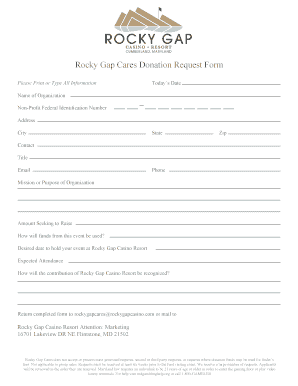

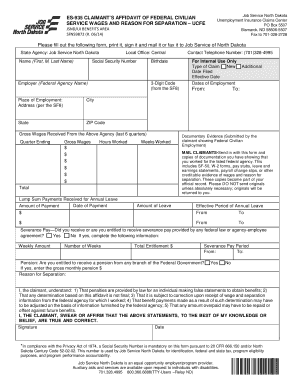

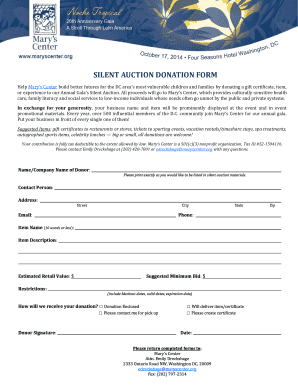

Save time and effort with our Service Donation Forms templates on DocHub. Edit, fill out, and distribute templates seamlessly for a streamlined donation workflow.

Form administration occupies to half of your office hours. With DocHub, it is easy to reclaim your time and effort and improve your team's efficiency. Access Service Donation Forms online library and discover all templates relevant to your everyday workflows.

The best way to use Service Donation Forms:

Boost your everyday file administration using our Service Donation Forms. Get your free DocHub account right now to discover all forms.