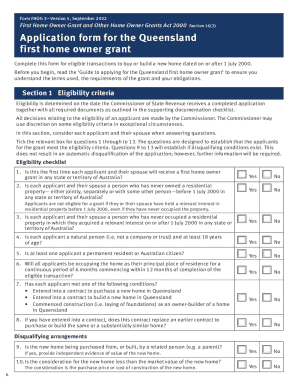

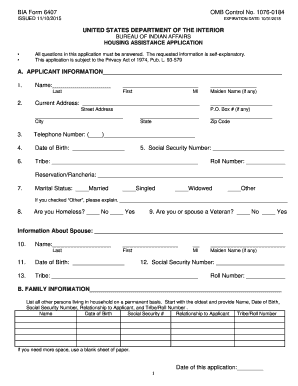

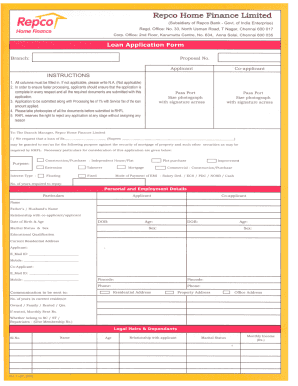

Modify and organize First home new home Application Forms online for free with DocHub. save, adjust, and distribute application templates, reducing mistakes and enhancing the process.

Speed up your form managing using our First home new home Application Forms library with ready-made form templates that meet your needs. Get the document template, change it, fill it, and share it with your contributors without breaking a sweat. Begin working more efficiently with your forms.

How to use our First home new home Application Forms:

Discover all the opportunities for your online file administration with our First home new home Application Forms. Get a free free DocHub profile today!