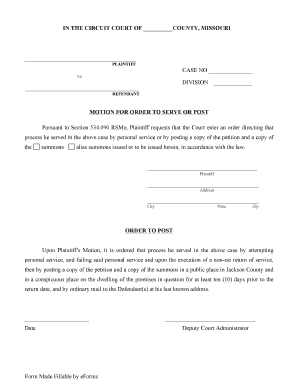

Definition and Meaning

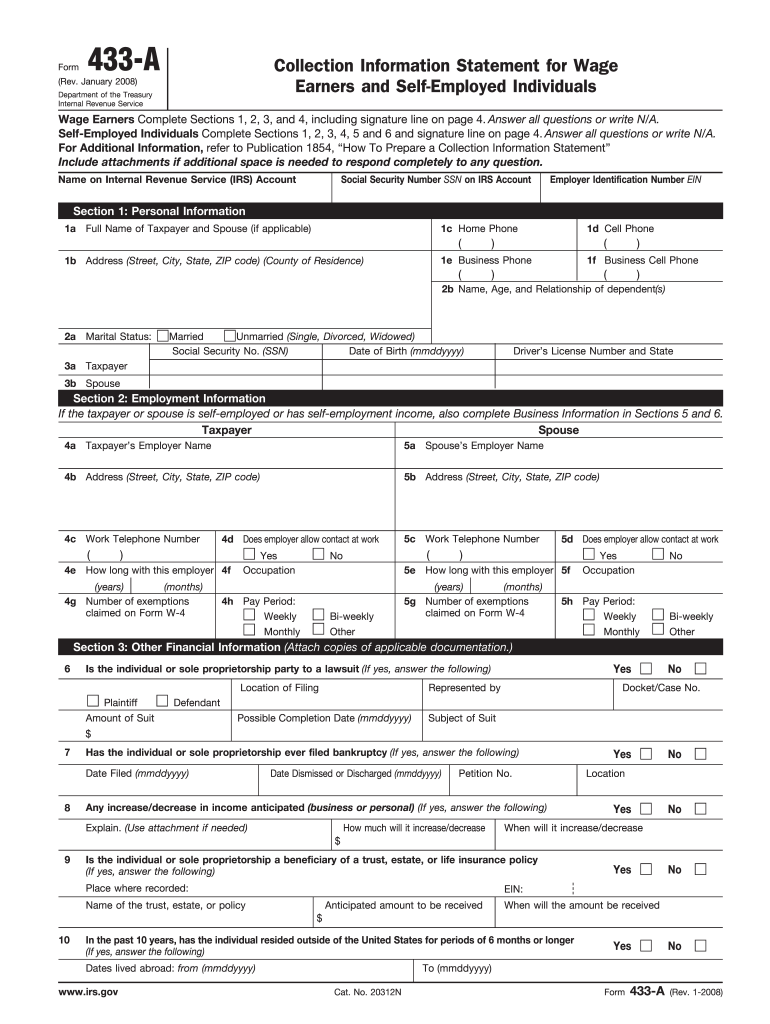

The IRS Form 433-A, specifically the 2008 version, is a Collection Information Statement for Wage Earners and Self-Employed Individuals. This form is used by the Internal Revenue Service (IRS) to collect detailed financial information about taxpayers. The form plays a critical role in assessing an individual's financial situation and their ability to satisfy tax liabilities. It requires comprehensive entries, encompassing personal, employment, and financial data.

Key Sections

- Personal Information: Includes details like name, social security number, and address.

- Employment Details: Requires information about current and past employment.

- Financial Assets: Covers bank accounts, retirement accounts, and other financial holdings.

- Monthly Income and Expenses: Documents income sources and necessary living expenses.

- Liabilities: Information on debts such as loans, mortgages, or credit cards.

Steps to Complete the IRS Form 433-A 2008

Completing IRS Form 433-A involves gathering and accurately reporting extensive personal and financial data. Below are the recommended steps to ensure thorough completion:

- Collect Personal Data: Gather basic information including contact details and dependents.

- Employment Records: Document current and past employment, including employer details and income streams.

- List Financial Assets: Include all savings accounts, investments, and properties.

- Detail Liabilities: Provide information on all outstanding debts and liabilities.

- Monthly Budget: Compile a detailed summary of monthly income and essential expenditures.

- Attach Supporting Documents: Gather and attach necessary documentation like bank statements and pay stubs to substantiate the entries.

Each step requires attention to detail to ensure all information is complete and accurate, which is vital for the IRS to evaluate tax payment capabilities effectively.

Who Typically Uses the IRS Form 433-A 2008

Form 433-A is predominantly used by wage earners and self-employed individuals who need to negotiate payment terms with the IRS. This includes:

- Taxpayers facing collection actions due to unpaid taxes.

- Individuals applying for an installment agreement or offer in compromise.

- Self-employed people who must provide a detailed account of their income and expenses.

Understanding who primarily utilizes this form helps guide taxpayers on when its usage is pertinent, especially when addressing tax debts and liabilities with IRS.

Required Documents for IRS Form 433-A 2008

Accurate completion of Form 433-A necessitates accompanying documentation that verifies the data provided. Essential documents include:

- Bank Statements: At least six months of history to validate cash flow.

- Pay Stubs: Recent pay slips to confirm employment income.

- Loan Statements: Documentation of outstanding loan balances.

- Utility Bills: Proof of necessary monthly expenses.

- Tax Returns: Recent tax filings to verify income and deductions.

Each document aids in ensuring the IRS has an accurate representation of the taxpayer's financial situation.

Important Terms Related to IRS Form 433-A 2008

Understanding key terms found in IRS Form 433-A is crucial for proper completion:

- Installment Agreement: A plan for paying tax debt over time.

- Offer in Compromise: A settlement proposal to pay less than the full tax debt.

- Financial Statement: An overview detailing income, expenses, and liabilities.

- Collection Action: IRS actions taken to collect unpaid taxes.

These terms are integral for comprehending the form's purpose and for communicating effectively with the IRS.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options when it comes to submitting IRS Form 433-A:

- Online Submission: Using the IRS website offers a quick and efficient means of providing information.

- Mail: Traditional postal services can be used to send the completed form along with supporting documents.

- In-Person: Individuals may choose to submit their forms directly at IRS offices for personalized assistance.

Each method provides different conveniences based on the taxpayer's preferences and time constraints.

IRS Guidelines for Form 433-A

The IRS provides specific guidelines that must be adhered to when completing Form 433-A:

- Accuracy: All information must be truthful and verifiable to avoid penalties.

- Timeliness: Submissions should be completed promptly to prevent additional collection steps.

- Completeness: Every section of the form must be filled unless not applicable, ensuring comprehensive disclosure.

Adhering to these guidelines is crucial in facilitating a smooth process and avoiding complications.

Filing Penalties for Non-Compliance

Failing to complete or submit IRS Form 433-A accurately or on time can lead to a host of penalties:

- Fines: Monetary penalties for late or inaccurate submissions.

- Increased Interest: Additional interest charges on unpaid taxes.

- Legal Action: Potential for legal proceedings for serious cases of non-compliance.

Understanding these penalties underscores the importance of diligent completion and submission of the form.