Supercharge your output with Trust & Estate Planning

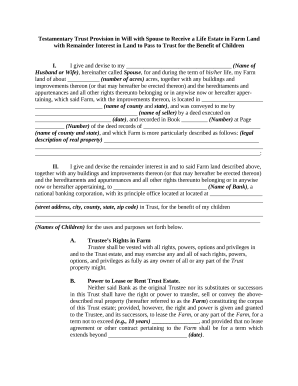

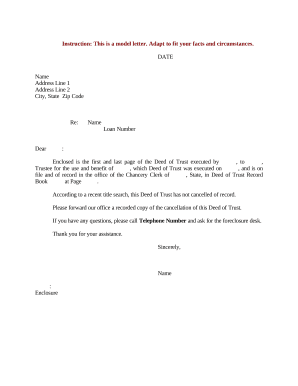

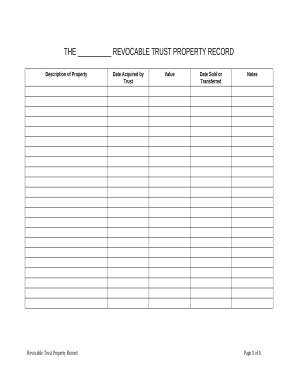

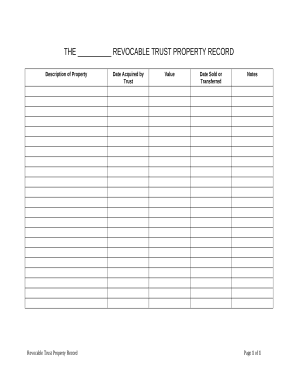

Papers management occupies to half of your business hours. With DocHub, it is easy to reclaim your office time and enhance your team's efficiency. Access Trust & Estate Planning online library and explore all templates related to your daily workflows.

Effortlessly use Trust & Estate Planning:

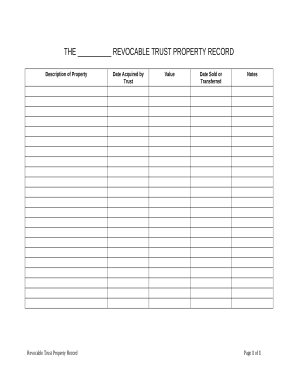

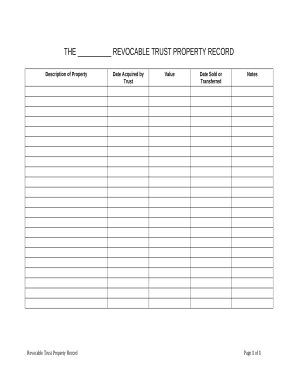

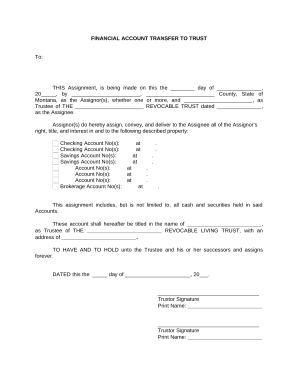

- Open Trust & Estate Planning and use Preview to find the relevant form.

- Click on Get Form to begin working on it.

- Wait for your form to upload in our online editor and begin modifying it.

- Add new fillable fields, symbols, and pictures, adjust pages, and many more.

- Fill out your file or prepare it for other contributors.

- Download or deliver the form by link, email attachment, or invite.

Boost your daily document management using our Trust & Estate Planning. Get your free DocHub account today to explore all forms.