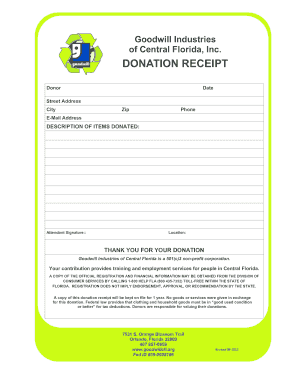

Make the donation process more efficient with DocHub's Reciept from estate sale Donation Forms catalog. Edit, complete, and securely keep finished documents in your profile.

Your workflows always benefit when you can easily locate all of the forms and documents you may need at your fingertips. DocHub gives a vast array of templates to relieve your day-to-day pains. Get hold of Reciept from estate sale Donation Forms category and quickly find your document.

Start working with Reciept from estate sale Donation Forms in a few clicks:

Enjoy effortless form management with DocHub. Check out our Reciept from estate sale Donation Forms online library and locate your form right now!