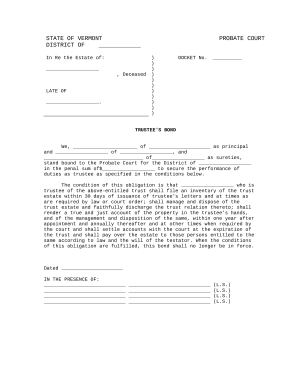

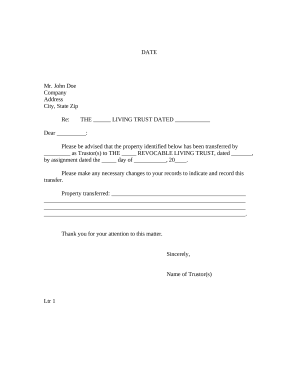

Accelerate your form operations with our Trust Administration Forms online library with ready-made form templates that suit your needs. Access your form template, modify it, complete it, and share it with your contributors without breaking a sweat. Start working more effectively with your documents.

How to use our Trust Administration Forms:

Explore all the possibilities for your online document management with the Trust Administration Forms. Get a free free DocHub account right now!