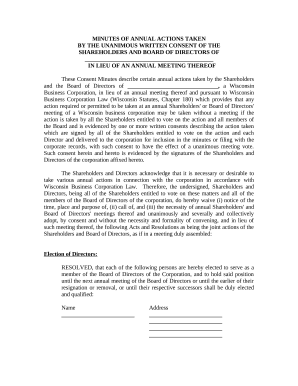

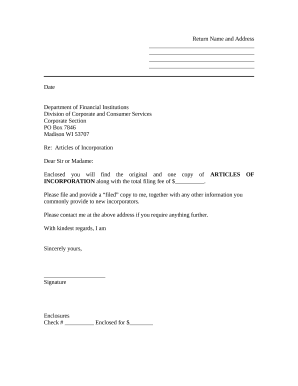

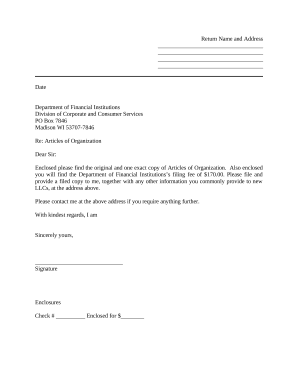

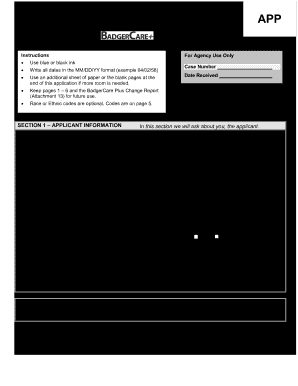

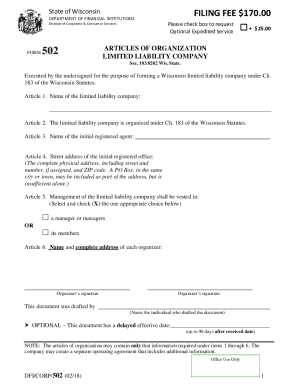

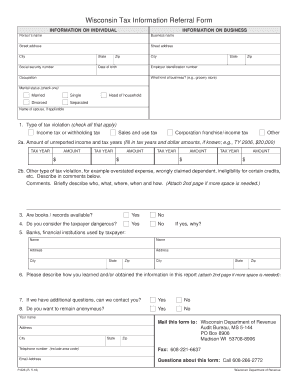

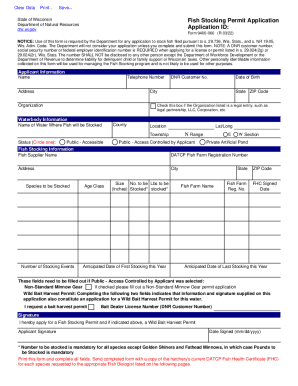

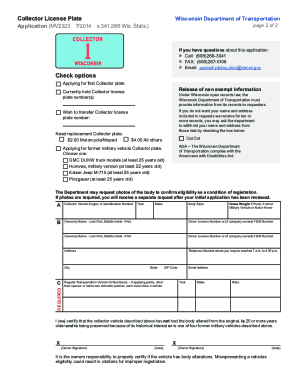

Improve your form preparation with Wisconsin llc Application Forms. Pick from various of documents for individual and business use and begin adjusting them immediately.

Your workflows always benefit when you can find all the forms and documents you require at your fingertips. DocHub provides a huge selection of documents to ease your day-to-day pains. Get a hold of Wisconsin llc Application Forms category and quickly find your document.

Begin working with Wisconsin llc Application Forms in a few clicks:

Enjoy easy form management with DocHub. Check out our Wisconsin llc Application Forms category and discover your form today!