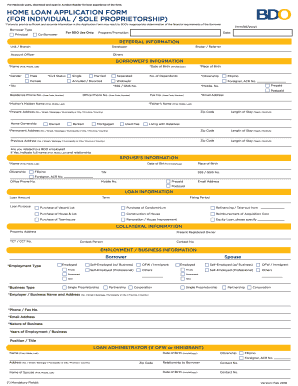

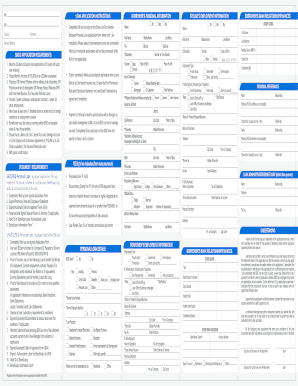

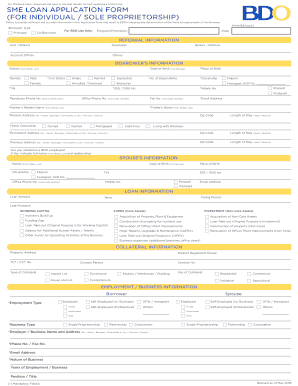

Improve your document preparation with Bdo home loan Application Forms. Choose from various of forms for individual and business use and begin modifying them immediately.

Improve your form administration with our Bdo home loan Application Forms category with ready-made templates that suit your requirements. Access the form template, edit it, fill it, and share it with your contributors without breaking a sweat. Start working more effectively with the forms.

How to use our Bdo home loan Application Forms:

Examine all the possibilities for your online file administration using our Bdo home loan Application Forms. Get your free free DocHub account right now!