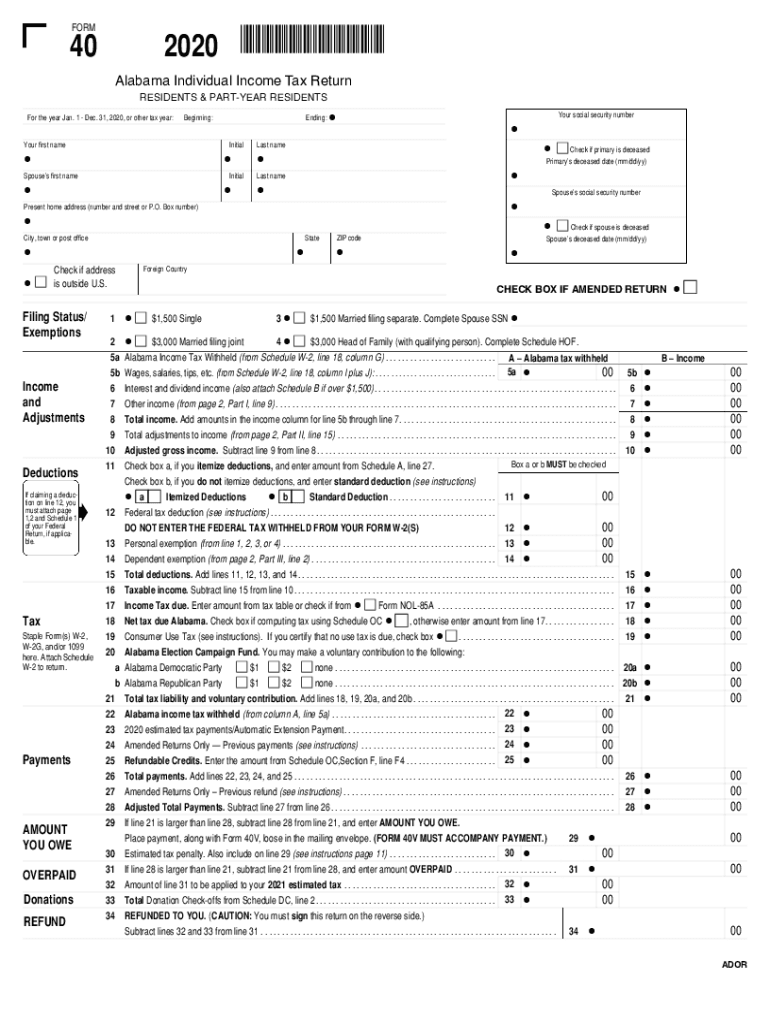

Definition and Meaning of "6 Check if Primary is Deceased"

The "6 Check if primary is deceased" refers to a verification process within various administrative forms and documentation where a user must indicate whether the primary individual named in the document is deceased. This check is essential for ensuring the correctness and validity of the information recorded, especially in financial, legal, and tax-related documents. Identifying the deceased status of the primary person helps organizations and agencies determine the appropriate next steps in processing any claims, benefits, or legal obligations.

Understanding this check is crucial for administrators, tax professionals, and legal representatives who contribute to the accuracy and integrity of documentation. When filing forms that require this declaration, it is important to confirm the status of the individual to prevent fraud, errors, or delays. This check could involve sourcing official documents like death certificates, obituaries, or court records that confirm the individual's passing.

Steps to Complete "6 Check if Primary is Deceased"

Completing the "6 Check if primary is deceased" section typically involves the following steps:

-

Gather Documentation: Collect any necessary records that verify the individual's status. This often includes legal documents such as the death certificate.

-

Review the Prompt: Clearly read the instructions related to the "Check if primary is deceased" section on the form. Different forms may have specific requirements for supporting documents or additional information needed.

-

Marking the Check: If applicable, select or check the designated box indicating that the primary person is deceased. Ensure you provide any required context or additional details as specified in the form instructions.

-

Provide Additional Information: Some forms may require you to include the date of death or contact information for the executor of the estate. Ensure you provide accurate details to prevent issues.

-

Submit the Form: Once the information has been filled out accurately, submit the entire document according to the provided guidelines, whether online, by mail, or in-person.

These steps help maintain clarity and accuracy in the processing of the documentation, which can be pivotal in legal processes or the disbursement of benefits.

Important Terms Related to "6 Check if Primary is Deceased"

Familiarizing oneself with terminology associated with the "6 Check if primary is deceased" will facilitate a better understanding of the process:

-

Death Certificate: An official document issued by a government authority providing legal proof of an individual's death.

-

Executor: The appointed individual responsible for managing the deceased's estate, including settling debts and distributing remaining assets.

-

Probate: The legal process by which a deceased person's will is validated and their estate is administered and distributed.

-

Beneficiary: An individual or entity designated to receive assets, benefits, or proceeds from the estate of the deceased.

These terms help clarify the associated responsibilities and legal implications when verifying the status of the primary individual in the specified document.

Who Typically Uses "6 Check if Primary is Deceased"?

Various stakeholders utilize the "6 Check if primary is deceased" section across different contexts:

-

Tax Professionals: Accountants and tax preparers often require this verification to ensure that tax returns filed on behalf of deceased individuals are processed correctly, affecting tax liabilities and refunds.

-

Financial Institutions: Banks and investment firms need this information when managing accounts or settling estates of deceased clients to transfer assets appropriately.

-

Legal Practitioners: Lawyers involved in estate planning or probate law will invoke this check when dealing with wills, estates, and estate tax forms.

-

Government Agencies: Federal and state agencies may use this information to determine eligibility for benefits or social security payments for surviving relatives.

Understanding the users of this check highlights its significance in ensuring legal compliance and facilitating accurate administrative processes.

IRS Guidelines for "6 Check if Primary is Deceased"

When dealing with IRS forms, it is crucial to follow specific guidelines related to indicating if the primary individual is deceased:

-

Identification: The IRS directs that if the primary taxpayer is deceased, the return should be filed with the name of the deceased along with the date of death. This applies primarily to important tax returns such as Form 1040.

-

Signature: The surviving spouse, if applicable, must sign the tax return. If no spouse remains, the executor or administrator of the estate typically signs for the deceased.

-

Documentation: While you do not need to submit a death certificate with the return, you must maintain it as part of your records in case of future inquiries by the IRS.

These guidelines ensure proper compliance and uphold the legal transfer of obligations associated with filing tax documents after an individual's death, safeguarding both the taxpayer's and the IRS's interests.