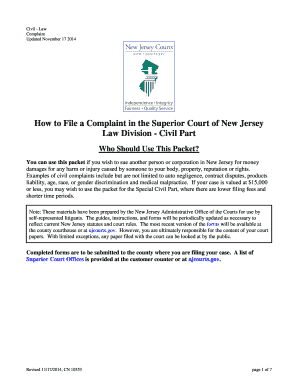

Find and organize customizable New jersey legal Business Forms specific to your industry. Adjust, finalize, and distribute your documents with other collaborators without holdups.

Your workflows always benefit when you can obtain all the forms and files you will need on hand. DocHub gives a vast array of templates to ease your daily pains. Get a hold of New jersey legal Business Forms category and quickly find your document.

Start working with New jersey legal Business Forms in several clicks:

Enjoy effortless record managing with DocHub. Explore our New jersey legal Business Forms category and look for your form right now!