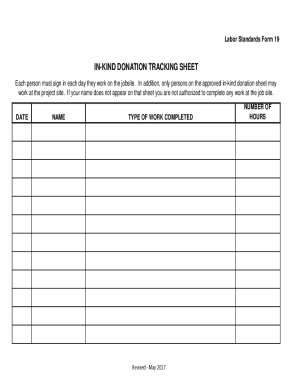

Keep track of all your fundraising contributions easily with Non profit organization sign up sheet Donation Forms catalog. Obtain them anytime, anywhere, and never miss crucial donation information again.

Your workflows always benefit when you are able to find all of the forms and documents you need at your fingertips. DocHub gives a huge selection of document templates to relieve your everyday pains. Get hold of Non profit organization sign up sheet Donation Forms category and quickly browse for your document.

Start working with Non profit organization sign up sheet Donation Forms in several clicks:

Enjoy easy document management with DocHub. Discover our Non profit organization sign up sheet Donation Forms category and find your form right now!