Definition & Meaning

The IRS Form 433-A, officially known as the Collection Information Statement for Wage Earners and Self-Employed Individuals, is a comprehensive document utilized by individuals to report detailed financial information to the Internal Revenue Service (IRS). This form is essential for wage earners and self-employed individuals facing tax collection actions as it provides the IRS with a clear picture of one's financial situation, including income, expenses, assets, and liabilities. By accurately completing this form, taxpayers can potentially negotiate payment plans or installment agreements with the IRS to settle their tax debts.

IRS Guidelines

When completing Form 433-A, taxpayers must adhere strictly to IRS guidelines to ensure accurate representation of their financial status. The IRS specifies that all sources of income must be reported, including wages, self-employment income, and other earnings. Taxpayers are also required to disclose all assets, including real estate, vehicles, bank accounts, and retirement accounts, along with any outstanding liabilities. Following the IRS instructions carefully is imperative to prevent mistakes that could delay processing or lead to unfavorable outcomes.

- Income Reporting: List wages, salaries, self-employment income, and any additional regular income.

- Expense Documentation: Include monthly living expenses such as rent, utilities, and transportation.

- Asset Listing: Detail all tangible and intangible assets, including property, vehicles, and investments.

- Liability Declaration: Provide information on debts, including mortgages, loans, and credit card balances.

Steps to Complete the Form

Filling out Form 433-A involves several crucial steps to ensure accuracy and compliance with IRS requirements. It is advised to gather all necessary documentation before beginning the form to streamline the process.

- Collect Financial Documents: Gather pay stubs, bank statements, asset appraisals, and debt records.

- Income Details: Accurately list all income sources, including employer details for wage earners and business information for self-employed individuals.

- Expenses Section: Document fixed monthly living expenses, ensuring all costs are supported by receipts or bills.

- Asset Disclosure: Enumerate all significant assets, providing appraised values and ownership details.

- Liabilities Reporting: Offer documentation for all liabilities, such as loan agreements and credit card statements.

- Review and Verify: Thoroughly check the form for completeness and correctness before submission.

Who Typically Uses Form 433-A

Form 433-A is primarily used by individuals who require negotiation with the IRS due to outstanding tax obligations. It caters to wage earners who receive regular income from employment and self-employed individuals who earn income independent of a traditional employer. This form is often used in scenarios where an installment agreement or other payment arrangement needs to be established with the IRS.

- Wage Earners: Employees who earn consistent income subject to withholding taxes.

- Self-Employed: Individuals who conduct business independently, such as freelancers or independent contractors, reporting income through 1099 forms.

- Part-time Employees: Those juggling multiple jobs and income sources may also complete this form for comprehensive tax reporting.

Key Elements of the Form

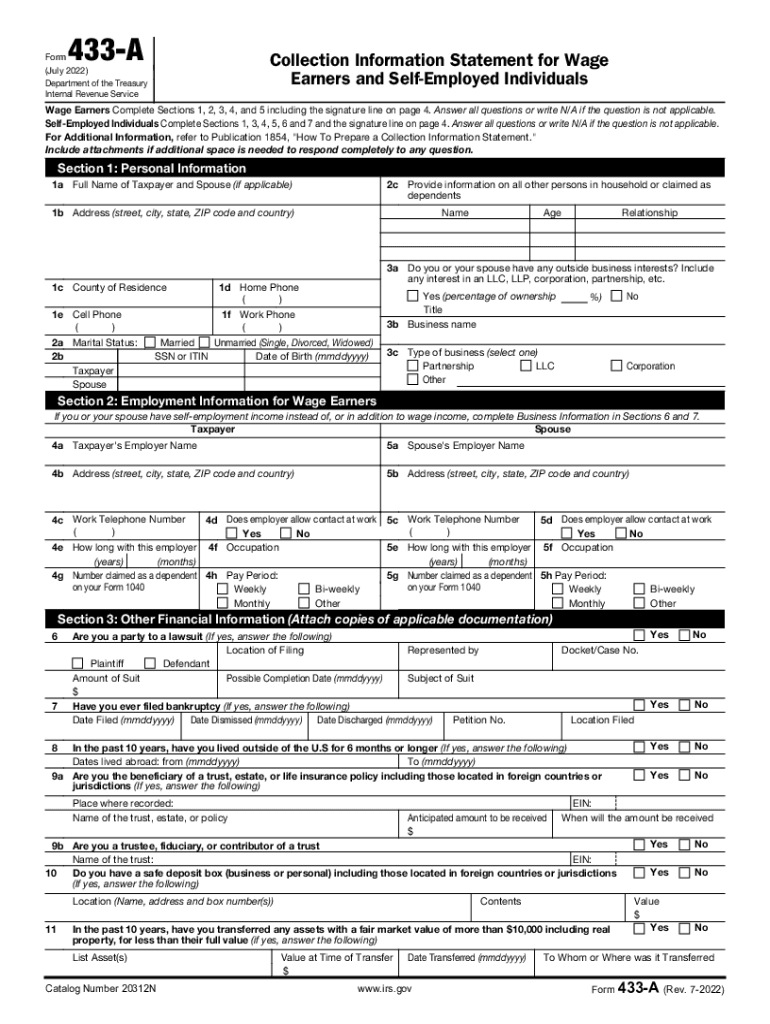

Form 433-A is structured into several parts, each designed to capture specific financial data. Understanding these segments is critical for precise completion.

- Section 1: Personal Information: Includes taxpayer identification details and contact information.

- Section 2: Employment Information for Wage Earners: Details employment status and income specifics.

- Section 3: Self-Employment Information: Collects business-related details for self-employed individuals.

- Section 4: Financial Condition: Encompasses income, expense, asset, and liability declarations.

- Section 5: Business and Financial Information: For businesses operated by the taxpayer.

Legal Use of Form 433-A

The completion of Form 433-A is not just a formality but a legal requirement in dealings with the IRS regarding unpaid taxes and collection actions. The data provided on this form forms the basis for any negotiations or agreements reached with the IRS. Deliberate inaccuracies or omissions can result in penalties or legal action. Tax practitioners and legal advisors can guide taxpayers in legally maximizing their use of this form for debt resolution.

Required Documents

To properly fill out Form 433-A, you will need a variety of documents that accurately capture your financial situation. These documents ensure that the information provided to the IRS is both accurate and verifiable.

- Income Documents: Pay stubs, 1099 forms for the self-employed, and any other income-related documents.

- Expense Records: Bills for utilities, rent or mortgage statements, and receipts for other regular expenses.

- Asset Documentation: Property appraisals, vehicle registration and valuation documents, and bank account statements.

- Liability Documents: Loan agreements, credit card statements, and any other evidence of debts or obligations.

Penalties for Non-Compliance

Failure to submit Form 433-A or providing false information can result in significant consequences. The IRS may impose penalties, escalate collection efforts, or pursue legal action.

- Financial Penalties: Fines for late or incorrect submissions can burden taxpayers further.

- Increased Collection Actions: Non-compliance can lead to more aggressive actions like wage garnishments or bank levies.

- Legal Implications: Serious cases of fraud or evasion can result in legal proceedings against the taxpayer.

Software Compatibility

Many financial and tax preparation software include features to assist in filling out Form 433-A. These tools can automate calculations and ensure compliance with IRS guidelines, reducing the chances of errors.

- TurboTax and QuickBooks: Provide guided processes for completing tax forms, including Form 433-A, ensuring accurate data entry and compliance.

- IRS e-Services: Directly access and submit forms electronically, streamlining the process for taxpayers and reducing reliance on paper submissions.

In summary, the Fillable IRS - Form 433-A is a critical document for taxpayers facing collection measures. Proper completion requires careful adherence to guidelines, accurate data entry, and comprehensive financial disclosure. Utilizing available tools and maintaining thorough records can help ensure a smooth and compliant interaction with the IRS.