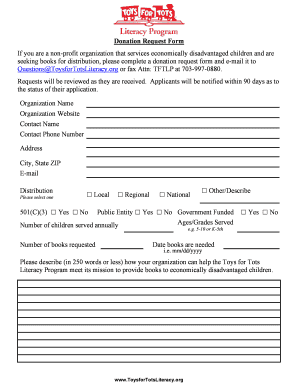

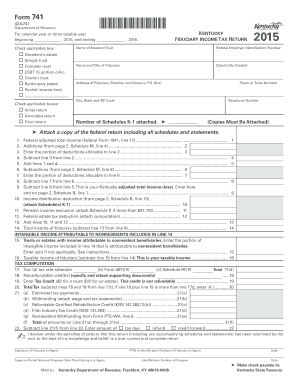

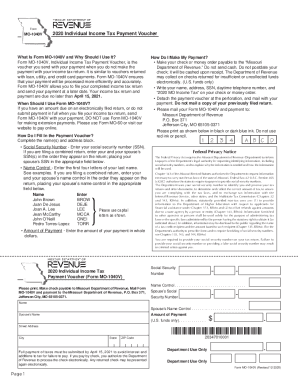

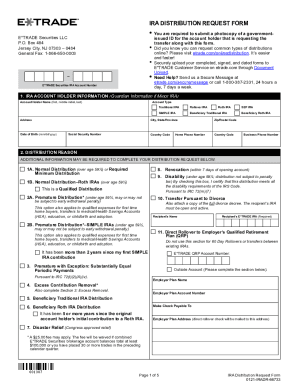

Find relevant documents with our Distribution Donation Forms collection. Ensure a compliant document management process with DocHub's powerful document editing tools.

Your workflows always benefit when you can easily discover all of the forms and documents you require on hand. DocHub provides a wide array of form templates to relieve your everyday pains. Get a hold of Distribution Donation Forms category and quickly find your form.

Start working with Distribution Donation Forms in several clicks:

Enjoy easy record management with DocHub. Discover our Distribution Donation Forms online library and discover your form today!