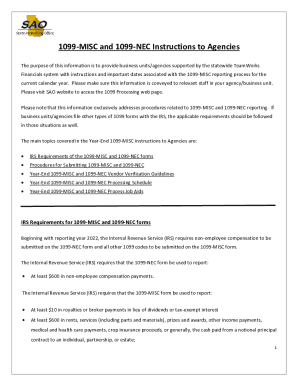

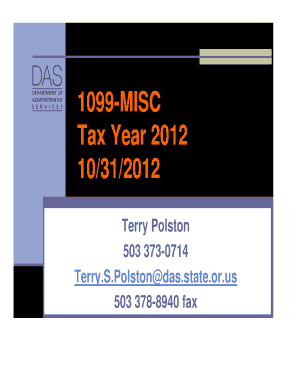

Select from a range of ready-made 1099 Business Forms and keep the process on the right track. Ensure your templates and documents are professional and compliant with DocHub.

Document administration can stress you when you can’t find all the forms you require. Fortunately, with DocHub's extensive form library, you can find everything you need and quickly handle it without the need of changing among apps. Get our 1099 Business Forms and start utilizing them.

How to use our 1099 Business Forms using these simple steps:

Try out DocHub and browse our 1099 Business Forms category easily. Get a free account right now!