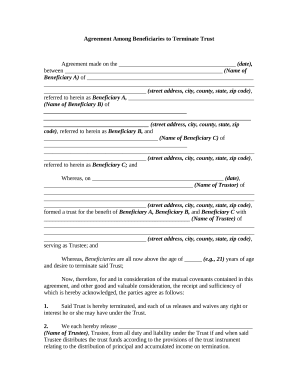

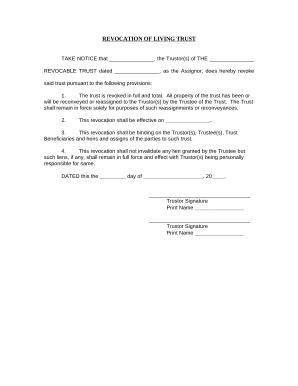

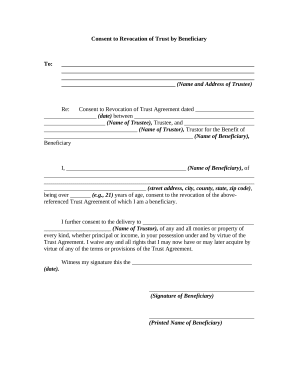

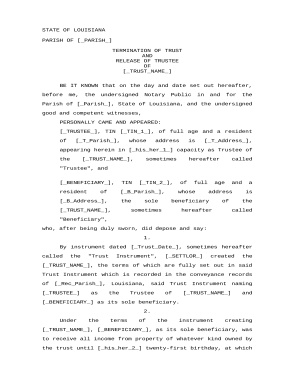

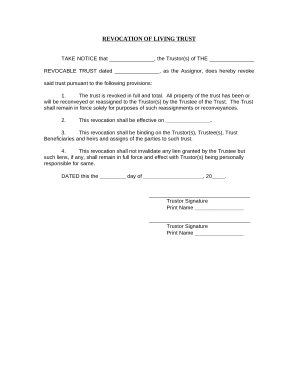

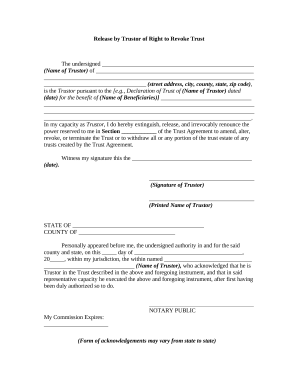

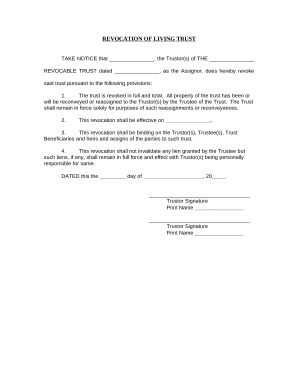

Speed up your form managing using our Trust Termination Forms collection with ready-made document templates that meet your needs. Access the document, modify it, complete it, and share it with your contributors without breaking a sweat. Begin working more efficiently with your documents.

The best way to use our Trust Termination Forms:

Examine all of the opportunities for your online file management using our Trust Termination Forms. Get a free free DocHub account today!