Definition and Purpose of the Arizona 140NR Form

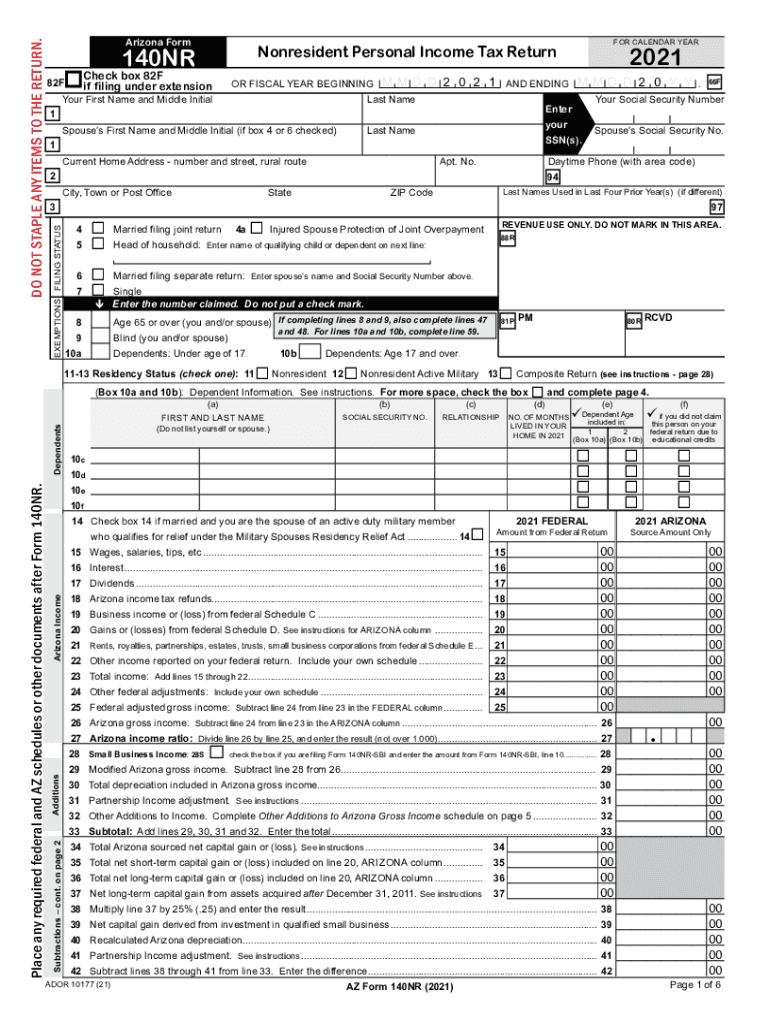

The Arizona 140NR form is a Nonresident Personal Income Tax Return used by individuals who earn income in the state of Arizona but do not reside there. This form is essential for accurately reporting income derived from Arizona sources, such as wages, rental income, or business profits. It helps nonresidents determine their tax liability or any potential refunds owed by or to the State of Arizona.

Key Elements of the Form

- Personal Information: Includes fields for names, Social Security numbers, and addresses.

- Income Reporting: Sections dedicated to detailing income accrued from Arizona-based sources.

- Deductions and Exemptions: Areas to claim specific deductions, exemptions, and credits applicable under Arizona tax laws.

- Tax Calculations: Guides through computing taxes owed or refunds due.

- Signature Section: To validate the filing, requiring the taxpayer’s and preparer’s signatures if applicable.

Steps to Complete the Arizona 140NR Form

- Gather Required Documents: Include W-2s, 1099s, and records of any Arizona-specific income.

- Fill in Personal Information: Input your name, address, and Social Security number.

- Report Arizona Income: Enter income earned from Arizona sources on the designated lines.

- Claim Deductions and Credits: Detail any deductions and credits you are eligible for according to Arizona tax regulations.

- Calculate Tax Liability: Utilize the form’s instructions to compute taxes owed or determine a refund.

- Final Review and Sign: Double-check all entries for accuracy, then sign and date the form.

- Submit the Form: Ensure submission by the deadline, either online, by mail, or in-person where applicable.

Obtaining the Arizona 140NR Form

Individuals can access the Arizona 140NR form through multiple channels:

- Arizona Department of Revenue: The primary source for downloading the form and its instructions.

- Tax Preparation Software: Platforms like TurboTax or QuickBooks often include this form or allow for seamless integration for e-filing.

- Professional Tax Preparers: Accountants or tax professionals can provide printed copies and offer guidance.

Who Typically Uses the Arizona 140NR Form

Nonresidents who have generated income in Arizona are the primary users of the 140NR form. This includes:

- Out-of-state Employees: Those working remotely for Arizona-based companies.

- Real Estate Investors: Individuals owning rental properties in Arizona.

- Business Owners: Proprietors or partners in Arizona businesses without residency in the state.

Legal Use and Compliance Requirements

Filing the Arizona 140NR form is a legal requirement for nonresidents with taxable income in Arizona. This ensures compliance with state tax obligations and prevents legal penalties or interest for underreporting income or late filings. The form must be filed correctly and timely to avoid penalties.

Compliance Considerations

- Accurate Reporting: Nonresidents must accurately report all applicable income derived from Arizona.

- Timely Submission: Adhering to submission deadlines is crucial to avoid penalties.

- Audit Trails: Maintaining supporting documentation is essential in case of discrepancies or audits.

Important Terms Related to the Arizona 140NR Form

Understanding specific terms is crucial when dealing with the Arizona 140NR form:

- Nonresident Income: Earnings attributable to work done or business conducted within Arizona, not elsewhere.

- Exemptions: Specific deductions, such as personal exemptions that reduce taxable income.

- Tax Credits: Financial reductions in tax liability applicable for actions benefiting Arizona, like sustainability or energy-saving investments.

State-Specific Rules for Nonresident Taxation

Arizona follows certain state-specific regulations for nonresident taxation:

- Prorated Taxation: Nonresidents pay taxes only on income derived from Arizona, prorated accordingly.

- Credit for Taxes Paid: Nonresidents may receive credits for taxes paid to other jurisdictions on Arizona-sourced income.

- Unique Allowances: Certain deductions or credits may apply exclusively to nonresident situations based on employment or investment conditions within Arizona.

Filing Deadlines and Important Dates

Timelines for filing the Arizona 140NR form are critical:

- Tax Filing Deadline: Typically due on April 15, aligning with federal tax deadlines unless otherwise extended.

- Extension Requests: Extensions can be requested if timely filed, but they do not defer tax payment dates.

- Estimated Payments: May be necessary for those who anticipate owing taxes to prevent penalties.

Understanding these timelines and requirements ensures proper filing and compliance for any nonresident taxpayer engaged with Arizona-sourced income.