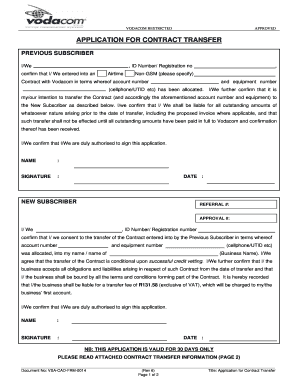

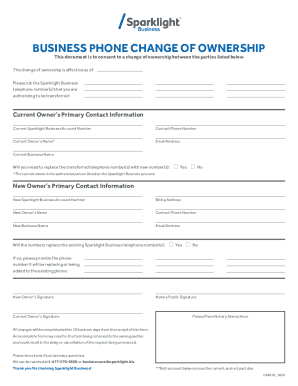

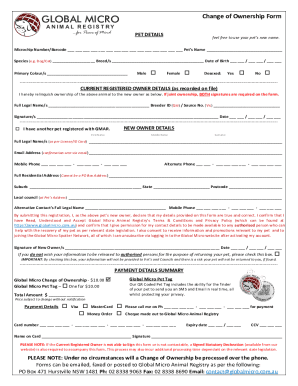

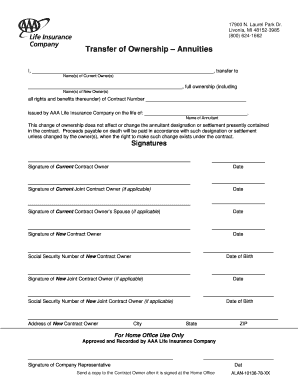

Enhance your business procedures with essential Ownership Business Forms. View, access, and modify documents all in one location - improve your precision and transparency with ease.

Your workflows always benefit when you can easily locate all the forms and files you require on hand. DocHub supplies a huge selection of form templates to ease your daily pains. Get hold of Ownership Business Forms category and quickly find your form.

Begin working with Ownership Business Forms in a few clicks:

Enjoy effortless document management with DocHub. Check out our Ownership Business Forms online library and find your form right now!