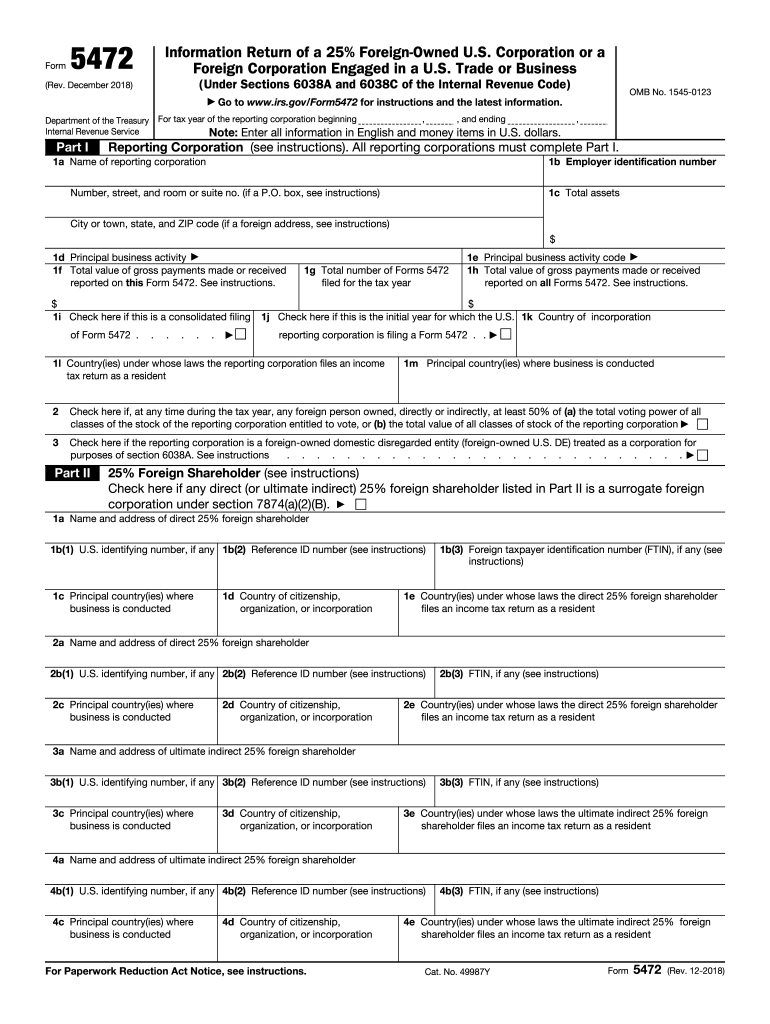

Definition and Purpose of Form 5472

Form 5472 is an informational return required by the IRS for specific corporations operating within the United States. This form applies to U.S. corporations with at least 25% foreign ownership as well as foreign corporations engaged in U.S. trade or business. The form collects data on financial activities, particularly focusing on transactions with foreign shareholders and other related parties. Its primary purpose is to ensure compliance with IRS regulations under the Internal Revenue Code, aiding in the monitoring and regulation of cross-border financial activities.

Steps to Complete Form 5472

-

Gather Necessary Information: Collect detailed information about the reporting corporation, including the name, address, and identifying number. You also need the details of any foreign entities involved.

-

Identify Reportable Transactions: Identify any reportable transactions between the reporting corporation and related foreign parties. This includes transactions such as sales, leases, licenses, exchanges, and financial activities.

-

Provide Financial Details: Complete sections dealing with monetary and financial aspects, such as total receipts and financial payments.

-

Compliance Review: Review the form for completeness and ensure all information complies with the IRS regulations.

-

Submission: Submit the form along with the corporation’s tax return, ensuring adherence to the IRS’s filing deadlines.

How to Obtain Form 5472

Form 5472 can be obtained directly from the IRS website. This form is typically available in both a downloadable paper format and a fillable PDF version. Corporations can also use tax preparation software that supports this form to ensure proper completion and submission. It’s important to frequently check for updates or revisions to the form to ensure compliance with any new regulations or requirements.

Why Form 5472 is Required

Form 5472 is a critical tool for assessing compliance with U.S. tax laws. By requiring detailed reporting of transactions with foreign shareholders, the IRS ensures that corporations are accurately reporting their global income and adhering to international tax obligations. The form serves as a mechanism to prevent tax evasion through misreported or non-reported financial transactions with foreign entities.

Who Typically Uses Form 5472

Corporations that are either:

- U.S. entities with substantial foreign ownership, or

- Foreign entities with U.S. trade or business operations.

Particular industries, such as multinational corporations, are more likely to engage in cross-border transactions, thus requiring the use of this form.

Key Elements of Form 5472

- Identifying Information: Includes basic data about the filing corporation and any related foreign entities.

- Transactions: Lists detailed entries of reportable transactions, such as financial exchanges and sales.

- Finances: Requires comprehensive financial data, including total receipts and payments related to foreign members.

Filing Deadlines and Important Dates

Form 5472 must be filed alongside the corporation’s annual tax return. Typically, for calendar-year corporations, this is by April 15 of the year following the tax year. However, extensions may apply, and these deadlines require strict adherence to prevent penalties.

Penalties for Non-Compliance

Corporations failing to file Form 5472 in a complete and timely manner are subject to significant penalties. These can escalate if the IRS deems the failure to comply as intentional or fraudulent. The base penalty starts at $25,000, with potential increases for continued non-compliance.

IRS Guidelines for Form 5472

The IRS provides detailed guidelines on how to complete and file Form 5472, ensuring adherence to specific requirements and avoiding common errors. These guidelines are essential for any corporation engaging in cross-border transactions to mitigate risks and ensure proper reporting. Such support includes clarity on which transactions qualify as reportable and how to properly document those on the form.