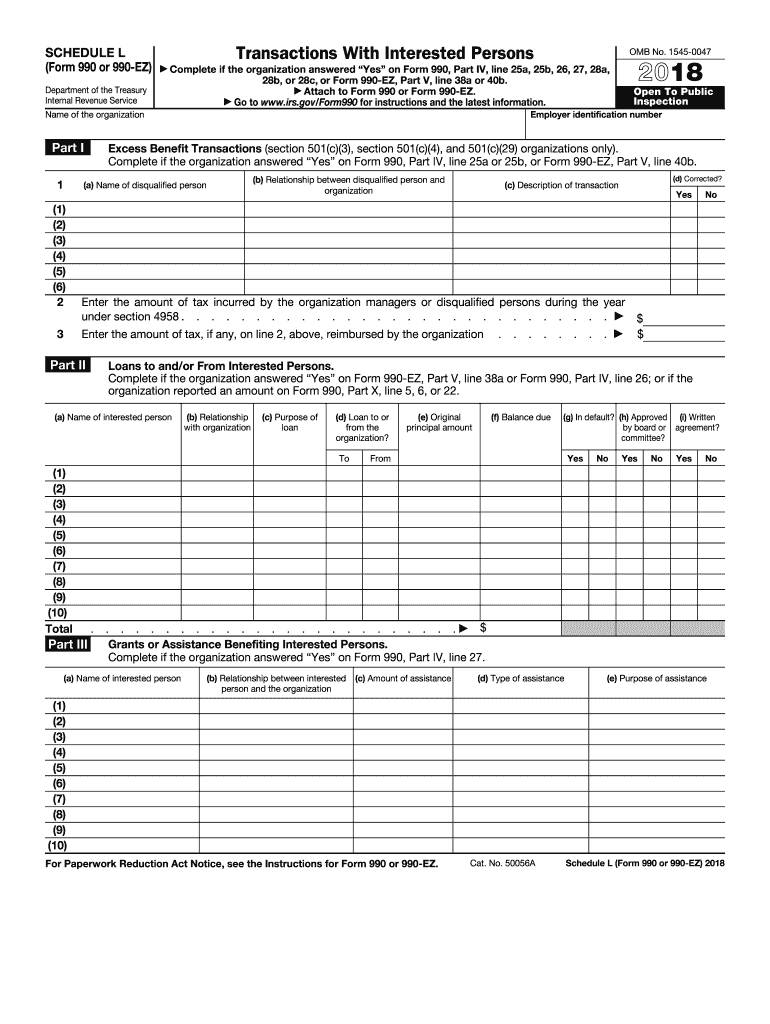

Definition & Purpose of Schedule L

Schedule L is part of the IRS Form 990 or 990-EZ, intended for tax-exempt organizations to disclose certain financial transactions. These transactions are typically between the entity and key individuals who have a substantial relationship with the organization. The primary goal is to ensure transparency, prevent abuse, and maintain public trust by reporting dealings like excess benefit transactions, loans, and grants involving interested parties.

How to Use Schedule L

Using Schedule L involves accurately reporting specific financial relationships and transactions. Organizations need to identify and detail transactions with individuals who hold influence over the entity's decisions, such as board members or major donors. This disclosure is vital for maintaining compliance with IRS regulations and protecting the organization's tax-exempt status.

Steps to Complete Schedule L

- Gather Necessary Information: Compile details of all transactions that fall under the purview of Schedule L, including excess benefits and loans.

- Identify Interested Persons: Determine individuals who meet the criteria of having significant relationships with the organization.

- Report Transactions: Use the form to disclose pertinent details of each transaction or relationship, including amounts and terms.

- Review for Accuracy: Double-check all entries for completeness and correctness to avoid potential penalties.

- File with Form 990 or 990-EZ: Include Schedule L when submitting the primary tax forms to the IRS.

Important Terms Related to Schedule L

- Interested Person: An individual with significant influence or a beneficial interest in the organization.

- Excess Benefit Transaction: When an organization's temporary benefits outweigh the value received in return.

- Grants and Loans: Funds provided to or received by the organization in transactions subject to disclosure.

Examples of Using Schedule L

Consider a nonprofit offering a loan to a board member who then uses that position to influence organizational decisions. Such a transaction would need reporting on Schedule L. Another case might involve a CEO receiving compensation significantly above industry norms, classified as an excess benefit transaction.

IRS Guidelines for Schedule L

IRS guidelines mandate full transparency in disclosing certain financial transactions by tax-exempt organizations. This involves reporting all relevant activities that might benefit individuals due to their position. Compliance with these guidelines is crucial to avoid revocation of tax-exempt status or potential penalties.

Filing Deadlines and Important Dates

Organizations typically must file Schedule L with Form 990 or 990-EZ by the 15th day of the 5th month after the end of their accounting period. Missing these dates can result in penalties, emphasizing the importance of a timely submission.

Required Documents

To accurately complete Schedule L, organizations must have:

- Detailed transaction records.

- Identifiable information for each interested person involved.

- Copies of financial agreements, like loans or grants, between all parties.

Penalties for Non-Compliance

Failure to properly complete or submit Schedule L can lead to serious consequences. Penalties may include monetary fines or revocation of the organization's tax-exempt status. Therefore, rigorous adherence to the filing requirements is necessary to avoid such outcomes.

State-by-State Differences

While Schedule L is a federal form, state-specific compliance requirements may also apply. Organizations should verify if additional forms or disclosures are required by the state in which they operate, as this can influence how transactions are reported locally.