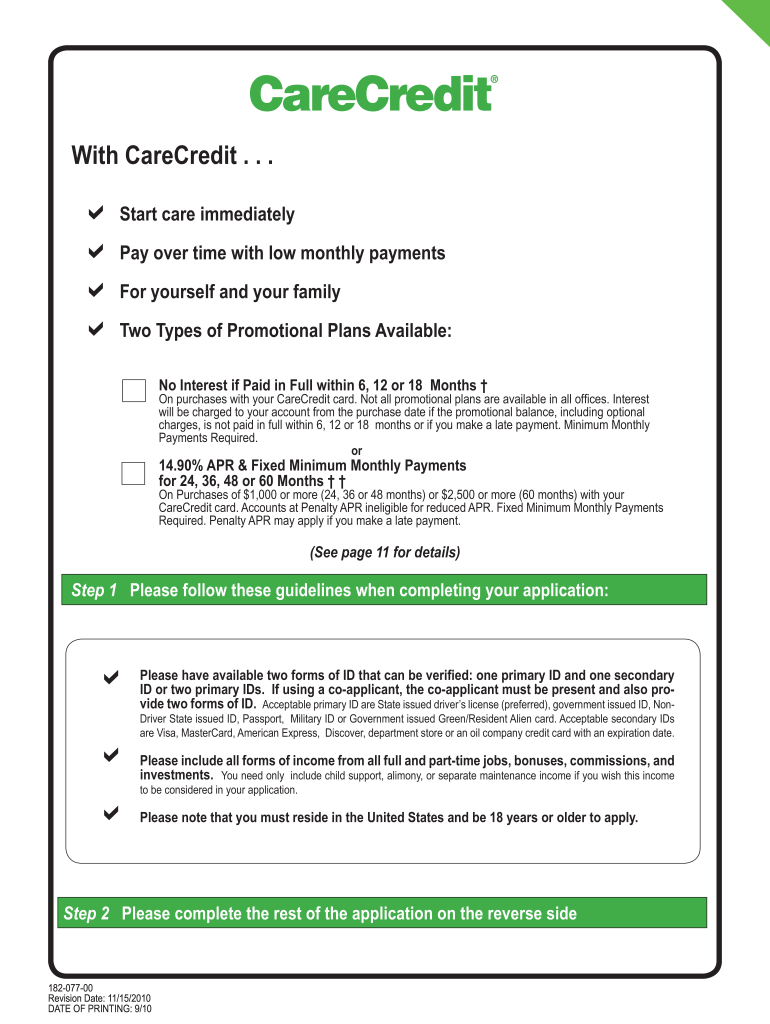

Definition & Meaning of the Care Credit Application PDF

The Care Credit application PDF is a formal document used to apply for the Care Credit card, which provides financial assistance specifically for health-related expenses, including dental, veterinary, cosmetic, and other healthcare services. It allows consumers to access immediate care and manage costs through flexible payment options over time. The PDF format makes the application accessible and easy to fill out, ensuring that applicants can submit their information securely and conveniently.

This application essentially serves as a request for credit, which is evaluated based on the applicant's financial profile. Upon approval, cardholders can utilize the card for eligible treatments and services, making healthcare more affordable. Care Credit aims to empower consumers by making essential health services accessible without the immediate financial burden.

Steps to Complete the Care Credit Application PDF

Filling out the Care Credit application PDF involves several essential steps to ensure a smooth and successful submission.

-

Download the Application: Start by obtaining the Care Credit application PDF from the official website or your healthcare provider.

-

Personal Information: Provide your name, address, phone number, and social security number. This section verifies your identity and eligibility.

-

Financial Information: Include details about your income, employment, and any existing credit accounts. Accurate financial disclosures help determine your creditworthiness.

-

Consent for Credit Check: The application requires consent for a credit report check, which is crucial for evaluating your application.

-

Review and Sign: Before submitting, review all information for accuracy. Sign and date the form to validate your application.

-

Submission: Decide on a submission method—either electronically through the healthcare provider's office or by mailing it directly to Care Credit.

Each step is vital to ensure that your application is processed efficiently and accurately. Taking care during these stages increases the likelihood of approval.

Important Terms Related to Care Credit Application PDF

Understanding terminology associated with the Care Credit application PDF can provide clarity during the application process. Key terms include:

-

APR (Annual Percentage Rate): This is the yearly interest rate charged on outstanding balances. Familiarity with the APR helps applicants gauge the cost of credit.

-

Credit Limit: This refers to the maximum amount of credit extended to the cardholder, which is determined by Care Credit after reviewing the application.

-

Promotional Financing: Care Credit often offers special financing options, such as no interest if paid in full within a specified timeframe.

-

Fair Credit Billing Act: This federal law provides guidelines for consumers regarding billing errors on credit accounts, ensuring protections against unjust practices.

-

Electronic Signature: A legally recognized method to approve documents electronically, making the process faster and more efficient.

Grasping these terms can enhance the user’s understanding and help navigate the application process more effectively.

Eligibility Criteria for the Care Credit Application

To successfully apply for the Care Credit card, applicants must meet specific eligibility criteria:

-

Age: Applicants must be at least 18 years old.

-

U.S. Citizenship or Residency: Being a U.S. citizen or a resident with a valid Social Security number is a requirement.

-

Credit Score: While there is no fixed score, a higher credit score generally improves the chances of approval.

-

Income Stability: Having a verifiable source of income ensures that applicants can manage their monthly payments.

-

No Recent Bankruptcy: Applicants should not have a bankruptcy filing in the past few years, as this can negatively impact credit evaluations.

Fulfilling these criteria is essential for a smooth application process, as it lays the foundation for the credit review and decision-making process.

How to Obtain the Care Credit Application PDF

Obtaining the Care Credit application PDF is a straightforward process.

-

Online Access: Visit the official Care Credit website or talk to your healthcare provider. Most providers offer a link to download the application directly from their platform.

-

In-Person Request: If you’re in a healthcare facility that supports Care Credit, you can request the application at the reception desk.

-

Email or Fax: Some healthcare providers may offer the application via email or fax upon request.

-

Customer Service: Contact Care Credit customer service for assistance with obtaining the application. They can provide guidance and resources necessary for a successful download.

These methods ensure that applicants have easy access to the application, making it convenient to begin the process of securing financial assistance for health-related expenses.

Digital vs. Paper Version of the Care Credit Application

When choosing between the digital and paper versions of the Care Credit application, consider the following aspects:

-

Convenience: The digital version is typically easier to access and submit. It eliminates the need for printing and mailing, allowing for real-time submission.

-

Efficiency: The electronic application can be filled out and sent quickly, reducing turnaround time for approval.

-

Accessibility: Digital applications can often be saved and edited before submission. This flexibility is beneficial for those needing extra time to gather information.

-

Paper Version Use: The paper application may appeal to those who prefer physical documents and are less comfortable with technology.

Regardless of the format chosen, the content is consistent, ensuring that applicants can receive assistance regardless of their preferred method of submission.

Application Process & Approval Time for Care Credit

Once your application for the Care Credit card is submitted, the application process typically follows these steps:

-

Application Review: Upon receipt, Care Credit reviews the submitted application, which includes a credit check.

-

Decision Notification: Most applicants receive a decision on their application within a few minutes, though it may take longer if further verification is needed.

-

Account Setup: If approved, you will receive your Care Credit card and account details via mail or electronically.

-

Use of Credit: Once received, the card can be used immediately for eligible services.

The approval time can vary based on several factors, including the completeness of the application and the applicant's credit history. However, the streamlined process is designed to provide timely assistance for urgent healthcare needs.