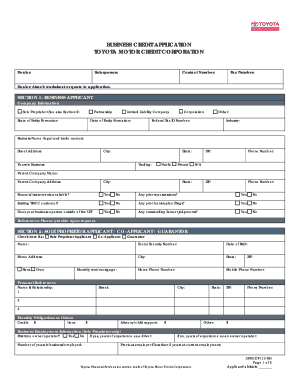

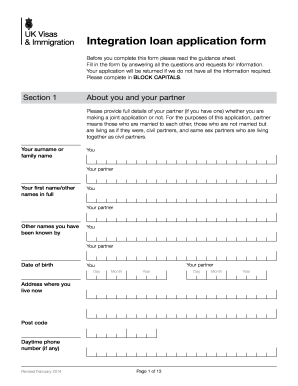

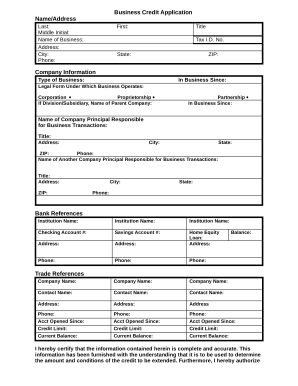

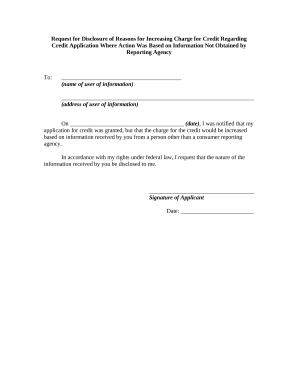

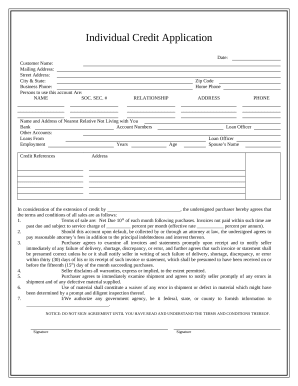

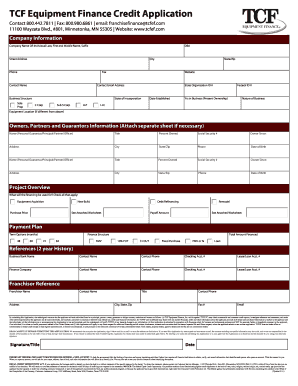

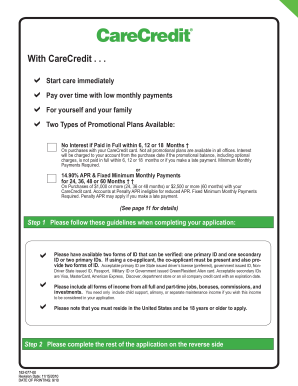

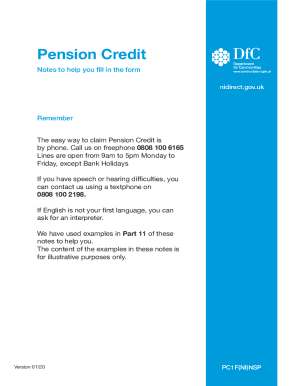

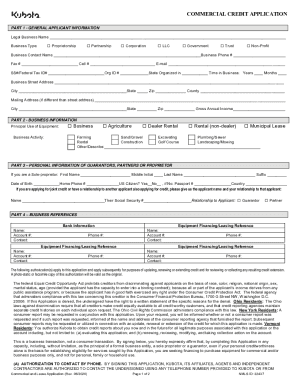

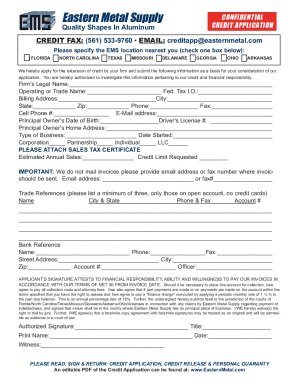

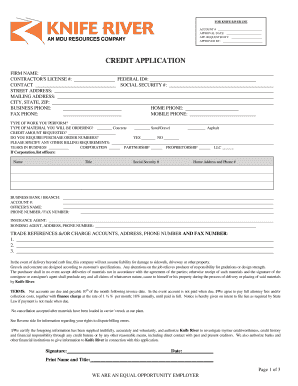

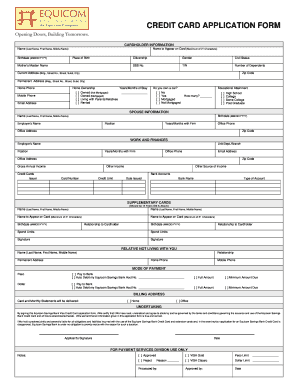

Monitor and enhance your Basic credit Application Forms management. Easily find, view, and fill out forms for personal and corporate use with DocHub free profile.

Boost your document operations using our Basic credit Application Forms category with ready-made form templates that meet your needs. Get the form template, alter it, complete it, and share it with your contributors without breaking a sweat. Start working more effectively with your documents.

How to use our Basic credit Application Forms:

Examine all of the possibilities for your online document management using our Basic credit Application Forms. Get a totally free DocHub profile today!