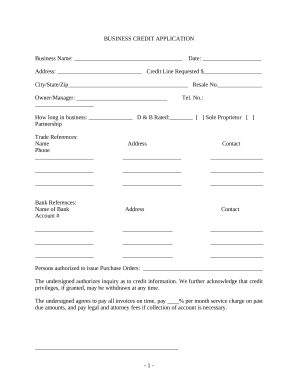

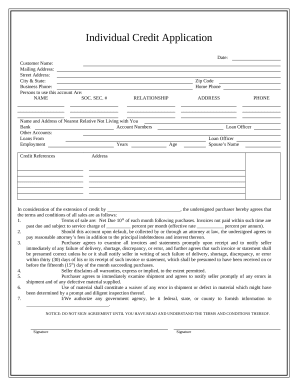

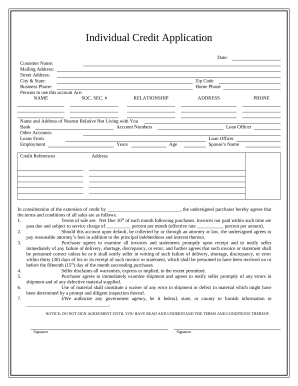

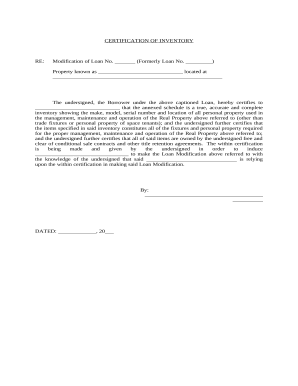

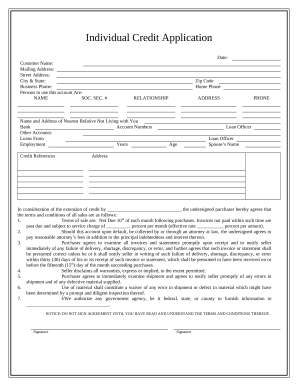

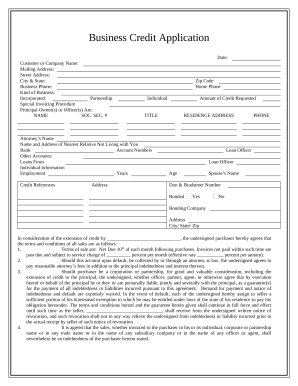

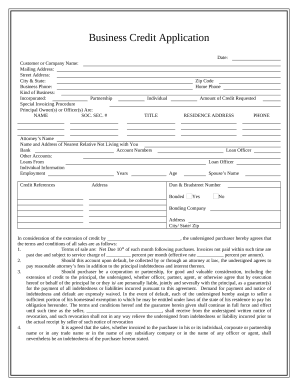

Speed up your form administration with our Loan Application Documents category with ready-made document templates that meet your needs. Access your document template, change it, fill it, and share it with your contributors without breaking a sweat. Start working more efficiently with your documents.

How to use our Loan Application Documents:

Discover all of the possibilities for your online document management using our Loan Application Documents. Get your totally free DocHub profile right now!