Definition and Purpose of IRS Form 13614-C

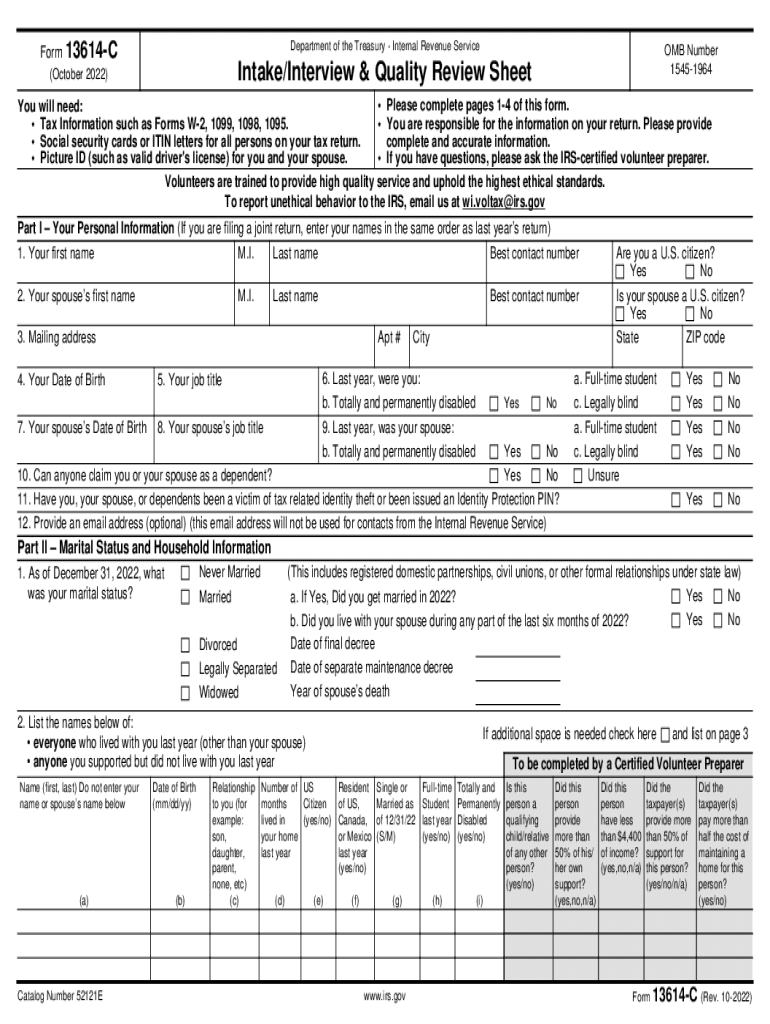

IRS Form 13614-C, known as the Intake/Interview & Quality Review Sheet, is a crucial document utilized by the Internal Revenue Service (IRS) to aid in tax preparation assistance. Primarily used at Volunteer Income Tax Assistance (VITA) and Tax Counseling for the Elderly (TCE) sites, this form systematically collects taxpayers' personal information, tax documents, and financial details. The form's primary goal is to ensure accurate and comprehensive data collection, facilitating a reliable tax filing process.

Components of the Form

The form is divided into several sections that gather specific information about taxpayers. These include:

- Personal Information: Gathers basic details such as name, contact information, and Social Security Number.

- Marital Status and Household Information: Identifies the taxpayer's marital status and household composition, affecting their filing status.

- Income Sources: Documents various income streams, including wages, social security benefits, and investment income.

- Expenses and Deductions: Records allowable expenses, such as medical expenses and educational costs, which may influence tax liability.

- Life Events: Captures significant events like buying a home or starting a business, impacting tax calculations.

How to Use IRS Form 13614-C

Using IRS Form 13614-C involves a structured approach to gathering and verifying taxpayer information. Here’s a step-by-step guide:

- Initial Preparation: Before meeting with a tax preparer, taxpayers should gather all relevant documents, including W-2s, 1099s, and records of expenses.

- Filling Out the Form: Taxpayers should accurately fill out each section, ensuring that all questions are answered truthfully.

- Review by Tax Preparers: At the tax site, a preparer reviews the completed form, asking clarifying questions to ensure accuracy.

- Quality Review Process: A secondary review ensures the information’s correctness, aiming to minimize errors in tax return filing.

Common Errors to Avoid

- Incomplete Information: Leaving sections blank or unanswered may result in processing delays.

- Inaccurate Income Reporting: All income sources need to be clearly documented to avoid discrepancies.

Steps to Complete IRS Form 13614-C

Completing IRS Form 13614-C requires attention to detail and adherence to the form's sequential question structure. Here is a detailed breakdown of the steps:

- Gather Required Documents: Collect identification, income statements, and other relevant financial documents.

- Enter Personal and Contact Details: Fill in personal information accurately to identify yourself on the form.

- Document Income: List all sources of income, ensuring each is appropriately recorded with supporting documents.

- List Expenses and Deductions: Include admissible expenses that may affect your taxable income.

- Verify Completed Sections: Carefully check each answer for completeness and accuracy before submission.

Helpful Tips

- Consult a Tax Preparer: Engage with a VITA or TCE volunteer for assistance if uncertainties arise.

- Double-Check Entries: Revisit entries to confirm that no section has been overlooked or inaccurately completed.

Key Terminology in IRS Form 13614-C

Important Terms and Explanations

- Adjusted Gross Income (AGI): The taxpayer's total income minus specific deductions, crucial for determining tax liability.

- Dependent: A qualifying person, such as a child or family member, who relies on the taxpayer for financial support and may alter tax benefits.

- Exemption: A specific dollar amount deducted from income for each taxpayer and dependent, reducing taxable income.

Frequently Misunderstood Concepts

- Taxable Income vs. Total Income: Taxable income is the portion of total income subject to taxes after deductions and exemptions.

- Standard Deduction: A fixed dollar amount that reduces the income on which you're taxed, which can be taken if not itemizing deductions.

Benefits of Using IRS Form 13614-C

The IRS Form 13614-C offers various advantages, particularly for taxpayers engaged in free tax preparation services. Key benefits include:

Improved Accuracy

- Comprehensive Data Collection: By organizing information systematically, the form reduces the likelihood of omissions.

Access to Professional Assistance

- Guidance from Tax Experts: Through VITA and TCE programs, taxpayers receive professional assistance, enhancing the correctness of their tax returns.

Obtaining IRS Form 13614-C

IRS Form 13614-C can be accessed through multiple channels, offering convenience to taxpayers.

Online and Physical Access

- IRS and VITA Websites: Download the form directly from the IRS official site or associated VITA centers.

- Tax Preparation Centers: Obtain a physical copy during visits to VITA or TCE tax preparation sites.

Tips for Acquisition

- Verify Current Version: Ensure the form version is the most current by checking the IRS site.

Who Typically Uses IRS Form 13614-C

Typically, IRS Form 13614-C is utilized by a wide range of individuals requiring tax preparation assistance.

Common Users

- Low to Moderate-Income Taxpayers: Individuals qualifying for VITA services due to their income level.

- Senior Citizens: Seniors eligible for services provided by TCE, seeking assistance with their taxes.

Benefits for Specific Groups

- Non-English Speakers: The form is available in multiple languages, aiding non-native speakers.

IRS Filing Guidelines and Deadlines

Understanding key IRS filing guidelines and timelines is essential for accurate submission.

Typical Filing Timelines

- Filing Due Dates: For most taxpayers, tax returns must be filed by April 15, unless an extension is granted.

Compliance Requirements

- Timely Submission: Ensuring the form is submitted by the deadline to avoid penalties.

Extensions and Exceptions

- Filing Extensions: Taxpayers can apply for an extension, providing additional time to file, but not to pay taxes owed.