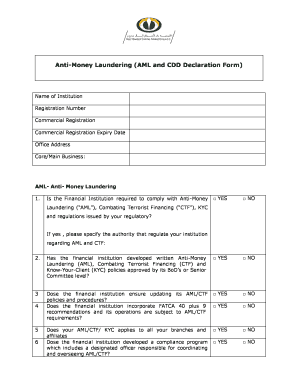

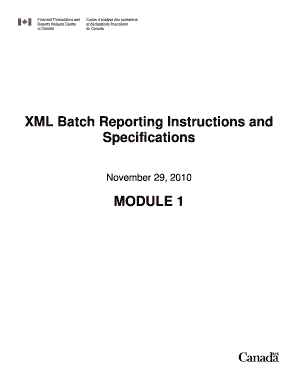

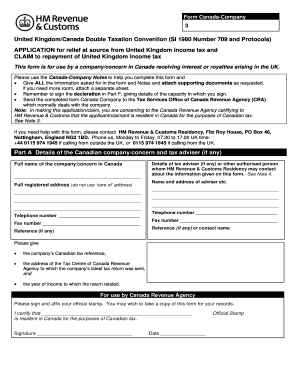

Manage Aml policy Canada Forms for individual or business use. Effortlessly edit and complete your templates, send them with your team, and keep complete forms in your DocHub profile.

Your workflows always benefit when you are able to get all the forms and documents you will need on hand. DocHub offers a wide array of forms to ease your everyday pains. Get a hold of Aml policy Canada Forms category and quickly find your document.

Begin working with Aml policy Canada Forms in a few clicks:

Enjoy effortless document administration with DocHub. Check out our Aml policy Canada Forms collection and discover your form today!