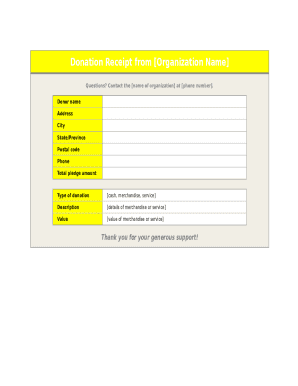

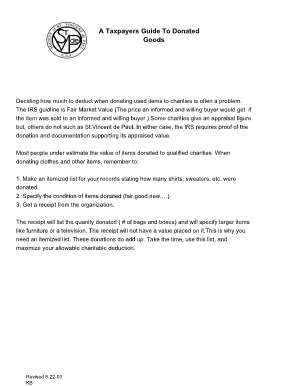

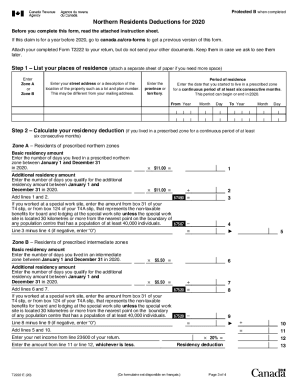

Obtain compliant and customizable Blank receipt that can be edited Donation Forms. Find and choose the forms necessary to your everyday document handling procedures.

Your workflows always benefit when you can easily locate all of the forms and files you require on hand. DocHub gives a vast array of form templates to ease your daily pains. Get hold of Blank receipt that can be edited Donation Forms category and easily discover your document.

Start working with Blank receipt that can be edited Donation Forms in several clicks:

Enjoy easy file managing with DocHub. Check out our Blank receipt that can be edited Donation Forms collection and locate your form right now!